The Prime Broker’s Playbook: Mastering SIA-150, SIA-151, PBL, and F1SA Compliance

Why Prime Brokers Can’t Slack on Paperwork: A Deep Dive into Compliance

Hey there, finance enthusiasts! Today, we’re diving into the world of prime brokers and why they need to dot every ‘i’ and cross every ‘t’ when it comes to paperwork. Specifically, we’re talking about those oh-so-exciting forms: SIA-150, SIA-151, PBL, and F1SA. Buckle up, because this ride through regulatory compliance is more thrilling than you might think!

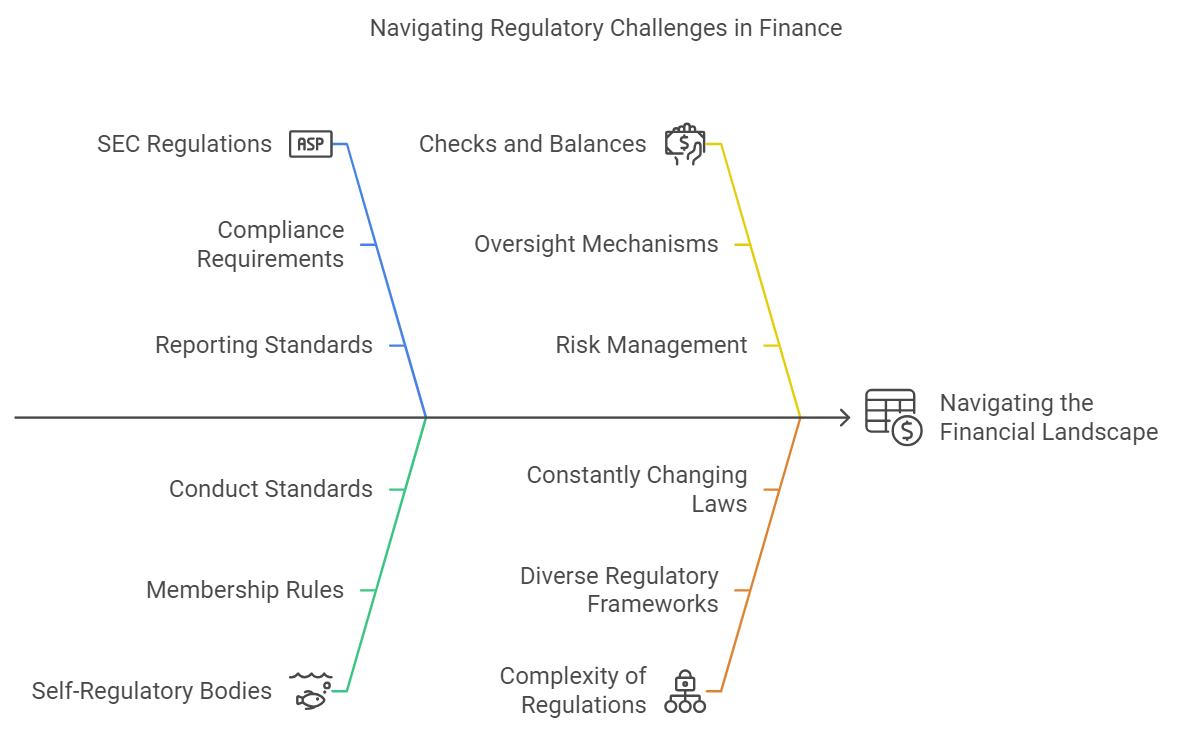

The Regulatory Rollercoaster

First things first: why all the fuss about paperwork? Well, imagine you’re building the world’s most complex Lego structure, but instead of instructions, you have a bunch of regulatory bodies shouting directions at you. That’s kind of what it’s like for prime brokers navigating the financial landscape.

The Securities and Exchange Commission (SEC) and various self-regulatory bodies are the architects of this complex structure. They’ve designed a system of checks and balances to keep the financial world from tumbling down like a poorly constructed Jenga tower.

The Ghost of Financial Crises Past

Remember 2008? Yeah, we’d all like to forget it, but that financial crisis taught us some valuable lessons. It showed us what happens when we don’t keep a close eye on the financial sector. Since then, regulatory agencies have been watching prime brokers like hawks, making sure they’re crossing their t’s and dotting their i’s on every form.

