Bolstering Defenses: Cybersecurity in the T+1 Settlement Era

Cyber Vigilance in T+1: Safeguarding the Next Generation of Financial Transactions

The finance sector’s march towards a T+1 settlement cycle signifies more than just expedited transactions—it heralds a new era of digital agility and increased cyber vulnerability. The denser flow of transactions, while a boon for market liquidity and efficiency, also opens up a wider surface for cyber threats. This reality necessitates a fortified cybersecurity framework, designed to protect the integrity of every transaction.

The finance sector’s march towards a T+1 settlement cycle signifies more than just expedited transactions—it heralds a new era of digital agility and increased cyber vulnerability. The denser flow of transactions, while a boon for market liquidity and efficiency, also opens up a wider surface for cyber threats. This reality necessitates a fortified cybersecurity framework, designed to protect the integrity of every transaction.

Safeguarding Tomorrow: Cybersecurity Strategies for T+1 Settlement

As the financial world gears up for the transition to T+1 settlement, the spotlight on cybersecurity shines brighter than ever. This accelerated settlement process, while a leap forward in efficiency, also opens up new vulnerabilities in our digital defenses. Our journey into the T+1 era is not just about speed—it’s about security.

Building a Robust Cyber Fortress

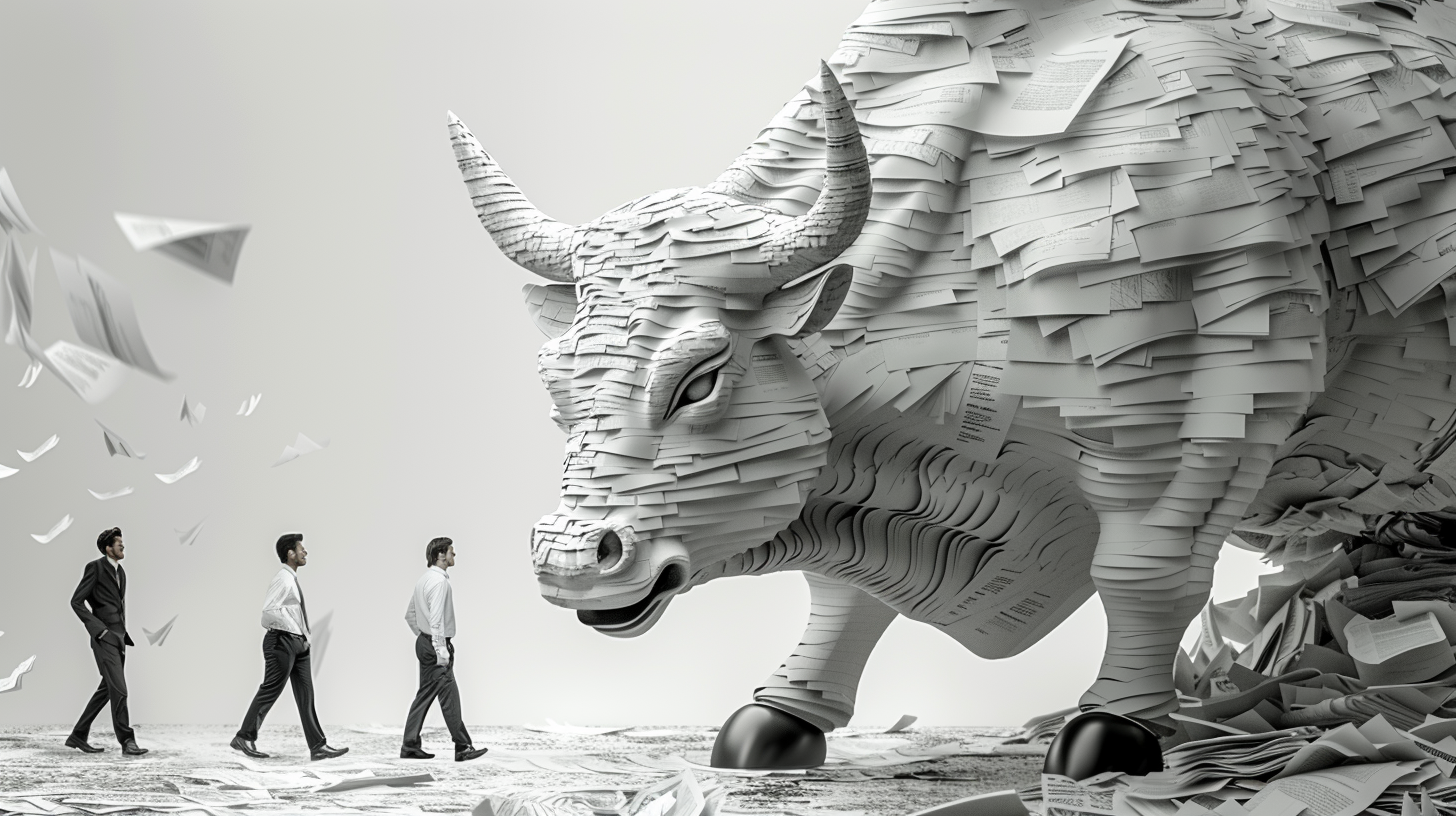

The essence of T+1 lies in its promise for faster settlements. But with this speed comes a critical need for an impenetrable cybersecurity framework. We’re talking about a fortress, equipped with the latest in encryption technologies, access control, and threat detection systems. These aren’t just tools; they’re the pillars of trust in the T+1 landscape.

The essence of T+1 lies in its promise for faster settlements. But with this speed comes a critical need for an impenetrable cybersecurity framework. We’re talking about a fortress, equipped with the latest in encryption technologies, access control, and threat detection systems. These aren’t just tools; they’re the pillars of trust in the T+1 landscape.

Constructing a robust cyber fortress is more crucial than ever. This digital bastion must be built on advanced defensive technologies, encompassing not only state-of-the-art encryption but also resilient firewalls and secure, multi-factor authentication systems to protect against unauthorized access. Furthermore, it requires a dynamic architecture that can swiftly adapt to emerging threats and vulnerabilities, ensuring the security perimeter remains unbreachable. As we forge ahead, this cyber fortress stands as the cornerstone of trust and reliability in the financial sector’s future, safeguarding the integrity of every transaction in the T+1 timeline.

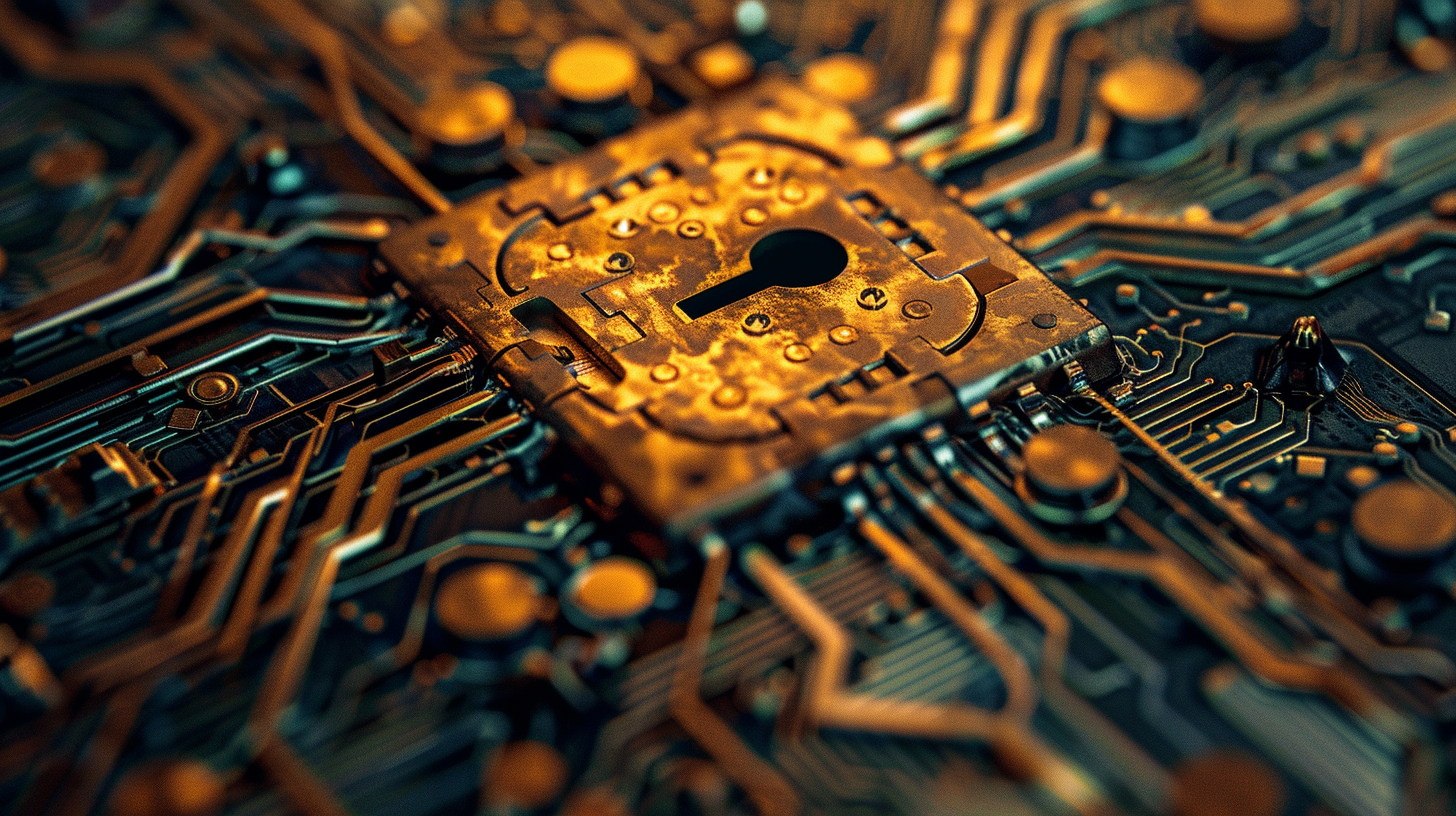

Encryption: The First Line of Defense

Encryption stands as our first guard against intrusion. It’s not just any encryption, but one that adapts, evolves, and responds to the shifting tactics of cyber adversaries.

Encryption stands as our first guard against intrusion. It’s not just any encryption, but one that adapts, evolves, and responds to the shifting tactics of cyber adversaries.

The significance of encryption as a fundamental safeguard cannot be overstated. Imagine it as a digital shield, transforming key data into a code that only a select few can interpret. This essential security measure guarantees that our financial conversations remain private, even as they journey through the vast digital landscape. By relying on the most current encryption methodologies, we’re not just keeping pace with technological advancements; we’re staying ahead of potential threats. The move towards quicker settlements underlines the critical role that encryption plays in preserving the cornerstone of our financial system: trust.

Access Controls: Guarding the Gates

Monitoring: The Watchful Eyes

In the landscape of T+1 settlements where financial transactions are executed with unprecedented speed, the importance of advanced monitoring systems escalates dramatically. The swift pace at which these transactions occur demands an equally agile and proactive approach to surveillance. It’s not sufficient to passively observe; organizations must actively engage in real-time monitoring, utilizing advanced algorithms and artificial intelligence (AI) to identify and address anomalies as they arise. This ensures not just the integrity of each transaction but also the overall security of the financial ecosystem.

