This incident, with the potential to render Baltimore Harbor inaccessible for six months or more, presents a unique case study in understanding the interconnectedness of infrastructure, supply chains, and financial systems. In this blog post, we’ll explore the multifaceted impact of such a disruption on the stock market, supply chain, inflation, and other economic indicators over the next year.

Supply Chain Disruptions and Stock Market Volatility

Firstly, the immediate fallout of this incident would likely be an increase in stock market volatility. Companies reliant on Baltimore Harbor for importing and exporting goods would face sudden disruptions in their supply chains. This could lead to delayed deliveries, increased costs, and reduced revenues, adversely affecting their stock prices. Industries such as manufacturing, retail, and commodities, particularly those with a significant presence in the Northeast, would be hit hardest.

Sector-Specific Impacts and Investment Shifts

Investors might see a shift in focus towards sectors less impacted by supply chain disruptions. Technology and services sectors, which are less dependent on physical goods and more on digital infrastructure, could see a relative increase in investment. Conversely, transportation and logistics companies could face a downturn due to the immediate operational challenges and increased costs associated with rerouting shipments.

Exploring how the pandemic influenced investment patterns, which sectors thrived or declined, and potential trends we might observe following significant disruptions such as the Baltimore bridge collapse.

Pandemic-Driven Investment Shifts

During the pandemic, investment patterns shifted markedly as global economies grappled with unprecedented challenges. Some sectors experienced rapid growth due to changing consumer behaviors and needs, while others faced significant downturns.

-

- Technology and E-commerce: With remote work and digital commerce becoming the norm, technology and e-commerce sectors saw substantial growth. Companies offering cloud computing, collaboration tools, and online retail platforms experienced increased demand, leading to stock price surges.

- Healthcare and Biotech: The urgent need for vaccines, treatments, and medical supplies propelled the healthcare and biotech sectors. Investors flocked to companies contributing to pandemic mitigation efforts, expecting high returns from successful vaccine and therapeutic developments.

- Home Entertainment and Streaming Services: As lockdowns and social distancing measures were implemented, home entertainment and streaming services witnessed a boom, benefiting from a captive audience seeking leisure activities at home.

Conversely, some sectors faced severe challenges:

-

- Travel and Hospitality: Travel bans, lockdowns, and consumer hesitancy devastated the travel and hospitality industry, leading to plummeting stock prices for airlines, hotels, and related services.

- Energy: The dramatic reduction in travel and industrial activity led to a slump in demand for oil and gas, negatively impacting the energy sector.

Post-Pandemic Trends and Expectations

Looking ahead, the Baltimore bridge collapse could catalyze shifts in investment similar to those observed during the pandemic, albeit with sector-specific nuances:

-

- Infrastructure and Construction: Anticipation of infrastructure repair and enhancement projects could drive interest in construction and engineering firms, paralleling the increased investment in healthcare infrastructure during the pandemic.

- Logistics and Supply Chain Solutions: Just as e-commerce and technology solutions gained during the pandemic, logistics companies that can navigate disruptions and provide alternative supply chain routes might see increased investor interest.

- Sustainability and Renewable Energy: The emphasis on resilience may accelerate investments in sustainability and renewable energy, sectors that gained traction as the pandemic underscored the importance of long-term environmental sustainability.

Adapting to New Normals

Investors are likely to continue seeking sectors that demonstrate resilience to disruptions and show potential for innovation-driven growth. While the immediate aftermath may see a dip in sectors directly impacted by the harbor’s inaccessibility, adaptive industries, particularly those offering digital and logistical solutions, may experience an uptick.

The Baltimore bridge collapse, much like the pandemic, serves as a catalyst for reassessing investment strategies. By examining pandemic-induced trends, investors can anticipate sectors that might either withstand or benefit from such disruptions. As always, the key to navigating these shifts lies in adaptability, foresight, and a keen understanding of evolving global dynamics

Historical Parallels and Lessons Learned

The resilience of systems and communities in the face of disaster is a testament to human ingenuity and adaptability. As we face the collapse of the bridge in Baltimore, it’s imperative to look back at historical events that have shaped our preparedness and response mechanisms, particularly within the financial industry. From the fire at the Iron Mountain storage center, through the devastation of Superstorm Sandy, to the global upheaval caused by COVID-19, each event has carved out lessons on resilience, adaptability, and the crucial role of technology in mitigating disaster impacts.

- Superstorm Sandy and Infrastructure Resilience: Sandy’s rampage through New York on October 29, 2012 highlighted the importance of robust infrastructure and the need for emergency preparedness in critical sectors, including the financial markets. It accelerated the adoption of disaster recovery and business continuity plans that are now integral to operational strategies.

- COVID-19 and Operational Flexibility: The pandemic forced a global pivot to remote operations, testing the limits of digital systems and remote work capabilities. Financial institutions learned the importance of digital adaptability and the need for systems that can support significant shifts in operational modalities.