The Consequences of Cutting Corners

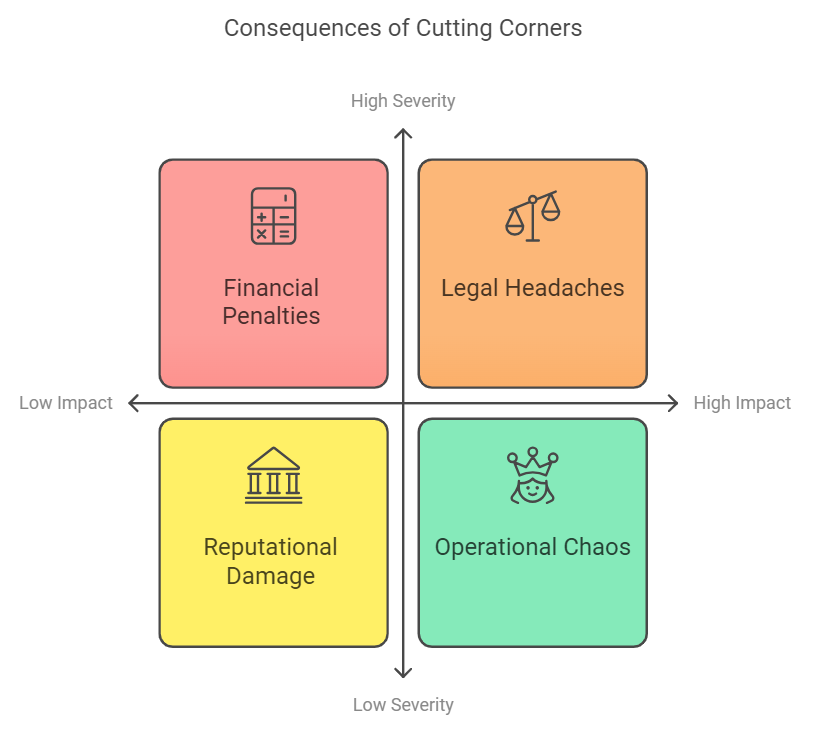

Now, you might be thinking, “So what if I miss a form or two?” Oh, my sweet summer child. The consequences of non-compliance are about as fun as a root canal. We’re talking:

Now, you might be thinking, “So what if I miss a form or two?” Oh, my sweet summer child. The consequences of non-compliance are about as fun as a root canal. We’re talking:

- Financial Penalties: Imagine fines so big they make your eyes water. We’re talking millions of dollars in some cases.

- Legal Headaches: Nothing says “fun times” like being dragged into court or having your licenses revoked, right?

- Reputational Damage: In the finance world, trust is currency. Lose it, and you might as well be trading with Monopoly money.

- Operational Chaos: Non-compliance can throw a wrench in your entire operation, leading to inefficiencies that’ll make your head spin.

The Paperwork Puzzle

Let’s break down these forms, shall we?

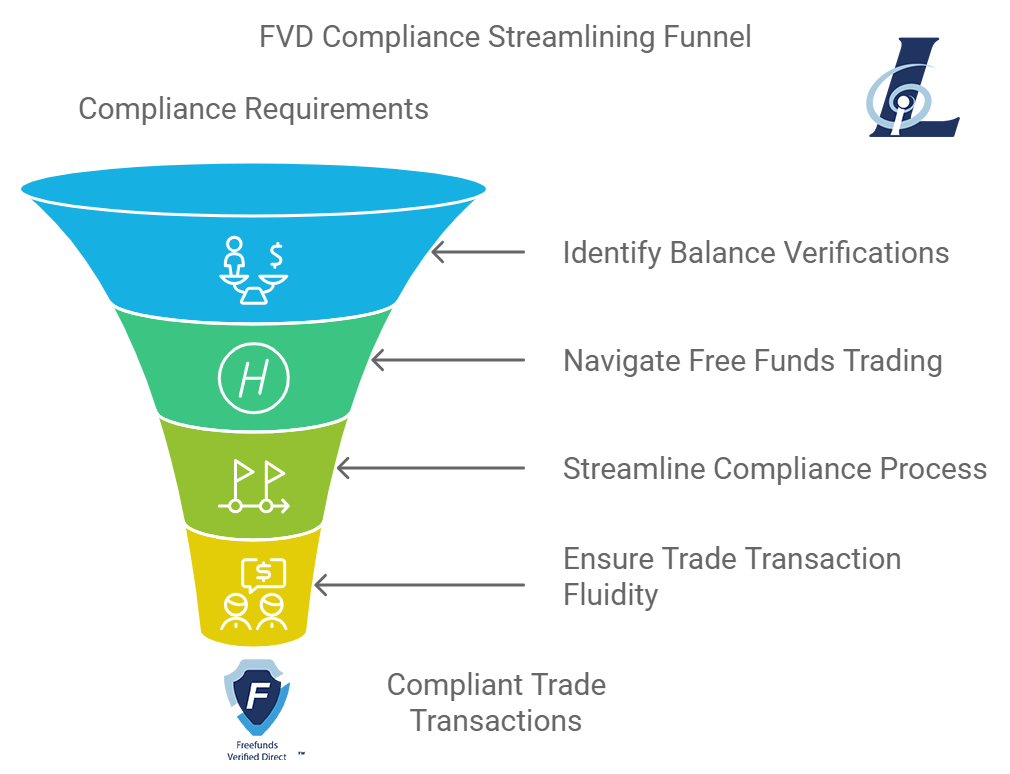

- SIA-150 & SIA-151: These bad boys establish the ground rules between prime brokers and executing brokers. Think of them as the prenup of the financial world.

- PBL: This form is like the VIP list for a super exclusive club. It outlines who’s allowed to trade and under what conditions.

- F1SA: This is the form that keeps track of individual trading accounts for registered investment advisors and hedge funds. It’s like the guest book at a fancy party, but with more numbers and less champagne.

Best Practices: How to Stay on the Right Side of the Law

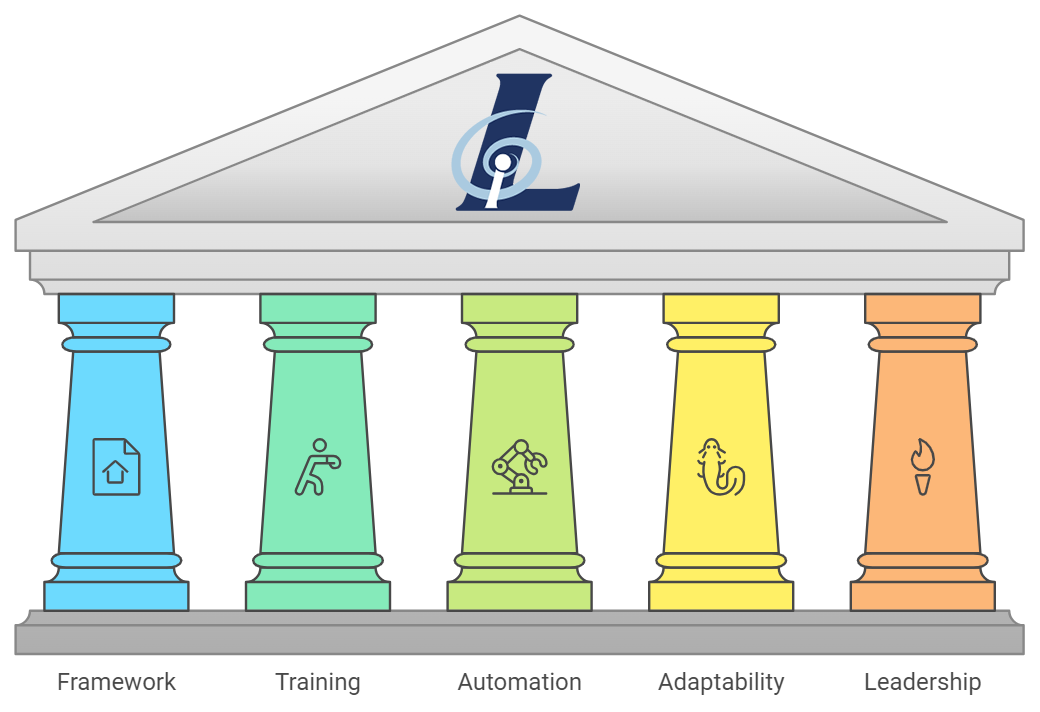

Now that we’ve scared you straight, here’s how to keep your compliance game strong:

Now that we’ve scared you straight, here’s how to keep your compliance game strong:

- Build a Robust Framework: Think of this as your compliance fortress. Make sure everyone knows the rules and how to follow them.