In the landscape of T+1 settlements where financial transactions are executed with unprecedented speed, the importance of advanced monitoring systems escalates dramatically. The swift pace at which these transactions occur demands an equally agile and proactive approach to surveillance. It’s not sufficient to passively observe; organizations must actively engage in real-time monitoring, utilizing advanced algorithms and artificial intelligence (AI) to identify and address anomalies as they arise. This ensures not just the integrity of each transaction but also the overall security of the financial ecosystem.

To align with the Center for Internet Security’s (CIS) Version 8 requirements, particularly at the Implementation Group 3 (IG3) level, financial institutions must revamp their monitoring strategies. This involves deploying sophisticated AI-driven tools capable of not only detecting unusual patterns indicative of potential security threats but also predicting such events before they occur. By integrating predictive analytics into their cybersecurity frameworks, firms can transition from a reactive posture to a more strategic, offensive stance against cyber threats.

The implementation of these enhanced monitoring protocols necessitates a comprehensive overhaul of existing policies. Firms must establish clear guidelines for the deployment, operation, and maintenance of monitoring systems. This includes defining thresholds for what constitutes normal and anomalous behavior, ensuring that these parameters are continuously updated to reflect evolving threat landscapes and transaction patterns. Additionally, policies must cover the timely and appropriate response to alerts generated by these monitoring systems, ensuring that potential threats are mitigated swiftly and effectively.