- September 11th The terrorist attacks on the World Trade Center directly impacted Wall Street by closing the New York Stock Exchange (NYSE) and the NASDAQ for four trading days. This was the longest shutdown since 1933 and had significant implications for financial markets globally.

- Hurricane Katrina (2005) While not directly impacting Wall Street, Hurricane Katrina had significant indirect effects on the national economy and the financial markets, particularly through its impact on oil prices and the insurance industry.

- Meme Stock (2021) The meme stock craze led to unprecedented volatility in the affected stocks and raised concerns about market manipulation, the role of social media in trading, and the potential for widespread financial loss among individual investors who joined the frenzy late.

- Iron Mountain Fire and Document Preservation: The Iron Mountain fires including a notable fire in April 1997 in New Jersey underscored the vulnerability of physical record-keeping. The financial industry’s shift towards digital documentation and the establishment of electronic data storage solutions have been pivotal in protecting crucial information from similar catastrophes.

Automation as a Buffer Against Cascading Disasters

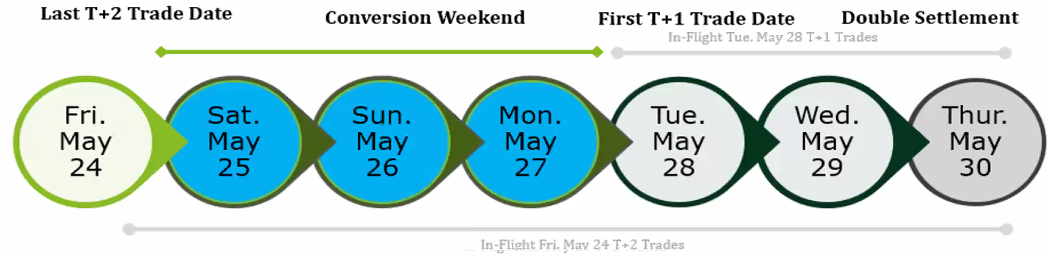

Automation plays a critical role in minimizing the cascading effects of disasters. The lessons from past events have highlighted the vulnerability of manual processes and the strength that automated systems can offer in terms of speed, accuracy, and reliability under duress. In the context of T+1 settlement:

- Enhanced Operational Efficiency: Automation streamlines processes, reducing the window for error and delays that can compound in the wake of a disaster. The move to T+1 is a step towards making the settlement process more resilient to external shocks.

- Robustness in Crisis: Automated systems provide a foundation for operations to continue with minimal disruption, even when traditional workflows are upended, as was demonstrated during the COVID-19 pandemic.

- Disaster Preparedness: The adoption of automation and digital technologies enables financial institutions to have more agile and responsive disaster recovery strategies. Automated alerts, real-time monitoring, and predictive analytics can help anticipate issues before they escalate into crises.

Inflationary Pressures

The blockage of a major port could exacerbate existing inflationary pressures. With the flow of goods stifled, the cost to transport goods to and from alternative ports would increase. These higher transportation costs would likely be passed on to consumers, contributing to broader inflationary pressures. Food, electronics, and other imported goods could see price increases, further straining household budgets and potentially dampening consumer spending, a key driver of economic growth.

Long-term Economic Implications

The longer-term economic implications could include a reevaluation of infrastructure resilience and supply chain diversification. Companies might accelerate efforts to diversify their supply chains to mitigate the risks of similar future disruptions. This could lead to increased investments in infrastructure and technology designed to enhance supply chain visibility and resilience, potentially benefiting companies in these sectors.

It’s crucial to delve into how significant infrastructure failures, such as the Baltimore Harbor bridge collapse, can ripple through economies, affecting everything from local businesses to global supply chains. These incidents can serve as a wake-up call, highlighting vulnerabilities in our economic systems and prompting a reevaluation of resilience strategies.

Direct Economic Impacts

-

- Local Economy Disruption: The immediate vicinity of Baltimore Harbor would experience significant economic impacts. Local businesses, especially those reliant on harbor activities, could face decreased revenue and potential closures. The tourism sector, including hotels, restaurants, and attractions, might also suffer due to decreased accessibility and visitor numbers.

- Supply Chain Delays: For industries dependent on goods transiting through Baltimore Harbor, delays could lead to increased costs, inventory shortages, and production slowdowns. This disruption could cascade through supply chains, affecting manufacturers, retailers, and consumers nationwide, potentially leading to price increases for goods and raw materials.

Indirect and Broader Economic Implications

-

- Shift in Trade Routes: Over the long term, shipping companies might reroute their operations to alternative ports, potentially leading to increased traffic in other areas but decreased economic activity for Baltimore. This shift could necessitate infrastructure upgrades at other ports to handle the increased volume, along with adjustments in logistics and transportation networks.

