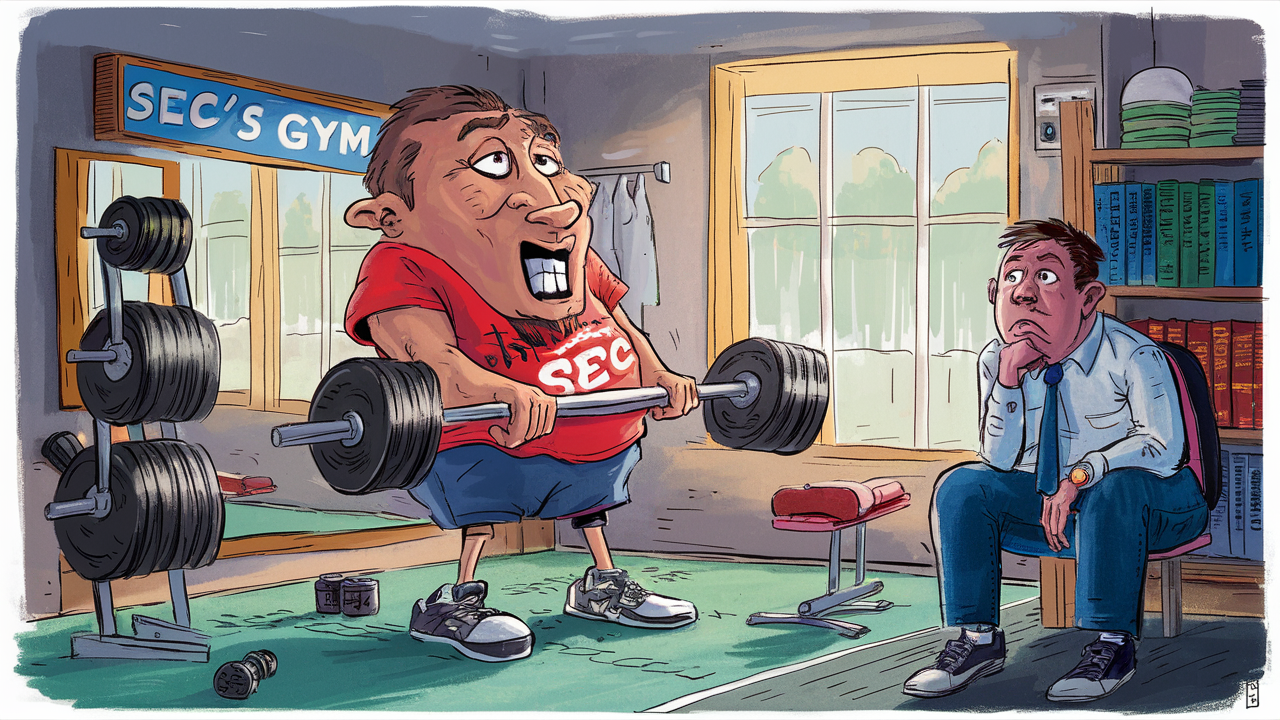

NYSE Operator’s $10 Million SEC Fine: A Cybersecurity Wake-Up Call

The Costly Lesson from NYSE’s Operator: A $10 Million SEC Fine Analysis

In an eye-opening turn of events that has rattled the cages of Wall Street, the SEC slapped a hefty $10 million fine on Intercontinental Exchange, the juggernaut behind the NYSE. This move comes after a critical cyber blunder in 2021, a stark wake-up call emphasizing the non-negotiable need for razor-sharp cybersecurity measures and a ninja-fast incident response mechanism.

In an eye-opening turn of events that has rattled the cages of Wall Street, the SEC slapped a hefty $10 million fine on Intercontinental Exchange, the juggernaut behind the NYSE. This move comes after a critical cyber blunder in 2021, a stark wake-up call emphasizing the non-negotiable need for razor-sharp cybersecurity measures and a ninja-fast incident response mechanism.

The Incident

The 2021 cyberattack wasn’t just a bad day at the office for Intercontinental Exchange; it was a glaring exposé of the weaknesses lying in their cybersecurity armor. The SEC didn’t mince words pointing out their sluggish response that left them and their clients dangling on a thin wire for too long. Moreover, their delay in waving the red flag to both the SEC and the relevant authorities landed them in this multi-million dollar soup.

The Core Lesson

It boils down to this – cybersecurity isn’t just about having the fanciest locks on your doors; it’s about knowing what to do when someone tries to pick them. Financial behemoths like the NYSE are gold mines for cybercriminals, making them attractive targets for attacks that can ripple through markets. Investing in cutting-edge security tech is one thing; training your brigade to counter-attack with precise, swift actions is another.

The Double Whammy: Regulatory Compliance and Market Integrity

Lax cybersecurity and delayed incident reporting don’t just hurt in terms of fines; they take a jab at the very integrity of financial markets. The SEC’s hefty fine sends out an SOS signal loud and clear — play fast and loose with cybersecurity, and you’re playing with fire.