Moreover, the adoption of CIS v8 standards at the IG3 level requires that monitoring efforts extend beyond mere transactional analysis. Organizations must also monitor access to critical systems and data, ensuring that any unauthorized attempts are quickly identified and addressed. This holistic approach to monitoring, encompassing both transaction integrity and system access, is essential for maintaining a robust cybersecurity posture in the fast-moving world of T+1 settlements. By embracing these advanced monitoring capabilities, financial institutions can better protect themselves and their clients from the ever-evolving threats that characterize today’s digital landscape.

Cultivating a Security-First Culture

Technology alone won’t win this battle. As we venture into the T+1 era, fostering a culture that prioritizes cybersecurity becomes critical. Training, awareness, and a shared commitment to security practices are the bedrock of this cultural shift.

Technology alone won’t win this battle. As we venture into the T+1 era, fostering a culture that prioritizes cybersecurity becomes critical. Training, awareness, and a shared commitment to security practices are the bedrock of this cultural shift.

Collaboration: A Unified Front

The fight for cybersecurity in the T+1 era isn’t a solo mission. It’s about forming alliances—between financial institutions, regulatory bodies, and technology partners. Sharing insights, threats, and victories makes us not just participants but champions in the cybersecurity arena.

Conclusion: A Secure Step Forward

Embracing T+1 settlement is about more than speeding up transactions—it’s about moving forward securely. As we navigate this transition, let’s fortify our defenses, educate our teams, and collaborate like never before. In the T+1 era, cybersecurity isn’t just a responsibility—it’s our foundation for a secure and prosperous future.

The concept extends beyond merely securing entry points to a comprehensive strategy ensuring that only authorized individuals have access to sensitive information and systems. It’s akin to establishing a highly selective entry system within a digital fortress, where every key is accounted for, and access levels are meticulously managed based on roles and necessity.

The concept extends beyond merely securing entry points to a comprehensive strategy ensuring that only authorized individuals have access to sensitive information and systems. It’s akin to establishing a highly selective entry system within a digital fortress, where every key is accounted for, and access levels are meticulously managed based on roles and necessity.

As the finance industry stands on the threshold of the T+1 era, it’s clear that the transition is more than just a procedural update; it’s a comprehensive shift that calls for an innovative blend of technology and strategic planning. Artificial Intelligence is at the heart of this transformation, not merely as a technological tool but as a catalyst for redefining financial operations. The future of settlements is not just about adapting to new timelines but about how we, as an industry, leverage technology to forge paths to efficiency, resilience, and strategic foresight.

As the finance industry stands on the threshold of the T+1 era, it’s clear that the transition is more than just a procedural update; it’s a comprehensive shift that calls for an innovative blend of technology and strategic planning. Artificial Intelligence is at the heart of this transformation, not merely as a technological tool but as a catalyst for redefining financial operations. The future of settlements is not just about adapting to new timelines but about how we, as an industry, leverage technology to forge paths to efficiency, resilience, and strategic foresight.

The transition to a T+1 settlement cycle, shortening the time between trade execution and settlement from two business days (T+2) to one (T+1), heralds a significant shift in the securities industry. This move aims to enhance market efficiency, reduce counterparty risk, and improve capital utilization. For investment advisors, adapting to T+1 is not just about compliance; it’s an opportunity to refine investment strategies, improve client communication, and leverage technology for better service delivery. Here’s what you need to know to navigate this change effectively.

The transition to a T+1 settlement cycle, shortening the time between trade execution and settlement from two business days (T+2) to one (T+1), heralds a significant shift in the securities industry. This move aims to enhance market efficiency, reduce counterparty risk, and improve capital utilization. For investment advisors, adapting to T+1 is not just about compliance; it’s an opportunity to refine investment strategies, improve client communication, and leverage technology for better service delivery. Here’s what you need to know to navigate this change effectively. Review and Upgrade Technology: Assess your current technology stack to ensure it can handle the increased speed of settlement. Consider automated solutions for trade processing, risk management, and client reporting to enhance operational efficiency.

Review and Upgrade Technology: Assess your current technology stack to ensure it can handle the increased speed of settlement. Consider automated solutions for trade processing, risk management, and client reporting to enhance operational efficiency. Strengthen Operational Processes: Revisit your operational workflows to identify areas for improvement. This includes ensuring compliance with the new settlement timeline, enhancing the accuracy of trade execution, and streamlining reconciliation processes.

Strengthen Operational Processes: Revisit your operational workflows to identify areas for improvement. This includes ensuring compliance with the new settlement timeline, enhancing the accuracy of trade execution, and streamlining reconciliation processes.