- Train Like You’re Preparing for the Compliance Olympics: Regular training sessions keep everyone on their toes and up to date with the latest regulations.

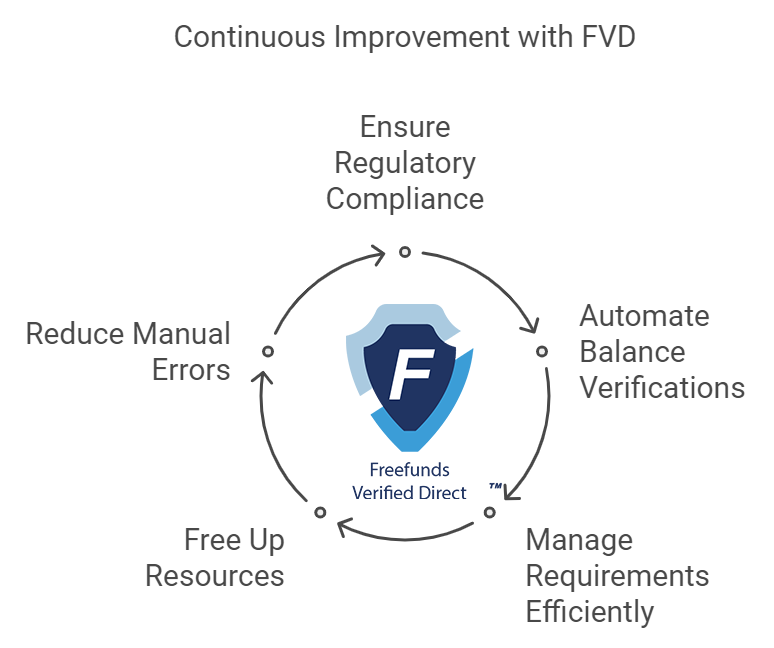

- Integrate and Automate: Use technology to your advantage. The more you can automate, the less chance there is for human error.

- Stay Flexible: Regulations change faster than fashion trends. Be ready to adapt at a moment’s notice.

- Leadership Matters: Compliance should be a top-down approach. When the bosses care, everyone cares.

The Bottom Line

Look, we get it. Paperwork isn’t sexy. But you know what’s even less sexy? Massive fines, legal battles, and a reputation in tatters. By staying on top of your SIA-150, SIA-151, PBL, and F1SA forms, you’re not just ticking boxes – you’re safeguarding your business and contributing to a more stable financial system.

So the next time you’re tempted to put off that paperwork, remember: in the world of prime brokerage, dotting your i’s and crossing your t’s isn’t just good practice – it’s essential for survival. Stay compliant, my friends!

In a world where digital transformation is not just buzzwords but pivotal to the success of financial services, Loffa Interactive Group has solidified its standing as a beacon of trust and innovation for Wall Street powerhouses.

In a world where digital transformation is not just buzzwords but pivotal to the success of financial services, Loffa Interactive Group has solidified its standing as a beacon of trust and innovation for Wall Street powerhouses.

A significant development has emerged from the U.S. Supreme Court, fundamentally altering the Securities and Exchange Commission’s (SEC) enforcement capabilities. The latest ruling casts a shadow on the constitutionality of its in-house adjudication process. More than just impacting the SEC, this pivotal decision signals broader consequences for the operational landscape of various federal agencies.

A significant development has emerged from the U.S. Supreme Court, fundamentally altering the Securities and Exchange Commission’s (SEC) enforcement capabilities. The latest ruling casts a shadow on the constitutionality of its in-house adjudication process. More than just impacting the SEC, this pivotal decision signals broader consequences for the operational landscape of various federal agencies.