Transforming Operations with AI and Automation

Embracing Automation: The Path Forward for Operations Professionals

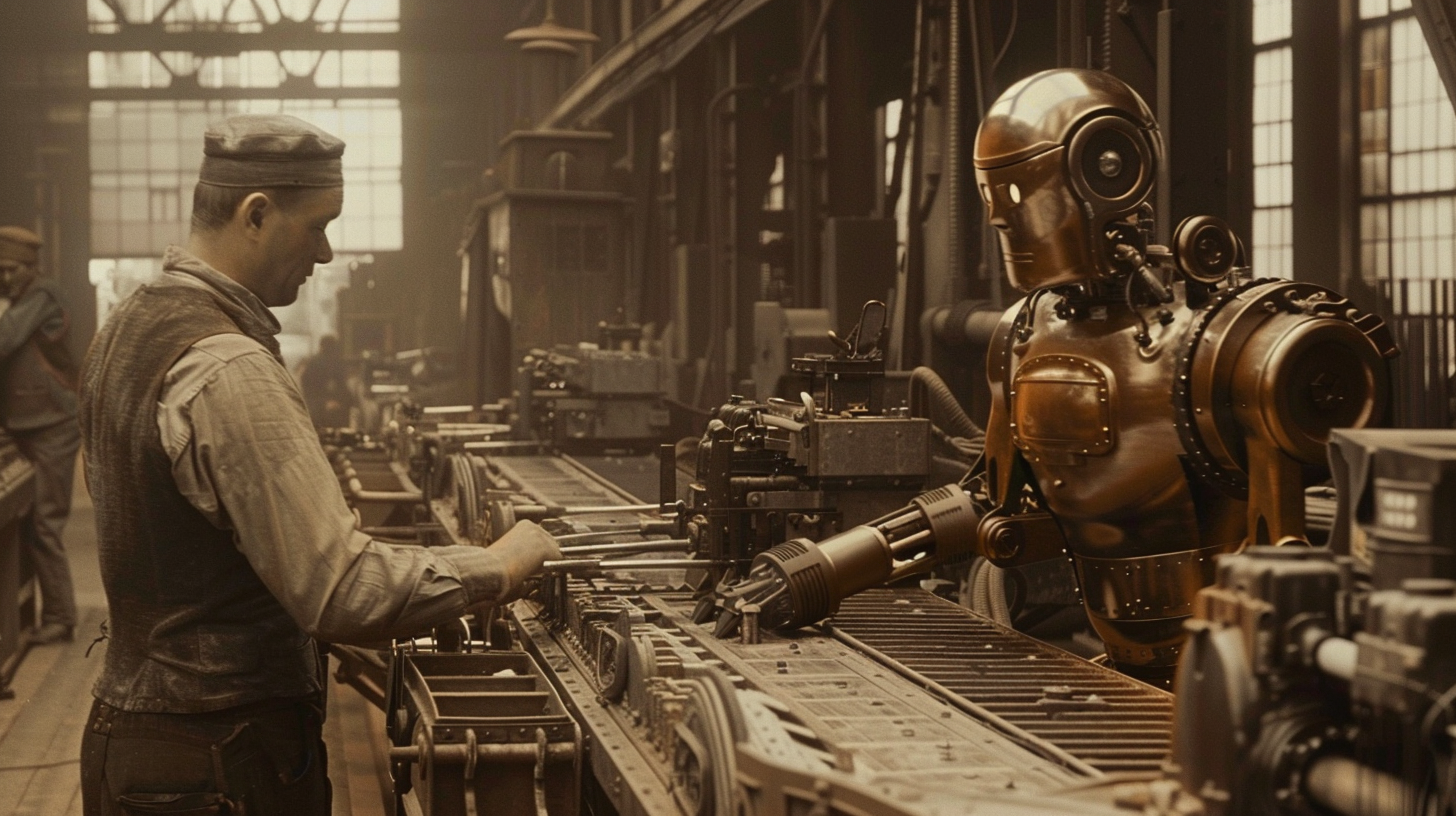

![]() In the rapidly evolving landscape of modern business, the advent of artificial intelligence (AI) and automation technologies has sparked a mix of excitement and apprehension among operations professionals. At the heart of this emotional maelstrom lies a deep-seated concern: the fear of displacement. This concern, while understandable, necessitates a shift in perspective from fear to opportunity. In essence, technology’s relentless march forward is not a harbinger of obsolescence for the operations workforce, but rather a clarion call to embrace innovation.

In the rapidly evolving landscape of modern business, the advent of artificial intelligence (AI) and automation technologies has sparked a mix of excitement and apprehension among operations professionals. At the heart of this emotional maelstrom lies a deep-seated concern: the fear of displacement. This concern, while understandable, necessitates a shift in perspective from fear to opportunity. In essence, technology’s relentless march forward is not a harbinger of obsolescence for the operations workforce, but rather a clarion call to embrace innovation.

