Mastering Financial Regulatory Compliance with Loffa Interactive Group’s Advanced Tools

Navigating the Complex Seas of Financial Regulatory Compliance: A Deep Dive with Loffa Interactive Group’s Innovative Arsenal

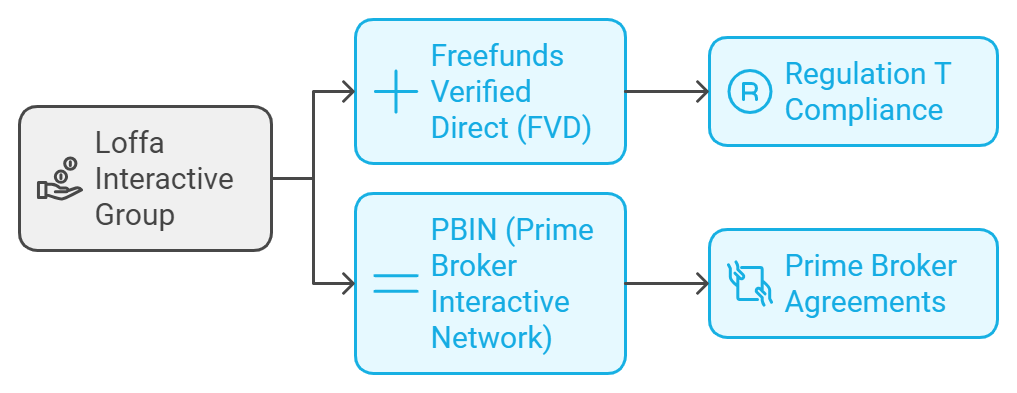

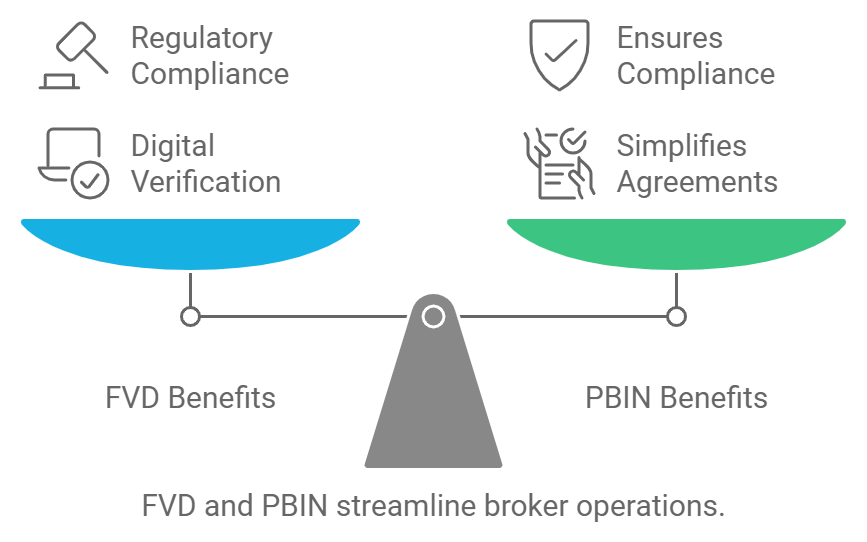

In the fast-paced world of finance, staying ahead of regulatory compliance curves while sailing towards operational excellence has become more of a necessity than a choice for firms. Loffa Interactive Group, standing tall with its legacy of empowering Wall Street giants, shines as a beacon of trust and innovation. Its arsenal, packed with tools like Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN), ensures that navigating these tumultuous waters is not just about staying afloat but cruising confidently.

In the fast-paced world of finance, staying ahead of regulatory compliance curves while sailing towards operational excellence has become more of a necessity than a choice for firms. Loffa Interactive Group, standing tall with its legacy of empowering Wall Street giants, shines as a beacon of trust and innovation. Its arsenal, packed with tools like Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN), ensures that navigating these tumultuous waters is not just about staying afloat but cruising confidently.

The Vanguard Tools: FVD and PBIN

At the heart of Loffa Interactive’s strategy lies its commitment to simplifying the convoluted processes of regulatory compliance, making them as seamless as guidelines on a map.

FVD: The Compass for Cash Account Trades

- Streamlining Regulation T Compliance: FVD acts as a compass, ensuring that brokers don’t veer off course. This tool is essential in managing Letters of Free Funds, aligning perfectly with Regulation T requirements. It’s the guiding light that ensures brokers can efficiently complete all necessary balance verifications and requirements for trading in cash accounts, offering a streamlined solution for managing trade settlements. Imagine the ease of plotting a course with such an intuitive compass!

PBIN: Charting the Course for Brokerage Agreements

- Simplifying Complex Navigation: Navigating the SIA-150 and SIA-151 form requirements often feels like charting unknown waters. PBIN emerges as the cartographer’s tool, simplifying the complex legal geography of prime brokerage agreements, amendments, and clearance agreements. It’s not just a tool; it’s a comprehensive map and guide rolled into one.

