Navigating SEC Compliance Challenges in the Wake of First Horizon’s Post-Merger Turmoil

The SEC Charges Against First Horizon Post-Merger

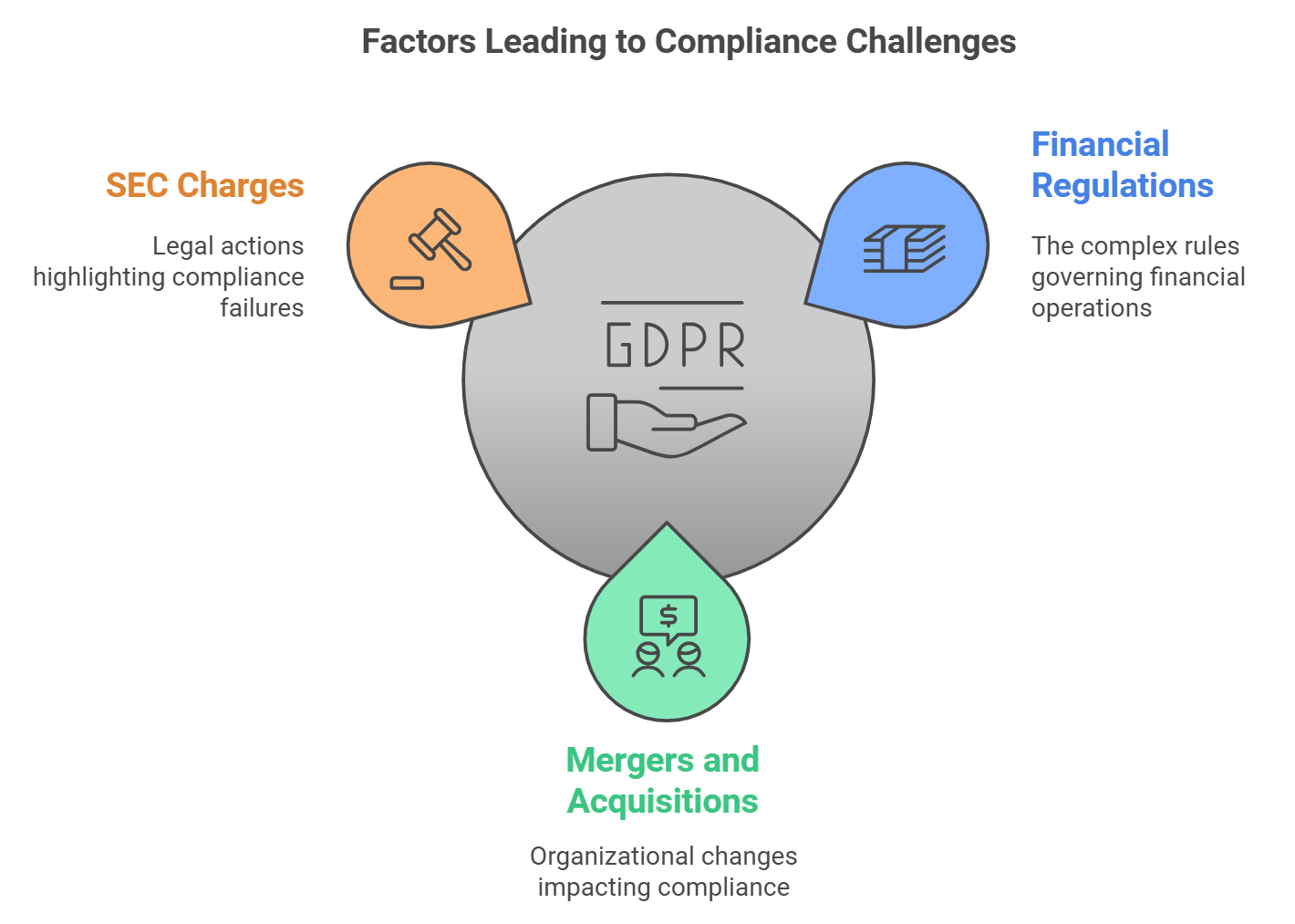

In the dynamic and complex domain of financial regulations, maintaining compliance stands as a formidable challenge for firms, particularly during significant organizational changes like mergers and acquisitions. The recent predicament involving First Horizon Corporation, faced with charges by the Securities and Exchange Commission (SEC), underscores the urgent need for stringent compliance protocols and the grave consequences of their neglect.

