Binance Broadens Horizons: Secures Broker-Dealer License in Brazil for Enhanced Compliance

In an exciting development for the financial industry, Binance, a leading figure in the digital asset exchange world, has now expanded its operational compass by securing a broker-dealer license in Brazil. This move underscores a growing trend of regulatory alignment within the crypto universe and highlights Binance’s unwavering dedication to compliance and operational excellence across international borders.

In an exciting development for the financial industry, Binance, a leading figure in the digital asset exchange world, has now expanded its operational compass by securing a broker-dealer license in Brazil. This move underscores a growing trend of regulatory alignment within the crypto universe and highlights Binance’s unwavering dedication to compliance and operational excellence across international borders.

As cryptocurrencies continue to weave into the fabric of global finance, Binance’s strategic step not only broadens its scope but also brings a fresh wave of compliance-focused trading opportunities to Brazilian investors. This significant leap could potentially reshape the Latin American financial landscape, marking Binance as a forward-thinking player in embracing regulatory norms.

Dive Deeper: Impact on Prime, Executing, and Clearing Brokers

For Prime Brokers:

Prime Brokers stand at the crossroads of facilitation and risk management for investment strategies, particularly in territories burgeoning with fintech innovations like Brazil. Binance’s operational expansion and compliance adherence spotlight two essential elements:

- Enhanced Market Access: With Binance’s broker-dealer license, Prime Brokers can liaise with a globally recognized exchange, offering their clients a broader spectrum of digital assets under a compliant and secure umbrella. This strategic alliance can significantly augment their service offerings, placing them at a competitive advantage.

- Regulatory Navigation: The intricate web of global crypto regulations demands in-depth expertise and constant vigilance. Binance’s demonstrated commitment to compliance provides a blueprint for Prime Brokers. Leveraging partnerships with entities like Binance can streamline their compliance journey, particularly in navigating the nuanced landscape of Brazilian financial regulations.

For Executing and Clearing Brokers:

Executing and Clearing Brokers, integral in ensuring the seamless execution and settlement of trades, face their own set of challenges and opportunities in this evolving digital asset environment.

- Operational Efficiency: Binance’s foray into regulated operations in Brazil introduces a new era of digital asset transactions. For Executing and Clearing Brokers, this could mean simplified transaction processes with enhanced security and compliance measures, akin to traditional securities transactions but in the digital sphere.

- Compliance Assurance: The broker-dealer license heralds a structured approach to digital asset trading, offering Executing and Clearing Brokers a solid compliance framework to adhere to. This paradigm shift towards regulated crypto transactions could mitigate risks associated with digital asset clearances and settlements, fostering a trusted trading environment.

Brazil’s Regulatory Landscape and Implementation Requirements

Regulatory Framework Deep Dive In Brazil, crypto exchanges seeking broker-dealer status face rigorous regulatory scrutiny under CVM (Comissão de Valores Mobiliários) oversight. The requirements mirror traditional financial institutions, with some crypto-specific additions. Broker-dealers must maintain minimum capital requirements of R$1 million (~US$200,000), implement robust risk management systems, and establish clear organizational structures with dedicated compliance officers. What sets Brazil apart is its innovative approach to crypto regulation, treating digital assets as securities while maintaining flexibility for market evolution.

Comparative Market Analysis Brazil’s approach stands in contrast to other major markets. While the U.S. continues to grapple with defining crypto regulatory frameworks, and the EU implements its Markets in Crypto-Assets (MiCA) regulation, Brazil has taken a more definitive stance. The country’s requirements align closely with traditional financial service providers, making it more stringent than Singapore’s Payment Services Act but less restrictive than Japan’s Financial Services Agency (FSA) requirements for crypto exchanges.

Technical Implementation Requirements For Binance, meeting Brazil’s broker-dealer standards necessitates substantial technical infrastructure investments. Key requirements include:

- System Integration

- Implementation of real-time transaction monitoring systems

- Integration with Brazil’s Central Bank’s Pix instant payment system

- Development of automated suspicious activity reporting mechanisms

- Implementation of local data storage solutions compliant with Brazilian data protection laws

- Compliance Technology Stack

- Enhanced KYC/AML systems tailored to Brazilian requirements

- Automated tax reporting infrastructure

- Real-time market surveillance tools

- Audit trail capabilities for all transactions

- Reporting Obligations

- Daily position reports to CVM

- Monthly transaction volume reports

- Quarterly financial statements

- Annual compliance audits

- Immediate suspicious activity reporting

Customer Verification Procedures Brazil’s specific requirements for customer verification include:

- CPF (individual taxpayer number) verification

- Proof of residence within the last 90 days

- Income source documentation

- Enhanced due diligence for transactions over R$50,000

- Face matching technology implementation for remote onboarding

Implementation Timeline The rollout follows a structured timeline: Phase 1 (Months 1-3):

- Initial system adaptation

- Local team establishment

- Basic compliance framework implementation

Phase 2 (Months 4-6):

- Enhanced monitoring systems integration

- Staff training programs

- Customer migration planning

Phase 3 (Months 7-9):

- Full compliance system implementation

- Testing and validation

- Customer onboarding initiation

Additional Exchange Context Binance joins a select group of licensed crypto exchanges in Brazil, including Mercado Bitcoin and NovaDAX. However, its broker-dealer status sets it apart, as most local exchanges operate under more limited licenses. This elevated status brings additional responsibilities but also provides competitive advantages in terms of service offerings and market access.