Impactful Innovation for Prime Brokers and Clearing Firms

Loffa Interactive Group’s innovations do more than just streamline processes; they redefine how prime brokers and clearing firms tackle the twin titans of compliance and operational efficiency. Let’s dive deeper into why these tools are not just beneficial but critical for these financial behemoths.

Crucial Efficiency for Prime Brokers

- Simplifying Prime Brokerage Operations: With PBIN, prime brokers can now expedite the handling of complex agreements and amendments. This translates to faster operational workflows, improved client satisfaction, and a marked reduction in the risk of compliance infractions. The impact? A prime brokerage operation that is not only efficient but also resilient in the face of regulatory storms.

Operational Precision for Clearing Brokers

- Streamlined Compliance and Transactions: For executing or clearing brokers, FVD serves as the linchpin in maintaining compliance without sacrificing operational speed. By automating and streamlining the verification of free funds, it reduces the administrative burden significantly. This precision in compliance and operations ensures that transactions are not just compliant but are conducted with unparalleled efficiency.

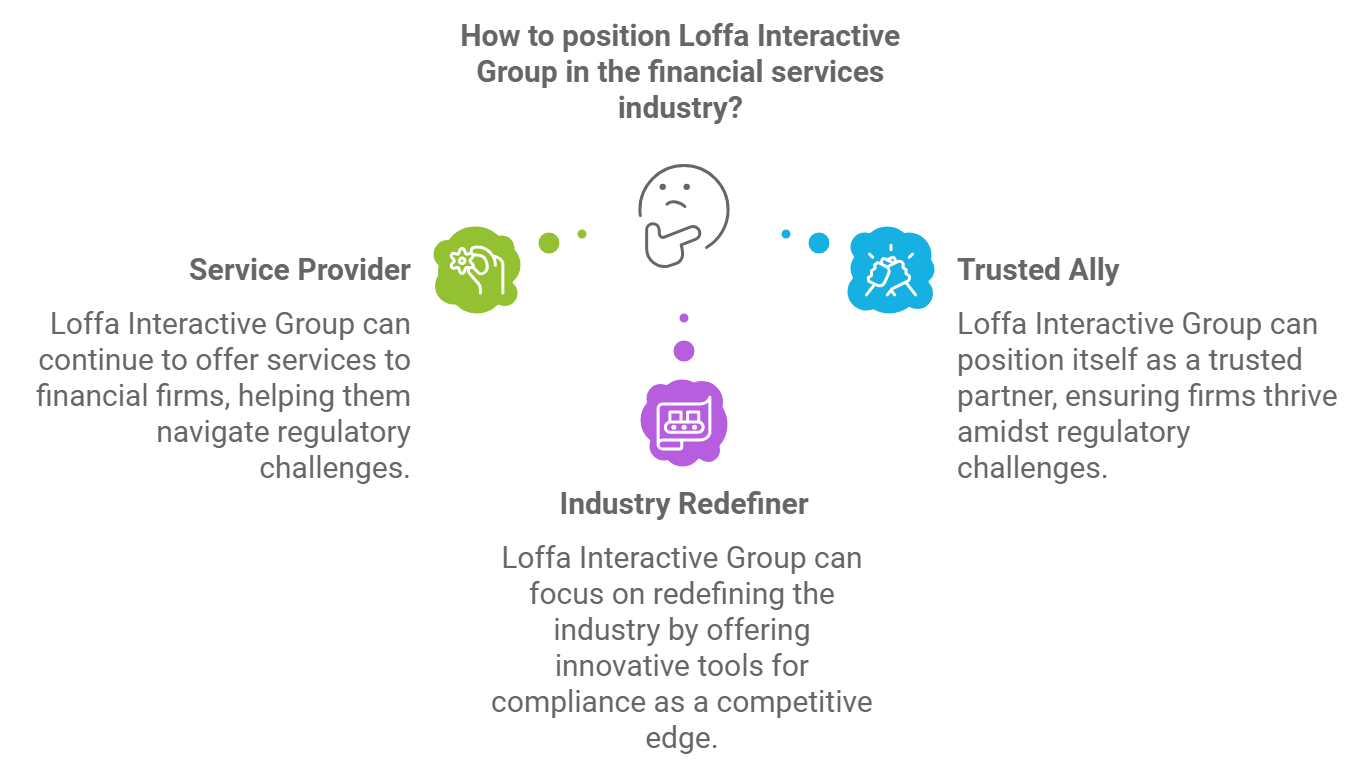

Loffa Interactive Group’s dedication to pushing the envelope of financial technology secures its position as a trusted partner for financial firms. With security measures that are as fortified as a stronghold and a suite of products tailored for the high seas of finance, Loffa Interactive ensures that firms are not just compliant but are sailing towards operational excellence with the wind at their backs. As the regulatory landscape continues to shift, partnering with a navigator like Loffa Interactive Group isn’t just prudent; it’s imperative for firms aiming for the horizon of success in the financial industry.