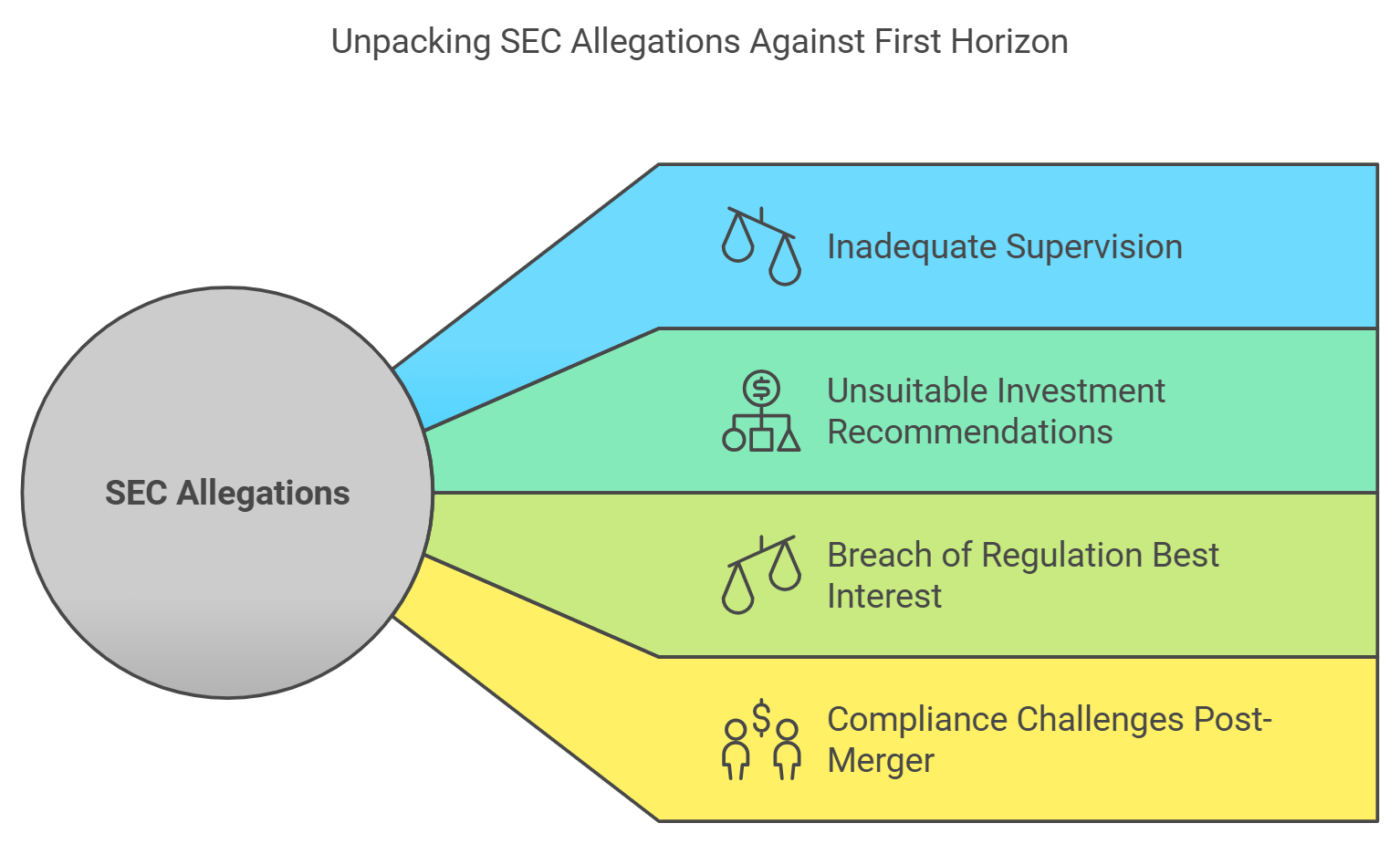

The Allegations and Their Aftermath

The SEC’s accusations claim that post its merger with IberiaBank, First Horizon inadequately supervised its registered representatives. These reps were recommending intricate structured notes to retail investors, advice that was unsuitable and breached Regulation Best Interest (Reg BI)—a rule set forth to bolster investor protection by mandating broker-dealers to prioritize their clients’ interests.