As the finance realm continues to intertwine with advanced technologies, the cyber threat landscape morphs accordingly, escalating the risks. It’s a game of high stakes where ensuring top-tier cyber defense and regulatory compliance isn’t a luxury; it’s table stakes.

The Prime Broker and Clearing Broker Crosshair

Cybersecurity: A Tightrope Walk for Prime and Clearing Brokers

For Prime and Clearing Brokers, the cyberattack on Intercontinental Exchange is a stark reminder of their vulnerability in the fintech ecosystem. These entities are the linchpins in the execution, settlement, and clearing of transactions, making them prime targets for cyber threats. Their critical role in ensuring the flow of capital and securities means any disruption reverberates throughout the financial system, undermining the market’s efficiency and stability.

Regulatory Compliance: More Than a Checkbox

This incident highlights how compliance isn’t just about checking boxes off a list. For Prime and Clearing Brokers, it’s about knitting security into their operational fabric. These brokers are under the microscope, subject to stringent regulations designed to safeguard market integrity and investor interests. A slip-up doesn’t just lead to financial penalties but can erode trust — the currency of the financial markets.

The Bottom Line

The $10 million reminder to Intercontinental Exchange is more than a penalty; it’s a call to action for all in the financial domain. It underscores the necessity of cybersecurity vigilance, prompt incident response, and unwavering regulatory compliance. In the chess game of financial services, where Prime and Clearing Brokers hold critical positions, it’s about staying several moves ahead in security and operational integrity. Partnering with trusted allies like Loffa Interactive Group, renowned for their security-first approach, becomes not just wise but essential in safeguarding interests and maintaining the trust vested by the market and its participants.

In a decisive move to fortify compliance and safeguard investor privacy, the Financial Industry Regulatory Authority (FINRA) has imposed a humming $250,000 fine on an influencer company. This penalty springs from the company’s social media misconduct and lapses in privacy protection. FINRA’s bold action underscores a no-nonsense message across the financial landscape: compliance and customer privacy are not just talk; they are imperative, enforced by substantial penalties for breaches.

In a decisive move to fortify compliance and safeguard investor privacy, the Financial Industry Regulatory Authority (FINRA) has imposed a humming $250,000 fine on an influencer company. This penalty springs from the company’s social media misconduct and lapses in privacy protection. FINRA’s bold action underscores a no-nonsense message across the financial landscape: compliance and customer privacy are not just talk; they are imperative, enforced by substantial penalties for breaches. Prime Brokers, the linchpins in providing comprehensive services to hedge funds and similar entities, face sharper scrutiny and heightened responsibility. Given their central role in facilitating trades, managing assets, and offering custodian services, maintaining an unblemished compliance record becomes paramount. Regulatory missteps, especially in the nuanced realm of social media and data privacy, can lead to substantial fines, but more critically, erode client trust. Prime Brokers hence find a reliable ally in technologies that streamline compliance, like those offered by Loffa Interactive Group, ensuring they not only stay within regulatory grace but also fortify the trust vested in them by their high-profile clientele.

Prime Brokers, the linchpins in providing comprehensive services to hedge funds and similar entities, face sharper scrutiny and heightened responsibility. Given their central role in facilitating trades, managing assets, and offering custodian services, maintaining an unblemished compliance record becomes paramount. Regulatory missteps, especially in the nuanced realm of social media and data privacy, can lead to substantial fines, but more critically, erode client trust. Prime Brokers hence find a reliable ally in technologies that streamline compliance, like those offered by Loffa Interactive Group, ensuring they not only stay within regulatory grace but also fortify the trust vested in them by their high-profile clientele.

In a groundbreaking verdict, the Supreme Court clipped the wings of the Securities and Exchange Commission (SEC), transforming how enforcement disputes might play out in the future. The case of Securities and Exchange Commission v. Jarkesy changes the game, challenging the SEC’s method of leveraging in-house courts for adjudicating certain enforcement actions, especially those seeking civil penalties for alleged wrongdoings like fraud.

In a groundbreaking verdict, the Supreme Court clipped the wings of the Securities and Exchange Commission (SEC), transforming how enforcement disputes might play out in the future. The case of Securities and Exchange Commission v. Jarkesy changes the game, challenging the SEC’s method of leveraging in-house courts for adjudicating certain enforcement actions, especially those seeking civil penalties for alleged wrongdoings like fraud.

With the SEC now urged to press charges in public courts, a possible deceleration in enforcement momentum could spell a strategic pause for financial firms. This is the juncture where depth in compliance strategy, fortified by tech solutions like those provided by Loffa, transitions from advantage to necessity.

With the SEC now urged to press charges in public courts, a possible deceleration in enforcement momentum could spell a strategic pause for financial firms. This is the juncture where depth in compliance strategy, fortified by tech solutions like those provided by Loffa, transitions from advantage to necessity.