The Binance Blueprint: Thriving in a Regulated World

Binance’s Brazilian venture is more than just a geographic expansion; it’s a strategic maneuver in the complex chessboard of global finance regulation. By setting precedence with its proactive regulatory compliance, Binance doesn’t just aim to thrive in Brazil’s dynamic market; it seeks to catalyze a global movement towards the mainstream acceptance of digital assets, underpinning the critical role of compliance.

For Prime, Executing, and Clearing Brokers, Binance’s move serves as a beacon, guiding towards operational excellence and regulatory insightfulness. In an age where digital assets are increasingly blurring the lines with traditional finance, such alignments could be integral in shaping a future where digital asset transactions are as routine and regulated as any other financial service.

In closing, Binance’s broker-dealer license in Brazil is a significant milestone not only for the company but for the broader financial industry, advocating for a future where compliance, innovation, and financial expansion move hand in hand. It’s a testament to the fact that in the digital era, navigating the regulatory tides with agility and foresight is paramount for any entity aiming to make a lasting impact on the global financial landscape.

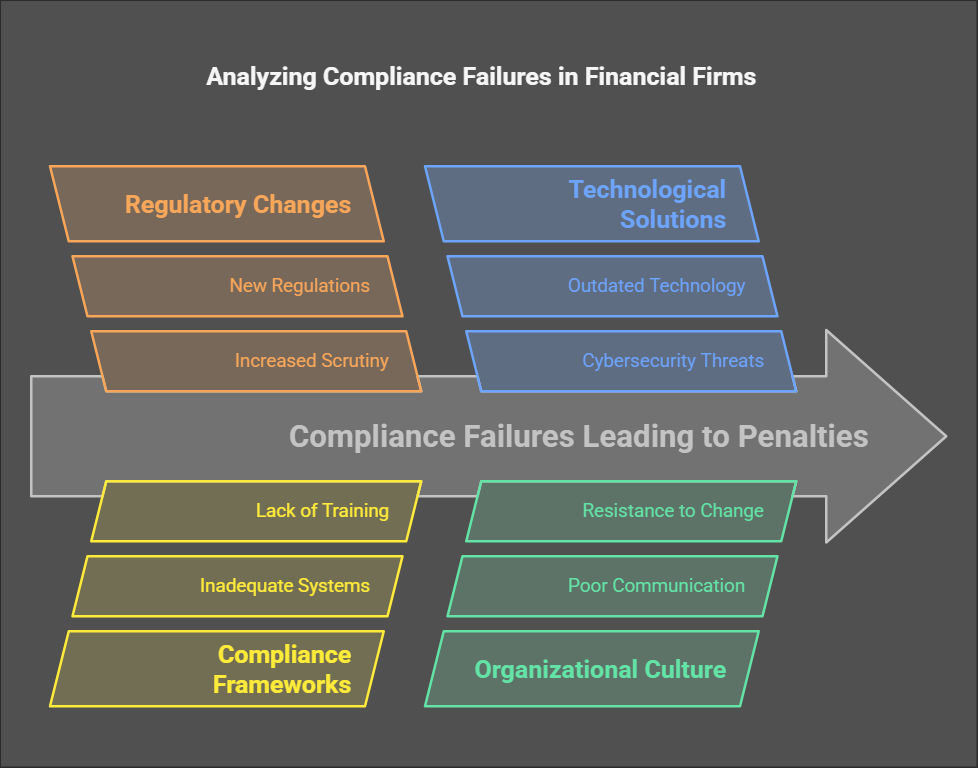

In the dynamic and ever-stringent realm of financial regulations, keeping a step ahead in compliance is more than crucial—it’s foundational for firms to safeguard their reputation and sidestep hefty penalties. The recent $600,000 slap by the Financial Industry Regulatory Authority (FINRA) on Fidelity Brokerage Services LLC is a wake-up call emphasizing the non-negotiable need for solid compliance frameworks.

In the dynamic and ever-stringent realm of financial regulations, keeping a step ahead in compliance is more than crucial—it’s foundational for firms to safeguard their reputation and sidestep hefty penalties. The recent $600,000 slap by the Financial Industry Regulatory Authority (FINRA) on Fidelity Brokerage Services LLC is a wake-up call emphasizing the non-negotiable need for solid compliance frameworks. For Clearing and Executing Brokers:

For Clearing and Executing Brokers:

In an exciting development for the financial industry, Binance, a leading figure in the digital asset exchange world, has now expanded its operational compass by securing a broker-dealer license in Brazil. This move underscores a growing trend of regulatory alignment within the crypto universe and highlights Binance’s unwavering dedication to compliance and operational excellence across international borders.

In an exciting development for the financial industry, Binance, a leading figure in the digital asset exchange world, has now expanded its operational compass by securing a broker-dealer license in Brazil. This move underscores a growing trend of regulatory alignment within the crypto universe and highlights Binance’s unwavering dedication to compliance and operational excellence across international borders.