This incident is a stark exposition of the pivotal role compliance plays, especially amidst the intricacies of post-merger integration. It’s during these phases that ensuring the sustenance, if not an enhancement, of compliance benchmarks against mounting challenges becomes essential.

Loffa’s Solutions to Compliance Challenges

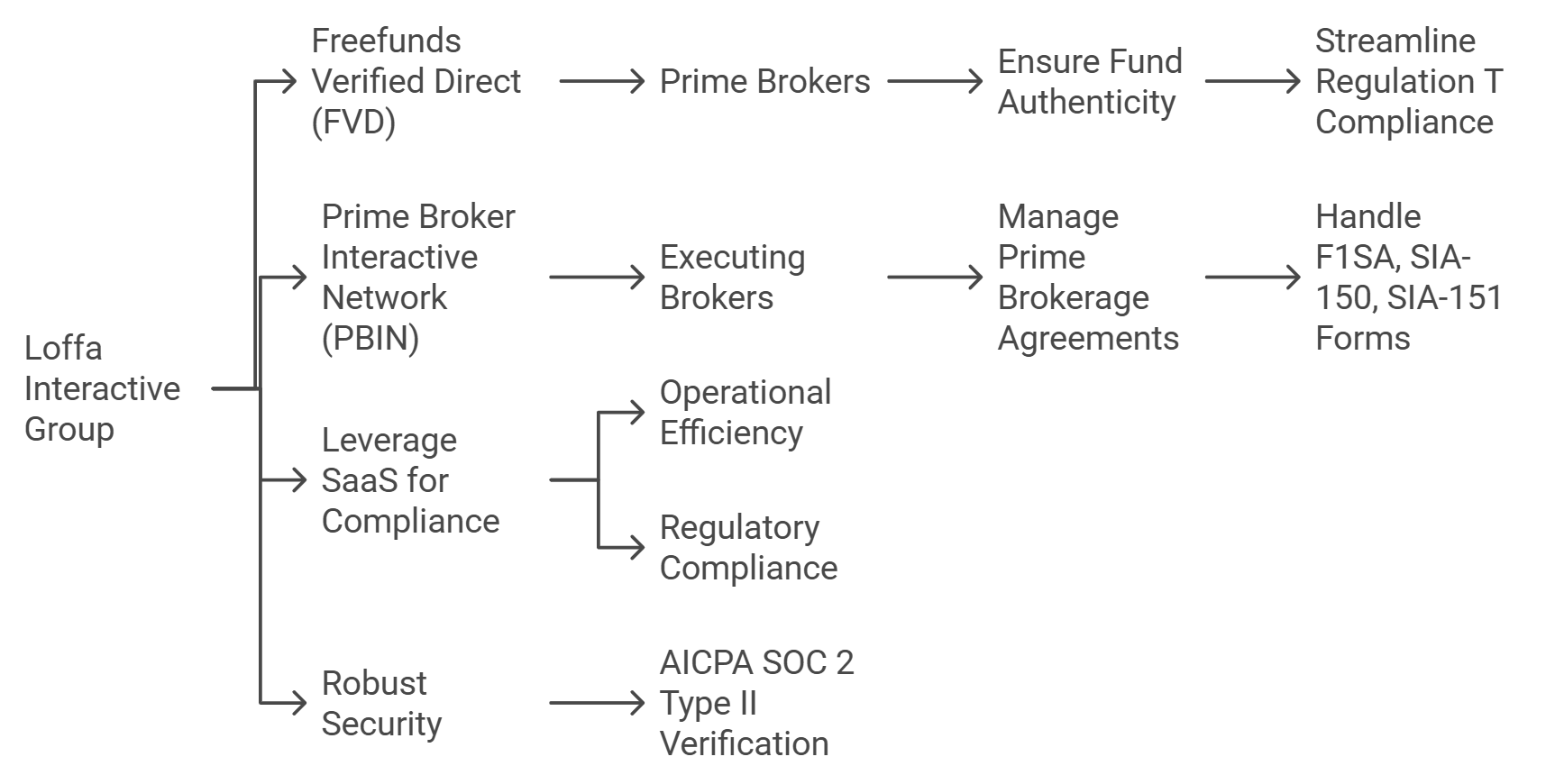

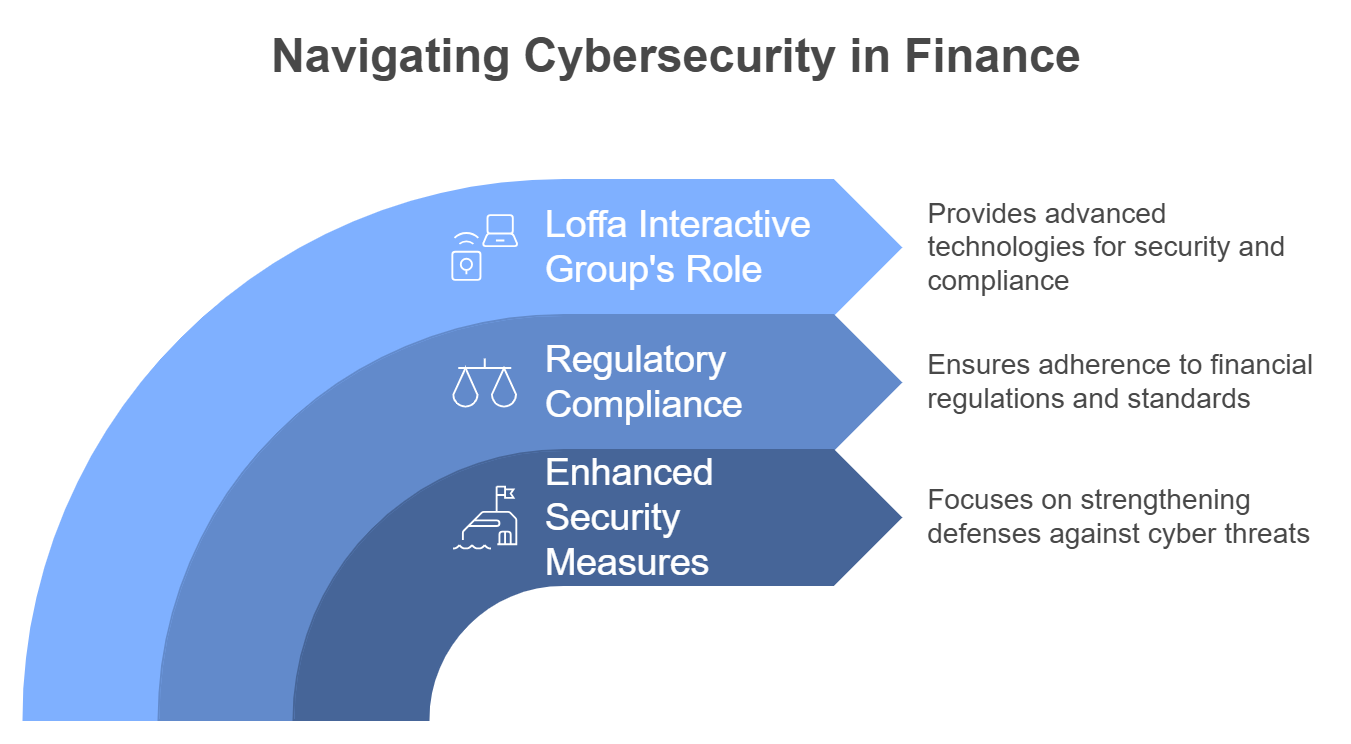

Loffa Interactive Group, a seasoned provider of technology solutions tailor-made for financial service entities, stands ready with insights and tools to navigate the swirling currents of regulatory adjustments. Our offerings, like Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN), are engineered to ease the burden of compliance, inclusive of mandatories like Regulation T and the complexities around prime brokerage agreements.

Diving Deeper: The Impact on Prime and Executing Brokers

- Freefunds Verified Direct (FVD) for Assurance in Trading: FVD enables Prime Brokers to ensure the authenticity of funds, streamlining the verification processes vital in upholding Regulation T compliance. This not only simplifies the management of free fund letters but also bolsters confidence in the regulatory adherence of cash account trading.

- The Prime Broker Interactive Network (PBIN) for Streamlined Processes: For Executing or Clearing Brokers, PBIN demystifies the labyrinth of F1SA, SIA-150, and SIA-151 forms, ensuring prime brokerage agreements and their affiliated amendments are managed with fluidity and precision. This guarantees the maintenance of a stringent compliance posture amid evolving regulatory landscapes.

Leveraging SaaS for Compliance

Incorporating Loffa Interactive’s solutions transforms compliance from a daunting obstacle to a manageable and efficient operation. By adopting our SaaS offerings, firms gain a dual advantage: operational workflow efficiencies and an unwavering commitment to meeting regulatory standards—even amidst the upheaval of corporate transformations.

Our esteemed position, backed by robust security measures and an AICPA SOC 2 Type II verification, renders us an indispensable ally for financial firms aiming to navigate the turbulence of regulatory compliance.

The SEC’s legal action against First Horizon is a cautionary highlight for companies in the midst of mergers and acquisitions. As we advance, the imperative to prioritize compliance and investor protection only intensifies. Firms can confidently face these challenges head-on by leveraging Loffa Interactive’s tools and expertise, adapting to and exceeding the expectations of an ever-evolving financial industry.