- Investment in Infrastructure Resilience: The collapse could prompt increased investment in infrastructure resilience, not just in Baltimore but nationwide. Governments and private entities may prioritize funding for the maintenance and upgrading of aging infrastructure to prevent similar incidents, leading to job creation in construction, engineering, and related sectors.

- Insurance and Risk Management: The incident could lead to higher insurance premiums for businesses operating in and around crucial infrastructure points. Companies might also invest more in risk management strategies to mitigate potential losses from future disruptions, affecting financial planning and operational costs. Although the US Government has stated it will cover the clean-up and rebuilding of the bridge, there are still insurance concerns.

-

Broader Insurance Implications and Industry Impact

- Indirect Claims from Delayed Shipments:

- Even if the government covers the direct costs of cleanup and reconstruction, insurance companies may face indirect claims related to the incident. For example, ships stuck waiting due to an obstructed waterway can lead to claims under policies covering business interruption or delay in shipment. These policies compensate for lost income and additional expenses incurred while operations are suspended.

- Liability and Cargo Claims:

- Companies with products in shipping containers that are delayed or damaged as a result of the incident might file claims. This includes claims under marine cargo insurance, which covers the loss or damage of ships’ cargo, and liability insurance, if companies face legal actions due to the delays or damage of goods.

- Increased Premiums and Reduced Coverage:

- In response to heightened risks and potential for significant claims, insurance companies might increase premiums or reduce coverage availability in affected regions or sectors. This can further strain businesses relying on these routes for shipping, as the cost of insurance becomes a larger operational expense.

- Risk Assessment and Insurance Market Dynamics:

- The withdrawal of insurance companies from high-risk areas can lead to a reevaluation of risk across the sector. It may prompt insurance providers to adjust their models, potentially leading to broader market changes. This can affect not just local operations but also global shipping and logistics chains, as insurance is a critical component in managing operational risk.

- Government as Insurer of Last Resort:

- When the government steps in to cover costs not addressed by private insurance, it acts as an insurer of last resort. While this can mitigate immediate financial burdens, it also raises questions about long-term sustainability and the division of risk between public and private entities. Over-reliance on government intervention can lead to challenges in risk management and insurance market stability.

- Policy and Regulatory Changes: In response to the collapse, there could be a push for stricter regulatory standards for infrastructure maintenance and safety. This might lead to increased compliance costs for companies but also opportunities for businesses specializing in infrastructure inspection, maintenance, and safety technologies.

Long-term Economic Growth and Innovation

While the immediate aftermath of the collapse presents challenges, it also offers opportunities for economic growth and innovation. Investments in infrastructure can stimulate economic activity, create jobs, and enhance the efficiency and resilience of supply chains. Additionally, the incident could accelerate the adoption of innovative logistics solutions, such as drone delivery or enhanced freight tracking technologies, as businesses seek to mitigate the impact of similar future disruptions.

The long-term economic implications of the Baltimore bridge collapse extend far beyond the immediate disruption. They underscore the interconnectedness of our economic systems and the importance of investing in resilient infrastructure. By addressing these challenges proactively, we can not only mitigate the negative impacts but also spur economic growth, innovation, and a more resilient future.

Policy Responses and Market Recovery

The response from policymakers could also influence market trajectories. Efforts to expedite repairs and minimize disruptions could help mitigate the negative impacts. Furthermore, this incident could prompt increased investment in infrastructure development and maintenance, creating opportunities in construction, engineering, and related sectors.

Reflections

The collapse of a bridge in Baltimore serves as a stark reminder of the vulnerabilities in our supply chain and economic infrastructure. The ripple effects through the stock market, inflation rates, and the broader economy highlight the critical need for resilient infrastructure and diversified supply chains. While the immediate impacts may pose challenges for investors and companies alike, the long-term lessons and responses could pave the way for a more robust and adaptable economic system.

In an era where digital transformation is more than just a buzzword, the security of the software supply chain has become a paramount concern. The recent urgent security alert from Red Hat regarding a compromise in XZ Utils, a popular data compression library, serves as a stark reminder of the vulnerabilities that lurk within the very tools we rely on daily. This breach, denoted as CVE-2024-3094, has sent ripples through the Linux community, underscoring the critical need for vigilance and proactive security measures.