Loffa Interactive Group’s dedication to pushing the envelope of financial technology secures its position as a trusted partner for financial firms. With security measures that are as fortified as a stronghold and a suite of products tailored for the high seas of finance, Loffa Interactive ensures that firms are not just compliant but are sailing towards operational excellence with the wind at their backs. As the regulatory landscape continues to shift, partnering with a navigator like Loffa Interactive Group isn’t just prudent; it’s imperative for firms aiming for the horizon of success in the financial industry.

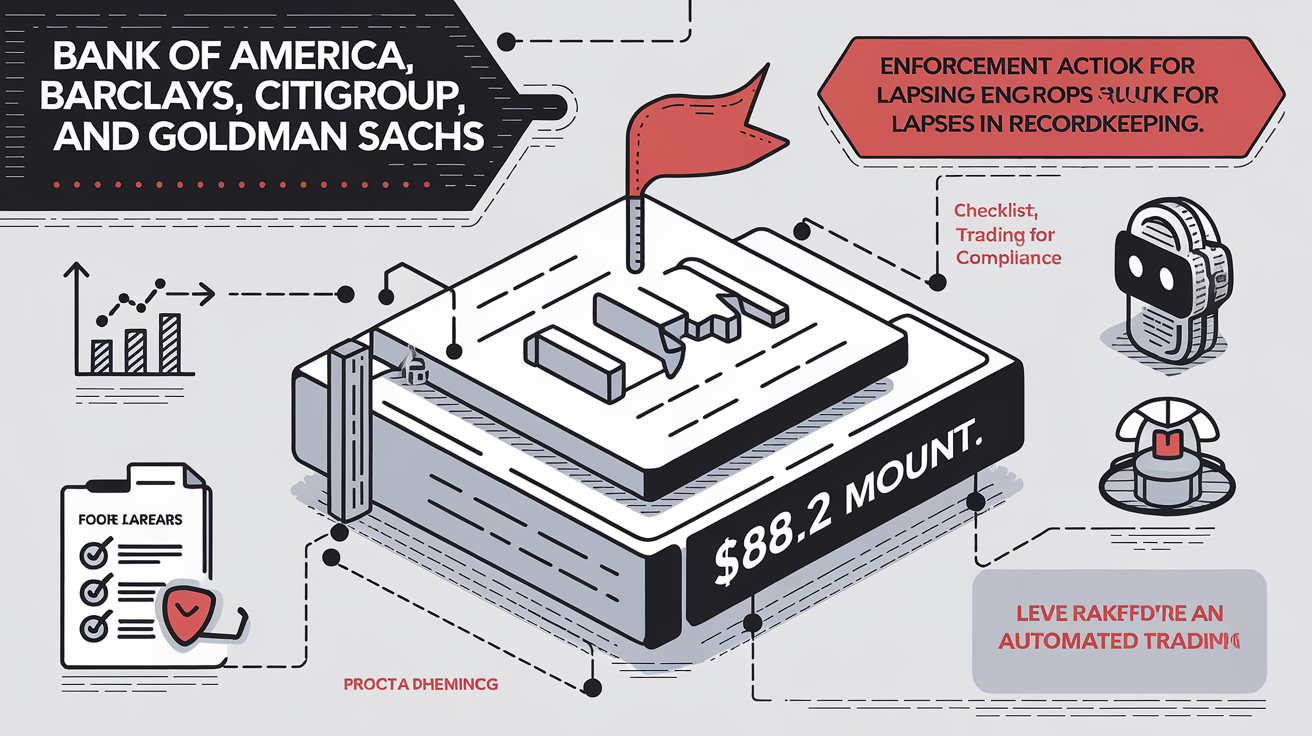

In a groundbreaking move that sent ripples across the financial industry, the Securities and Exchange Commission (SEC) levied an eye-watering $88.2 million fine on 12 leading financial institutions, including titans like Bank of America, Barclays, Citigroup, and Goldman Sachs. This penalty, stemming from lapses in recordkeeping, underscores the non-negotiable nature of regulatory compliance and serves as a stark reminder of the hefty price of non-compliance.

In a groundbreaking move that sent ripples across the financial industry, the Securities and Exchange Commission (SEC) levied an eye-watering $88.2 million fine on 12 leading financial institutions, including titans like Bank of America, Barclays, Citigroup, and Goldman Sachs. This penalty, stemming from lapses in recordkeeping, underscores the non-negotiable nature of regulatory compliance and serves as a stark reminder of the hefty price of non-compliance.

In the complex world of financial regulations, Loffa Interactive Group stands out, offering a helping hand to navigate the choppy waters of regulatory compliance. With over 20 years under their belt, Loffa’s not just another vendor; they’re the go-to guys for Wall Street’s elite, crafting top-shelf tech solutions that make broker transaction services a breeze.

In the complex world of financial regulations, Loffa Interactive Group stands out, offering a helping hand to navigate the choppy waters of regulatory compliance. With over 20 years under their belt, Loffa’s not just another vendor; they’re the go-to guys for Wall Street’s elite, crafting top-shelf tech solutions that make broker transaction services a breeze.

Freefunds Verified Direct (FVD): The Executing Broker’s Best Friend

Freefunds Verified Direct (FVD): The Executing Broker’s Best Friend