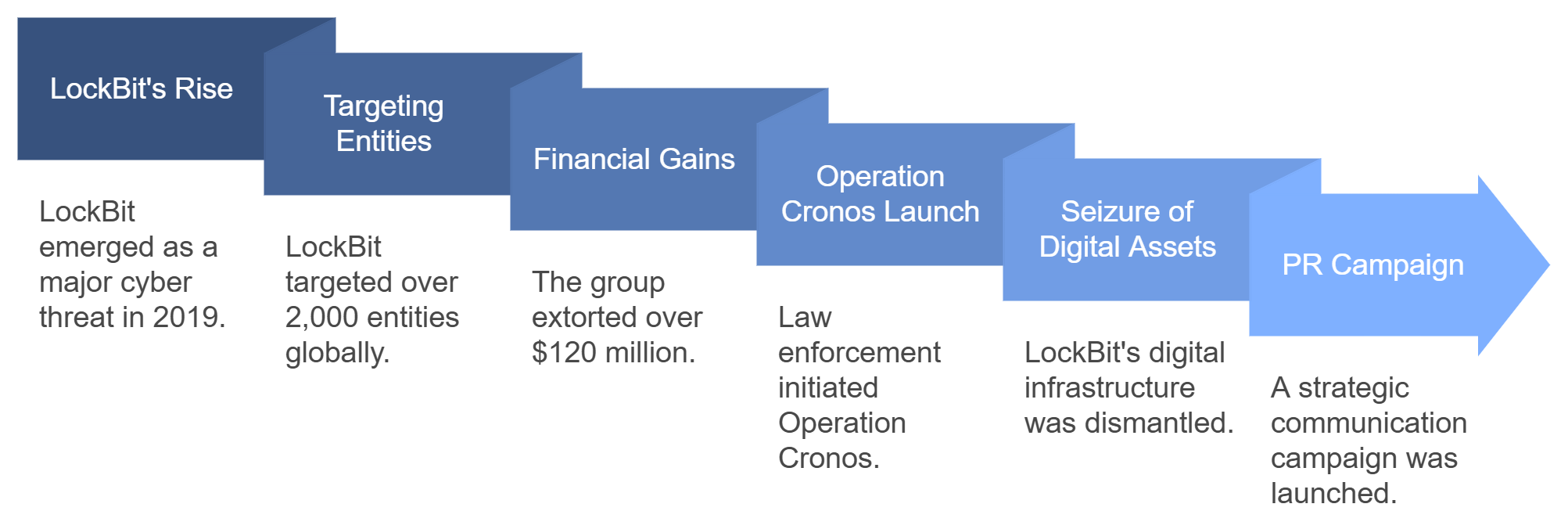

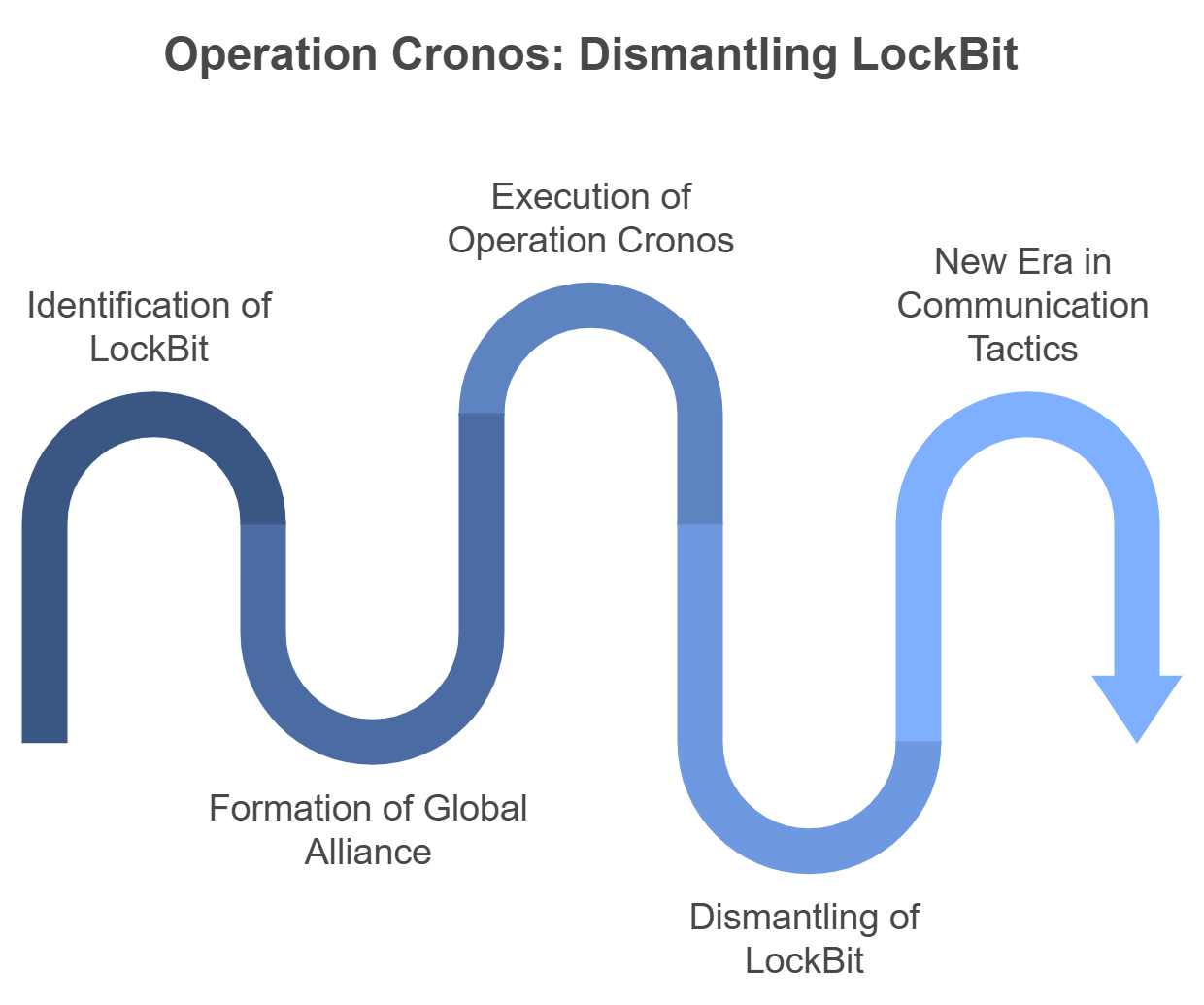

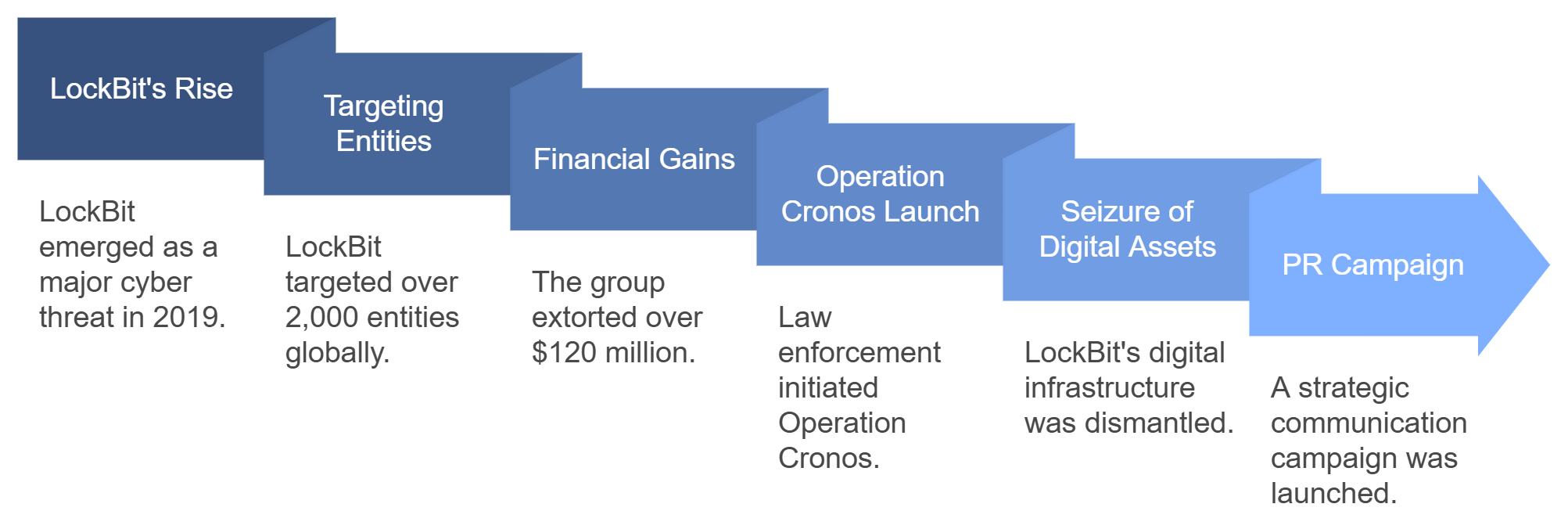

The takedown also spotlights the ever-present need for regulatory compliance. With financial institutions squarely in the crosshairs of sophisticated cyber threats, ensuring adherence to stringent regulatory standards has never been more critical. Loffa Interactive’s solutions for regulatory compliance shine here, enabling brokers to navigate the complex web of financial regulations confidently. By leveraging our tools, brokers can rest assured that their operations not only withstand the scrutiny of regulators but also build a fortress against potential cyber threats.

The takedown also spotlights the ever-present need for regulatory compliance. With financial institutions squarely in the crosshairs of sophisticated cyber threats, ensuring adherence to stringent regulatory standards has never been more critical. Loffa Interactive’s solutions for regulatory compliance shine here, enabling brokers to navigate the complex web of financial regulations confidently. By leveraging our tools, brokers can rest assured that their operations not only withstand the scrutiny of regulators but also build a fortress against potential cyber threats.

In the intricate dance of finance, where the tempo is set by changing regulations, maintaining client confidence is not just about keeping pace. It’s about moving with purpose and assurance. Today, we’re diving into how the innovative spirit of Loffa Interactive Group is empowering broker-dealers to waltz through compliance and regulations with grace and strength, ensuring their clients are always leading with trust and transparency.

In the intricate dance of finance, where the tempo is set by changing regulations, maintaining client confidence is not just about keeping pace. It’s about moving with purpose and assurance. Today, we’re diving into how the innovative spirit of Loffa Interactive Group is empowering broker-dealers to waltz through compliance and regulations with grace and strength, ensuring their clients are always leading with trust and transparency. Empowering Broker-Dealers: A Deeper Dive into Impactful Solutions

Empowering Broker-Dealers: A Deeper Dive into Impactful Solutions