Loffa Interactive: Pioneering the Future of Financial Compliance Tools

Loffa Interactive: Revolutionizing Compliance for Financial Titans

In an ever-shifting sea of financial regulations, Loffa Interactive Group stands like a beacon for Wall Street titans, innovating solutions that make the cumbersome juggle of regulatory compliance look like child’s play. Boasting two decades of mingling with the financial elite, Loffa isn’t just about brute security and operational finesse; it’s about streamlining the lifeblood of finance.

In an ever-shifting sea of financial regulations, Loffa Interactive Group stands like a beacon for Wall Street titans, innovating solutions that make the cumbersome juggle of regulatory compliance look like child’s play. Boasting two decades of mingling with the financial elite, Loffa isn’t just about brute security and operational finesse; it’s about streamlining the lifeblood of finance.

The Heart of Loffa’s Arsenal

Diving into their treasured toolkit, Loffa Interactive wields the Freefunds Verified Direct (FVD) and Prime Broker Interactive Network (PBIN) with the finesse of a seasoned fencer. These aren’t just tools; they’re lifelines for firms entangled in the dense thicket of regulations.

FVD: Your Compliance Swiss Army Knife

When it comes to playing by Regulation T’s rules, FVD doesn’t just keep brokers in check—it puts them in the driver’s seat. Free funds trading in cash accounts? More like a breezy Sunday drive, courtesy of streamlined balance verifications. It’s compliance without the headache, infusing efficiency into every transaction.

PBIN: The Prime Broker Whisperer

Then there’s PBIN, a godsend for navigating the labyrinth of prime brokerage agreements, amendments, and those pesky clearance agreements. Managing F1SA, SIA-150, and SIA-151 forms becomes less of a chore, and more of a zen moment. It’s not just about staying within the lines; it’s about coloring the compliance canvas with bravado.

Deep Dive: What Really Makes Waves for Brokers

Let’s zero in on the big fish—how these tools change the game for prime, executing, or clearing brokers.

A Beacon for Prime Brokers

For prime brokers, PBIN illuminates the murky waters of prime brokerage agreements like a lighthouse at midnight. It’s about getting a hawk’s eye view of the entire prime brokerage landscape—without getting lost in the fog of amendments and agreements. By automating and simplifying the grave task of form management, prime brokers can not only ensure compliance but also pivot their focus towards optimizing their strategic offerings.

Clearing the Path for Executing/Clearing Brokers

On the flip side, FVD stands as a colossus, guarding the gates of compliance for executing and clearing brokers. In the rapid-fire world of trades, having a tool that can manage Letters of Free Funds with the agility of a gazelle means these brokers can dance through Regulation T requirements with finesse. This is not just about avoiding the compliance bear traps—it’s about sprinting through them with confidence.

The Verdict

In the grand theatre of financial compliance, Loffa Interactive doesn’t just give firms a seat; it puts them in the director’s chair. With tools like FVD and PBIN, the nuisance of regulatory compliance morphs into a strategic advantage. It’s not just about surviving in the age of scrutiny; it’s about thriving with a smirk. Loffa Interactive: not just a vendor, but a titan’s ally in the art of compliance.

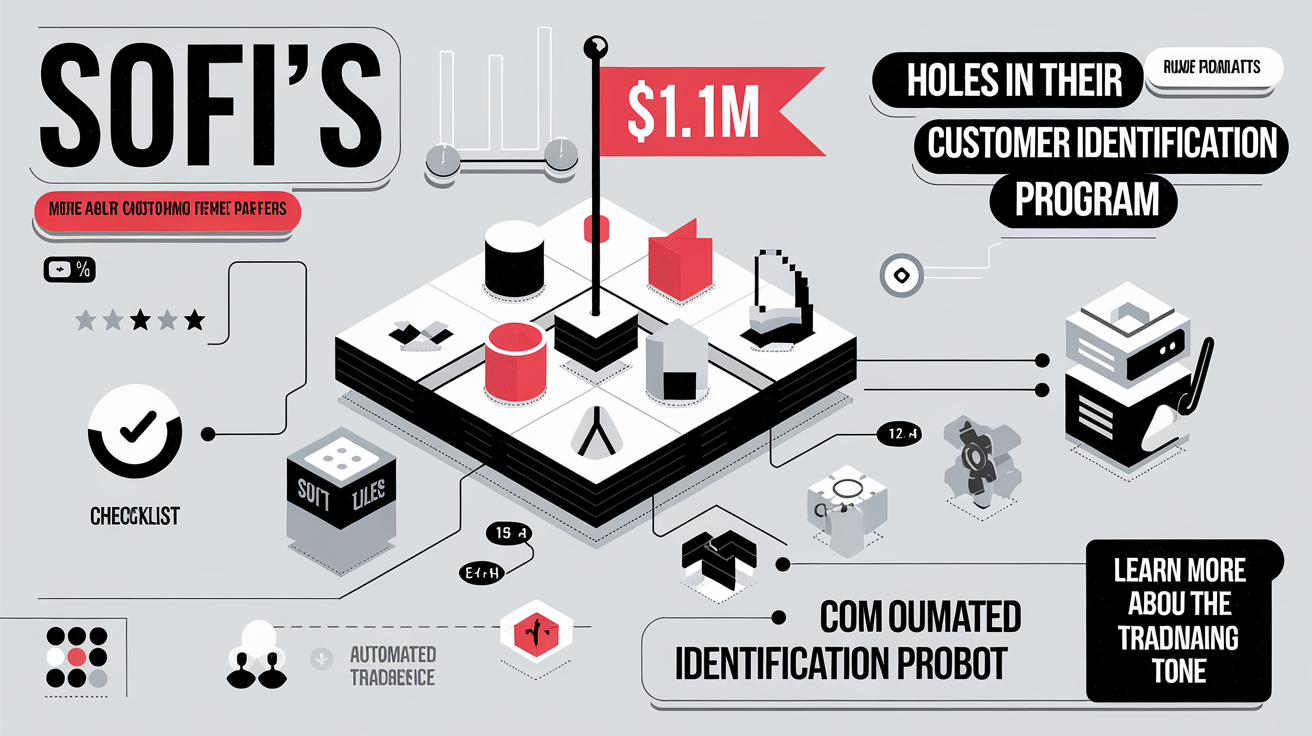

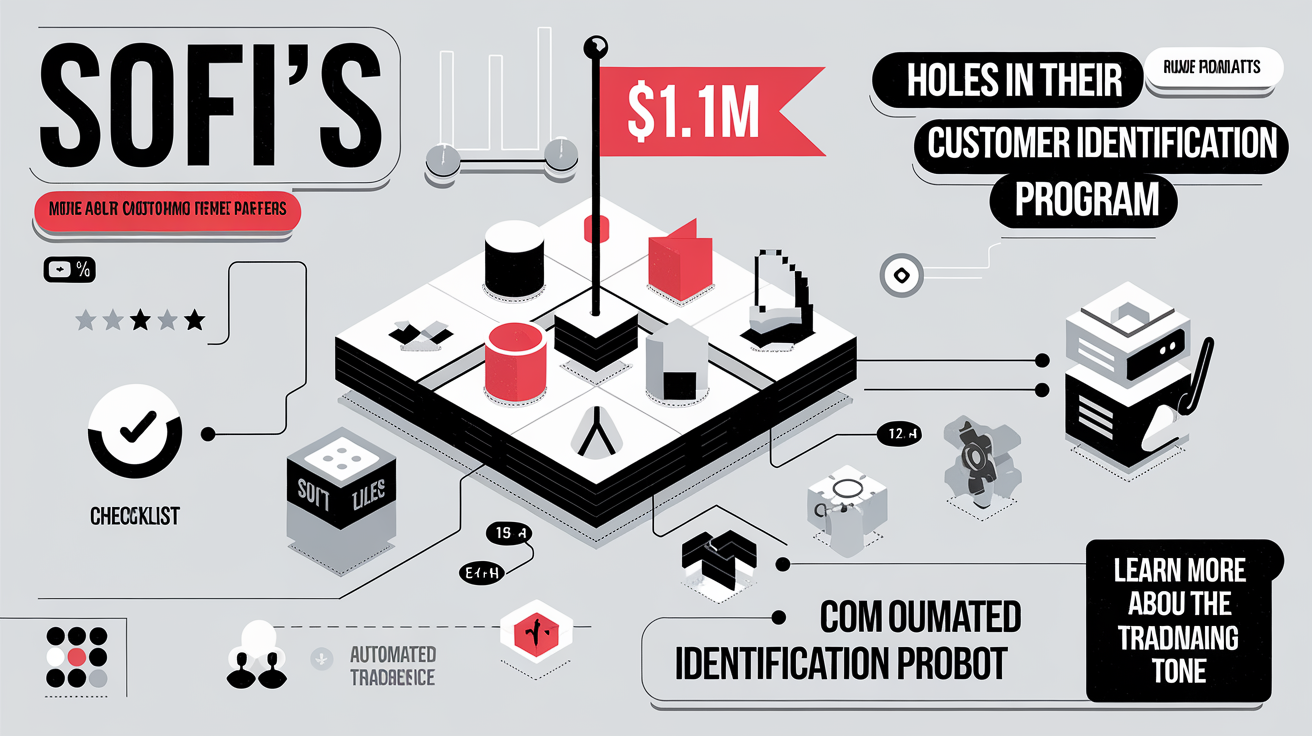

In an eye-opening development for the finance sector, SoFi Securities got hit with a hefty $1.1 million fine by FINRA. This penalty puts a spotlight on the gaping holes in SoFi’s Customer Identification Program (CIP) which paved the way for unauthorized fund siphoning from customer cash accounts. This situation isn’t just a wake-up call; it’s a loud siren for financial institutions everywhere to beef up their security game and stay on the right side of regulatory compliance.

In an eye-opening development for the finance sector, SoFi Securities got hit with a hefty $1.1 million fine by FINRA. This penalty puts a spotlight on the gaping holes in SoFi’s Customer Identification Program (CIP) which paved the way for unauthorized fund siphoning from customer cash accounts. This situation isn’t just a wake-up call; it’s a loud siren for financial institutions everywhere to beef up their security game and stay on the right side of regulatory compliance.

In a move that echoes across the corridors of financial institutions, the Financial Industry Regulatory Authority (FINRA) slapped Morgan Stanley with a hefty $400,000 fine. This wasn’t just a monetary slap on the wrist; it was a loud wake-up call to banks, brokers, and financial entities everywhere about the uncompromising importance of transparency and the increasingly complex regulatory terrain. Let’s dissect this recent regulatory action to understand its ramifications and how strategic partnerships, say with Loffa Interactive Group, can steer companies clear of such financial mishaps.

In a move that echoes across the corridors of financial institutions, the Financial Industry Regulatory Authority (FINRA) slapped Morgan Stanley with a hefty $400,000 fine. This wasn’t just a monetary slap on the wrist; it was a loud wake-up call to banks, brokers, and financial entities everywhere about the uncompromising importance of transparency and the increasingly complex regulatory terrain. Let’s dissect this recent regulatory action to understand its ramifications and how strategic partnerships, say with Loffa Interactive Group, can steer companies clear of such financial mishaps. Let’s zoom in on two aspects where Loffa’s solutions are transformative, especially for Prime Brokers, and for that matter, Executing or Clearing Brokers.

Let’s zoom in on two aspects where Loffa’s solutions are transformative, especially for Prime Brokers, and for that matter, Executing or Clearing Brokers. Partnering with a veteran like Loffa Interactive could well be the compass that guides firms through the regulatory storm. With an unwavering commitment to secure, compliant, and efficient operations, Loffa Interactive emerges as a beacon for firms navigating the complexities of today’s financial market.

Partnering with a veteran like Loffa Interactive could well be the compass that guides firms through the regulatory storm. With an unwavering commitment to secure, compliant, and efficient operations, Loffa Interactive emerges as a beacon for firms navigating the complexities of today’s financial market.