In an era where digital transformation is more than just a buzzword, the security of the software supply chain has become a paramount concern. The recent urgent security alert from Red Hat regarding a compromise in XZ Utils, a popular data compression library, serves as a stark reminder of the vulnerabilities that lurk within the very tools we rely on daily. This breach, denoted as CVE-2024-3094, has sent ripples through the Linux community, underscoring the critical need for vigilance and proactive security measures. Lessons from CVE-2024-3094: Strengthening the Chain

Lessons from CVE-2024-3094: Strengthening the Chain

As we anchor the lessons learned from the XZ Utils compromise, the journey ahead in cybersecurity remains a vast and uncharted sea. This incident not only underscores the fragility of our digital infrastructure but also illuminates the resilience and adaptability required to navigate future challenges. With each wave of innovation, the question looms: how do we fortify our defenses without stifling the spirit of exploration and progress? The answer lies not in the stars, but in our collective will to innovate, adapt, and sail boldly into the future, armed with knowledge and a steadfast commitment to security.

As we anchor the lessons learned from the XZ Utils compromise, the journey ahead in cybersecurity remains a vast and uncharted sea. This incident not only underscores the fragility of our digital infrastructure but also illuminates the resilience and adaptability required to navigate future challenges. With each wave of innovation, the question looms: how do we fortify our defenses without stifling the spirit of exploration and progress? The answer lies not in the stars, but in our collective will to innovate, adapt, and sail boldly into the future, armed with knowledge and a steadfast commitment to security.

As the financial industry grapples with these challenges, it’s clear that the path to T+1 is not just a technical upgrade but a philosophical pivot. The balance between speed and safety, efficiency and oversight, requires a nuanced approach. It calls for enhanced technologies that can handle rapid affirmation without bypassing essential checks, regulatory frameworks that adapt to the new pace without diluting standards, and a culture of vigilance that prioritizes integrity over expediency.

As the financial industry grapples with these challenges, it’s clear that the path to T+1 is not just a technical upgrade but a philosophical pivot. The balance between speed and safety, efficiency and oversight, requires a nuanced approach. It calls for enhanced technologies that can handle rapid affirmation without bypassing essential checks, regulatory frameworks that adapt to the new pace without diluting standards, and a culture of vigilance that prioritizes integrity over expediency. When market participants push for affirmation (the process of confirming trade details before they move to settlement), the responsibility for guarding against Anti-Money Laundering (AML) doesn’t rest with just one entity. Instead, it is a collective responsibility, with various safeguards and protocols in place across different levels of the financial ecosystem. Here’s how AML efforts are distributed among the different stakeholders:

When market participants push for affirmation (the process of confirming trade details before they move to settlement), the responsibility for guarding against Anti-Money Laundering (AML) doesn’t rest with just one entity. Instead, it is a collective responsibility, with various safeguards and protocols in place across different levels of the financial ecosystem. Here’s how AML efforts are distributed among the different stakeholders: The transition to T+1 settlements is not just an inevitability but a necessity in a world where financial transactions move at the speed of light. However, this transition must be navigated with a keen awareness of the intricate dance between operational efficiency and regulatory compliance. As the financial ecosystem evolves, so too must our approaches to safeguarding the market’s integrity. By fostering innovation in compliance technologies and strengthening collaborative oversight mechanisms, we can ensure that the move to T+1 enriches the market, enhancing both its velocity and its virtue.

The transition to T+1 settlements is not just an inevitability but a necessity in a world where financial transactions move at the speed of light. However, this transition must be navigated with a keen awareness of the intricate dance between operational efficiency and regulatory compliance. As the financial ecosystem evolves, so too must our approaches to safeguarding the market’s integrity. By fostering innovation in compliance technologies and strengthening collaborative oversight mechanisms, we can ensure that the move to T+1 enriches the market, enhancing both its velocity and its virtue.

The Francis Scott Key Bridge is located in Baltimore, Maryland, far from the New York Financial District. A collapse of the bridge wouldn’t have direct impact on Wall Street workers and the operations of the financial district in New York would likely be minimal in terms of commuting or direct business operations, given the significant distance between the two locations. However, indirect impacts could arise from disruptions in the supply chain, especially if the bridge plays a key role in regional transportation and logistics networks that serve businesses in New York City. This could potentially affect businesses that rely on goods and services moving through the Baltimore area. Additionally, any significant infrastructure collapse can have broader financial market implications due to the potential impact on investor sentiment and market stability. But, these would be more diffuse and not as immediate or direct as they would be for businesses and individuals located in the vicinity of the bridge in Baltimore.

The Francis Scott Key Bridge is located in Baltimore, Maryland, far from the New York Financial District. A collapse of the bridge wouldn’t have direct impact on Wall Street workers and the operations of the financial district in New York would likely be minimal in terms of commuting or direct business operations, given the significant distance between the two locations. However, indirect impacts could arise from disruptions in the supply chain, especially if the bridge plays a key role in regional transportation and logistics networks that serve businesses in New York City. This could potentially affect businesses that rely on goods and services moving through the Baltimore area. Additionally, any significant infrastructure collapse can have broader financial market implications due to the potential impact on investor sentiment and market stability. But, these would be more diffuse and not as immediate or direct as they would be for businesses and individuals located in the vicinity of the bridge in Baltimore.