Navigating Financial Compliance Costs: How Technology Is Changing the Game

Revamped Blog Post: Navigating Compliance Costs in Finance

Introduction: The Price of Oversight

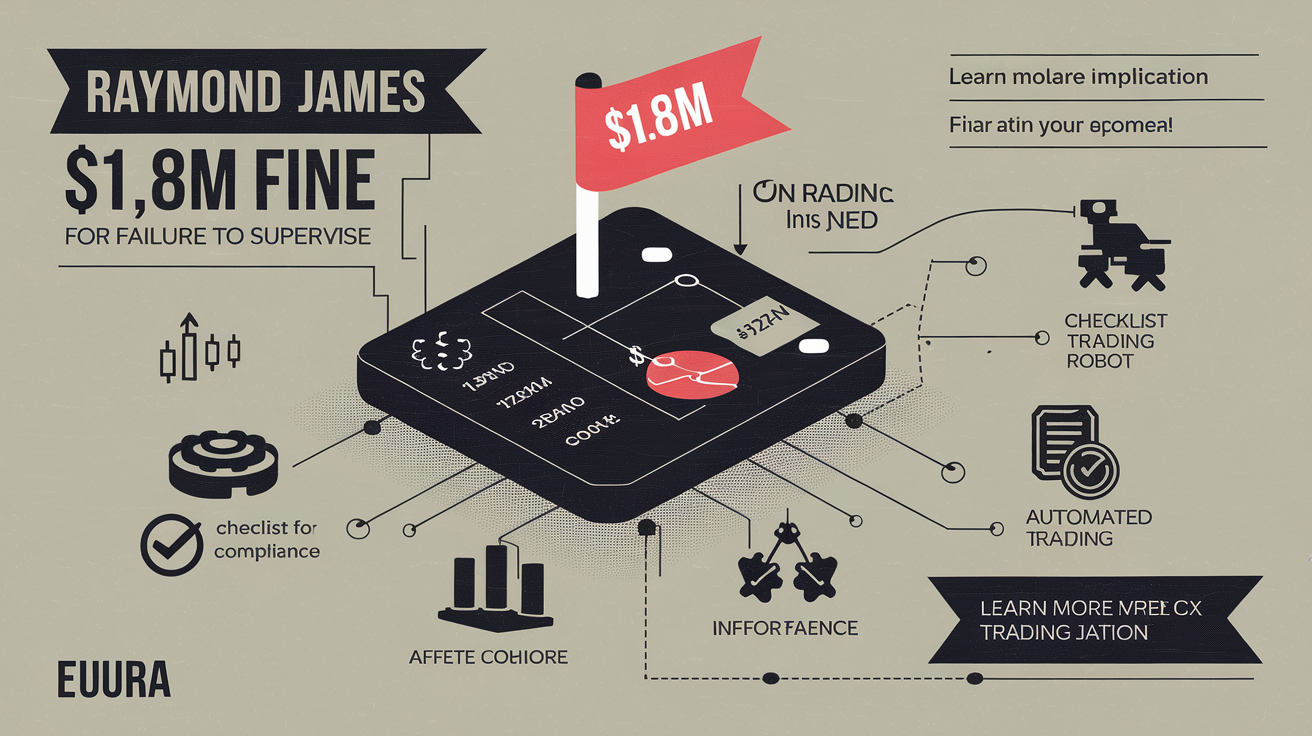

In the fast-paced realm of finance, regulations are the backbone of integrity and client trust. Yet, Raymond James’ recent $1.8 million slap on the wrist by FINRA for oversight lapses in mutual fund management paints a clear picture: compliance isn’t optional—it’s pivotal.

The Heart of the Matter: Raymond James’ Fine

Between 2016 and 2019, Raymond James missed the mark on ensuring the suitability of mutual fund transactions for clients, considering their financial standing and investment goals. This oversight wasn’t just a misstep; it was a costly reminder of the importance of meticulous supervisory systems in safeguarding compliance.

Between 2016 and 2019, Raymond James missed the mark on ensuring the suitability of mutual fund transactions for clients, considering their financial standing and investment goals. This oversight wasn’t just a misstep; it was a costly reminder of the importance of meticulous supervisory systems in safeguarding compliance.

Technology: The Unsung Hero in Compliance

Enter firms like Loffa Interactive Group, seasoned veterans in crafting secure, compliance-ready tech solutions for the financial sector. Their cutting-edge products, such as Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN), exemplify how technology is reshaping the adherence to regulations.

Deep Dive: The Impact on Prime and Clearing Brokers

Freefunds Verified Direct (FVD):

- For the Prime Broker: FVD is a game-changer. It smoothes out the management of Letters of Free Funds, crucial for aligning with Regulation T. For prime brokers, this means streamlined operations and ensured compliance with trade settlements—a clear win.

- For the Clearing Broker: The efficiency FVD introduces is unparalleled. It not only ensures compliance but also optimizes the verification processes for free funds trading in cash accounts, making it indispensable for clearing brokers aiming for operational efficiency.

Prime Broker Interactive Network (PBIN):

- For the Prime Broker: PBIN stands out by simplifying the complex web of F1SA, SIA-150, and SIA-151 forms management. Essential for navigating prime brokerage agreements and amendments, PBIN is a cornerstone for prime brokers looking to uphold regulatory standards effortlessly.

- For the Executing or Clearing Broker: PBIN is a beacon of efficiency. It streamlines the management of clearance agreements and amendments, reducing administrative burdens and ensuring adherence to compliance, which is crucial for executing or clearing brokers focused on regulatory accuracy.

Conclusion: Embracing Technology for Compliance

The Raymond James saga serves as a stark wake-up call: compliance is a dynamic landscape that demands robust systems and a proactive stance, especially in supervisory practices. In this evolving narrative, adopting technology like that offered by Loffa Interactive Group isn’t just beneficial—it’s critical for sustaining trust, ensuring transparency, and navigating the intricate world of financial regulations with confidence. In the end, firms that leverage these technological advancements are not just complying; they’re leading the way in operational excellence and reliability.

In the dynamic world of Wall Street, Loffa Interactive Group has been a beacon of innovation and trust for over twenty years. Specializing in the digitization of broker transaction services, our unwavering commitment to security and operational excellence has rightfully earned us a place as a favored technology partner among prestigious financial institutions.

In the dynamic world of Wall Street, Loffa Interactive Group has been a beacon of innovation and trust for over twenty years. Specializing in the digitization of broker transaction services, our unwavering commitment to security and operational excellence has rightfully earned us a place as a favored technology partner among prestigious financial institutions. For a Prime Broker, liquidity is the lifeblood that keeps the machinery of trades running smoothly. The FVD system streamlines the process of managing Letters of Free Funds, ensuring that liquidity needs are promptly met without falling afoul of Regulation T requirements. This tool not only brings efficiency but also peace of mind, knowing that compliance is baked into every transaction.

For a Prime Broker, liquidity is the lifeblood that keeps the machinery of trades running smoothly. The FVD system streamlines the process of managing Letters of Free Funds, ensuring that liquidity needs are promptly met without falling afoul of Regulation T requirements. This tool not only brings efficiency but also peace of mind, knowing that compliance is baked into every transaction.

Raymond James Fined $1.8M by FINRA: Supervision Failures Unpacked and Future Trajectories

Raymond James Fined $1.8M by FINRA: Supervision Failures Unpacked and Future Trajectories