The Strategic Value of Human Insight in an Automated World

It’s crucial to understand that automation does not render human insight obsolete. Instead, automation elevates the importance of our insights. Operations professionals who can interpret data, understand the nuances of AI’s analytical outcomes, and make strategic decisions based on this information become invaluable. The human ability to provide context, ethical considerations, and creative problem-solving remains unmatched by AI. For instance, while AI can predict trends and patterns, humans are needed to strategize on these insights, considering the broader business objectives, cultural implications, and potential for innovation. Emphasizing the development of these interpretative and strategic skills can help operations professionals ensure their indispensability.

The Role of Emotional Intelligence in Managing Change

Another critical insight for the modern operations professional is the role of emotional intelligence (EI) in navigating and leading through the technological transition. As AI and automation reshape the workplace, operations managers with high EI are better equipped to manage the human side of this change. They can effectively communicate the benefits of automation, address concerns and resistance, and foster an environment of continuous learning and adaptability. By championing a culture that values both technological proficiency and emotional intelligence, operations professionals can lead their teams more effectively through transitions, ensuring both the well-being of their colleagues and the strategic alignment of automation initiatives with organizational goals.

Finally, envisioning a future where AI and human workers collaborate synergistically offers a roadmap for operations professionals. Instead of viewing AI as a replacement, it should be seen as a partner that can augment human capabilities. For example, AI can handle large-scale data analysis, while humans apply these insights in creative and innovative ways to solve complex problems, design new products, or improve customer experiences. This partnership can also extend to learning from each other; as AI systems learn from human inputs to improve over time, professionals can gain insights from AI analyses to enhance their strategic thinking and decision-making skills.

The Luddite Reflex: A Historical Perspective

Historically, the Luddite movement of the early 19th century serves as a cautionary tale. The Luddites, skilled artisans, resisted the mechanization of production processes, fearing that machines would usurp their livelihoods. However, history has shown that while technology can displace specific roles, it also creates new opportunities, demanding higher-level skills and understanding. The real lesson here is not the dangers of technology, but the risks of failing to adapt.

Historically, the Luddite movement of the early 19th century serves as a cautionary tale. The Luddites, skilled artisans, resisted the mechanization of production processes, fearing that machines would usurp their livelihoods. However, history has shown that while technology can displace specific roles, it also creates new opportunities, demanding higher-level skills and understanding. The real lesson here is not the dangers of technology, but the risks of failing to adapt.

In today’s context, operations professionals face a similar crossroads. AI and automation present opportunities to eliminate tedious, repetitive tasks, allowing humans to focus on more strategic, value-adding activities. For instance, AI can enhance decision-making with predictive analytics, automate routine processes, and improve operational efficiencies. Rather than viewing these technologies as threats, embracing them as tools can redefine roles and open up new career pathways.

Pros of Embracing Automation:

- Efficiency and Productivity: Automation streamlines operations, reduces errors, and speeds up processes, leading to significant productivity gains.

- Opportunity for Skill Upgradation: As routine tasks are automated, professionals can focus on acquiring new skills, particularly in AI management and strategic decision-making.

- Job Creation: New technology sectors and needs arise, creating demand for roles that didn’t previously exist, such as AI system trainers, maintenance specialists, and compliance managers for automated systems.

Cons of Resisting Automation:

- Risk of Obsolescence: Professionals who resist learning new technologies may find their skills outdated, making them less competitive in the job market.

- Missed Opportunities for Innovation: By ignoring automation, companies and individuals miss out on opportunities to innovate and improve their operations, potentially falling behind competitors.

- Workplace Stress and Inefficiency: Avoiding automation can lead to continued reliance on inefficient, manual processes, increasing errors and stress among employees.

A Call to Action: The Advocacy for Automation

The key to navigating the transition to a more automated world lies in advocacy rather than resistance. Operations professionals should seek to understand the potential of AI and automation, advocate for thoughtful integration of these technologies, and actively pursue training and education to position themselves as leaders in this new landscape.

Conclusion: The Future is Collaborative

![]() Ultimately, the future of operations is not a zero-sum game between humans and machines but a collaborative evolution. Management and employees alike must recognize that embracing technology and advocating for automation is essential. In doing so, they ensure not only the relevance of their roles but also contribute to the creation of a more efficient, innovative, and humane working environment. Far from being a threat, automation offers a chance to redefine the essence of work itself, blending human creativity with the precision of machines to forge a brighter future for all.

Ultimately, the future of operations is not a zero-sum game between humans and machines but a collaborative evolution. Management and employees alike must recognize that embracing technology and advocating for automation is essential. In doing so, they ensure not only the relevance of their roles but also contribute to the creation of a more efficient, innovative, and humane working environment. Far from being a threat, automation offers a chance to redefine the essence of work itself, blending human creativity with the precision of machines to forge a brighter future for all.

For firms navigating this transition, a proactive approach to compliance is essential. This includes:

For firms navigating this transition, a proactive approach to compliance is essential. This includes: