Embracing Efficiency: The Critical Path to T+1 Success and Operational Excellence

Embracing Efficiency: The Critical Path to T+1 Success and Operational Excellence

Introduction

The financial services industry stands at a pivotal moment with the impending shift to T+1 settlement by May 28, 2024. This transition, while enhancing market efficiency, introduces significant challenges in operational processes. The DTCC’s recent report, “The Key to T+1 Success – Hitting 90% Affirmation by 9:00 pm ET on Trade Date,” is a clarion call to action. Firms like ours, specializing in SaaS solutions for operational efficiencies in settling DVP or Prime Broker SIA150 Forms and Letters of Freefunds, must navigate this change strategically.

The move to T+1 settlement is not just a regulatory shift; it’s a transformation in how financial markets operate. This change impacts every aspect of trade processing – from execution to settlement. For firms still relying on manual processes, this transition could be daunting. The key to success lies in embracing technological solutions that can handle the demands of a faster settlement cycle.

The move to T+1 settlement is not just a regulatory shift; it’s a transformation in how financial markets operate. This change impacts every aspect of trade processing – from execution to settlement. For firms still relying on manual processes, this transition could be daunting. The key to success lies in embracing technological solutions that can handle the demands of a faster settlement cycle.

Our role in this transition is crucial. As providers of cutting-edge SaaS solutions, we are uniquely positioned to help broker-dealers and other financial institutions adapt to this new environment. Our tools are designed to streamline and automate the complex processes involved in trade settlements, ensuring that our clients can meet the new regulatory requirements without sacrificing operational efficiency.

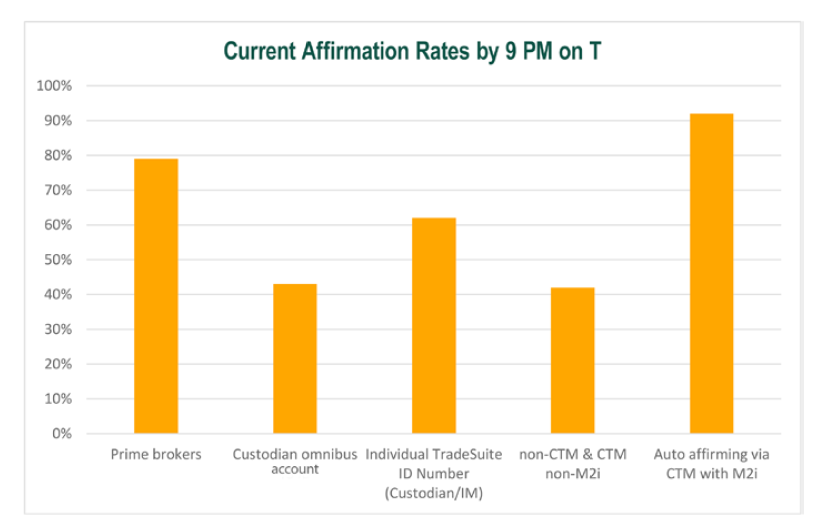

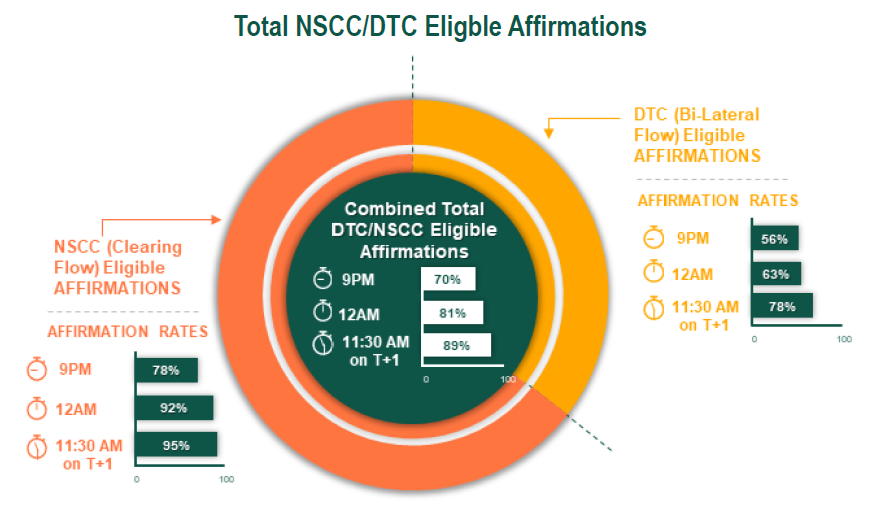

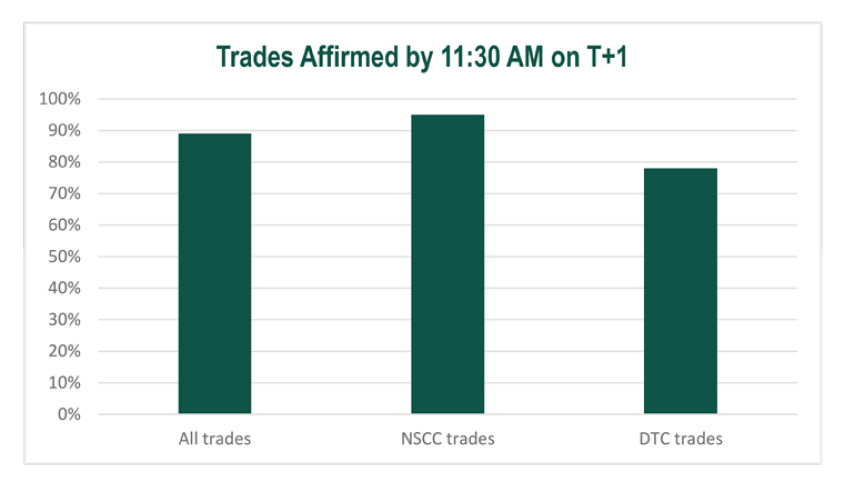

The DTCC report highlights a significant gap in the current state of trade affirmations. With only 69% of trades affirmed by the 9:00 PM ET deadline, there is a clear need for enhanced operational processes. This gap represents an opportunity for firms like ours to provide solutions that not only bridge this gap but also set new standards in trade processing efficiency.

The DTCC report highlights a significant gap in the current state of trade affirmations. With only 69% of trades affirmed by the 9:00 PM ET deadline, there is a clear need for enhanced operational processes. This gap represents an opportunity for firms like ours to provide solutions that not only bridge this gap but also set new standards in trade processing efficiency.

Understanding the T+1 Transition

The T+1 settlement cycle marks a significant shift from the traditional T+2 standard. This change is intended to reduce credit and operational risks while enhancing market liquidity. However, achieving this requires firms to reassess and overhaul their existing operational processes, a task easier said than done.

The complexity of transitioning to T+1 cannot be overstated. It involves rethinking every step of the trade lifecycle – from order execution to final settlement. Firms must ensure that their systems can handle the increased volume and velocity of trades, all while maintaining accuracy and compliance with regulatory standards.

The complexity of transitioning to T+1 cannot be overstated. It involves rethinking every step of the trade lifecycle – from order execution to final settlement. Firms must ensure that their systems can handle the increased volume and velocity of trades, all while maintaining accuracy and compliance with regulatory standards.

The DTCC report serves as a vital benchmark for firms preparing for this transition. It not only provides insight into the current state of trade affirmations but also sets a clear target for what needs to be achieved. Hitting the 90% affirmation rate by 9:00 PM ET on the trade date is a challenging but necessary goal for maintaining market stability in a T+1 environment.

For firms grappling with the complexities of this transition, the report is a valuable resource. It offers a comprehensive analysis of the current challenges and provides a roadmap for achieving T+1 readiness. Firms that take the time to understand and act on its insights will be better positioned to navigate this transition successfully.

Implications for Operational Processes

The T+1 settlement cycle necessitates a complete overhaul of existing trade processing systems. Firms must move away from manual, time-consuming processes and adopt automated, efficient solutions. The traditional ways of handling trade settlements are no longer viable in a T+1 world.

One of the most significant implications of the T+1 transition is the need for real-time processing. Trades need to be processed, confirmed, and affirmed much faster than before. This requires not only robust technology but also a change in operational workflows to support faster decision-making and execution.

Another critical aspect is data management. In a T+1 environment, the accuracy and timeliness of data become even more crucial. Firms must ensure that their systems can handle the influx of real-time data without compromising on accuracy or compliance. This involves investing in advanced data processing and analytics tools.

Risk management also takes on a new dimension in a T+1 settlement cycle. With a shorter window to settle trades, firms have less time to identify and mitigate risks. This requires more sophisticated risk management tools that can provide real-time insights and enable rapid response to potential issues.

Leveraging Technology for Efficiency

In a T+1 settlement environment, technology is not just a facilitator; it’s a necessity. SaaS solutions are designed to meet the specific needs of this new era. By automating key aspects of the trade settlement process, SaaS solutions help brokers achieve greater efficiency and compliance.

There are solutions offered that provide several benefits in a T+1 environment. First, automate the trade affirmation process, significantly reducing the time and effort required to confirm and affirm trades. This not only helps meet the new affirmation deadlines but also reduces the likelihood of errors.

Tools for real-time data processing and analytics. These tools enable firms to manage the increased volume of data in a T+1 world efficiently. They offer insights that help in making quicker, more informed decisions, a critical capability in a fast-paced trading environment.

Another key is risk management. In a T+1 settlement cycle, managing risk becomes more challenging due to the reduced time frame. Tools provide real-time risk analysis, enabling firms to identify and address potential issues before they impact the settlement process.

Lastly, it’s important to be highly scalable and adaptable. Making sure they can be customized to meet the specific needs of different firms, ensuring that regardless of size or complexity, every firm can navigate the T+1 transition successfully.

Key Strategies for T+1 Readiness

- Automated Trade Affirmation: Implementing systems that automatically affirm trades can drastically increase the rate of on-time affirmations.

- Enhanced Visibility and Control: With our tools, firms gain better visibility and control over the affirmation process, enabling them to identify and address delays promptly.

- Seamless Integration with TradeSuite ID: By integrating with TradeSuite ID, firms can streamline their affirmation process, ensuring compliance with the new settlement window.

The Role of SaaS Solutions

As the report suggests, achieving higher affirmation rates requires a shift towards more automated and efficient operational processes. Our SaaS solutions are tailored to meet these needs, offering a seamless transition to T+1 settlement. By harnessing the power of automation and digital transformation, firms can not only meet the compliance requirements but also gain a competitive edge in efficiency and reliability.

As the report suggests, achieving higher affirmation rates requires a shift towards more automated and efficient operational processes. Our SaaS solutions are tailored to meet these needs, offering a seamless transition to T+1 settlement. By harnessing the power of automation and digital transformation, firms can not only meet the compliance requirements but also gain a competitive edge in efficiency and reliability.

Conclusion: Preparing for the Future

The transition to T+1 settlement is a significant challenge, but it’s also an opportunity. Firms that successfully navigate this change will not only comply with new regulatory requirements but also achieve greater operational efficiency and risk management.

Our commitment is to be a partner in this journey. With our advanced SaaS solutions, we aim to provide the tools and support our clients need to make this transition smooth and successful. As the deadline for T+1 settlement approaches, we stand ready to help our clients embrace this new era of financial trading.

The journey to T+1 compliance might seem daunting, but with the right technology and strategies, it’s a path to greater efficiency and success. Let’s work together to turn this regulatory challenge into an opportunity for operational excellence.

AI also means navigating its security implications. This article delves into the secure application of AI systems, drawing insights from the Australian Signals Directorate’s publication and aligning it with our expertise in financial technologies.

AI also means navigating its security implications. This article delves into the secure application of AI systems, drawing insights from the Australian Signals Directorate’s publication and aligning it with our expertise in financial technologies. Further Reading and References: [ASD’s

Further Reading and References: [ASD’s

Loffa Interactive Group, with its extensive experience in developing secure technological solutions for the financial services sector, stands as a beacon of trust and reliability. The company’s journey through various iterations of Vendor Risk Management (VRM) in collaboration with clients surpassing industry standards is a testament to its commitment to excellence.

Loffa Interactive Group, with its extensive experience in developing secure technological solutions for the financial services sector, stands as a beacon of trust and reliability. The company’s journey through various iterations of Vendor Risk Management (VRM) in collaboration with clients surpassing industry standards is a testament to its commitment to excellence. The financial industry has witnessed several significant cyberattacks, with each breach providing critical lessons in cybersecurity:

The financial industry has witnessed several significant cyberattacks, with each breach providing critical lessons in cybersecurity: