Raymond James’ $1.8M FINRA Fine: Unveiling Supervision Lapses and Anticipating Industry Evolution

Raymond James Fined $1.8M by FINRA: Supervision Failures Unpacked and Future Trajectories

Raymond James Fined $1.8M by FINRA: Supervision Failures Unpacked and Future Trajectories

Introduction

Recently, Raymond James Financial Services was hit by a financial lightning bolt in the form of a $1.8 million fine from the Financial Industry Regulatory Authority (FINRA). At the heart of the storm is a failure to sufficiently monitor electronic communications, a cornerstone of modern regulatory compliance. Loffa Interactive Group, standing at the confluence of technology and financial regulation, sheds light on the implications this development portends for the broader industry.

The Lowdown on the Charges

FINRA’s bone of contention with Raymond James revolves around the company’s supervision systems—or the lack thereof—concerning employees’ digital communications. Some of the firm’s personnel, it emerged, were bypassing official channels by texting clients. This move, seen as sidestepping crucial recordkeeping protocols, not only contravenes FINRA’s playbook but also erodes the financial world’s commitment to transparency and accountability.

Why Keeping a Tab on Electronic Communications Is Critical

We’re navigating an era where emails, instant messages, and social platforms are the bread and butter of financial dealings. This digital shift brings the onus of curating comprehensive archives of all client interactions, as prescribed by regulatory bodies. A robust system to oversee and archive these digital conversations is non-negotiable, safeguarding firms against regulatory backlashes, facilitating internal inquiries, customer disputes resolution, and legal defenses.

Zooming In: Spotlight on Key Impacts

For Prime Brokers

- Regulatory Radar Sensitivity: Prime Brokers, deeply intertwined in the tapestry of financial operations, find themselves more exposed to regulatory scrutiny post the Raymond James saga. The episode serves as a clarion call to tighten surveillance over electronic communications, spotlighting the necessity for advanced solutions like those in Loffa’s arsenal.

- Operational Integrity: The ability of Prime Brokers to maintain operational integrity hinges significantly on their compliance frameworks. Loffa’s products are pioneered to seamlessly align with the intricate maze of financial regulations, ensuring Prime Brokers can navigate these with aplomb while centering on their core competencies.

For Executing or Clearing Brokers

- Surge in Compliance Costs: Executing and Clearing Brokers face a potential uptick in their compliance expenditures. Integrating sophisticated supervisory technologies is no longer optional but a mandate to preempt regulatory flags similar to those faced by Raymond James.

- Reputational Resilience: Amid tightening regulations, these brokers must lean heavily on technological partnerships, like that offered by Loffa Interactive, to buttress their reputation. Adhering to compliance dictates and leveraging top-tier security measures ensures they remain in good standing with regulators and clients alike.

Loffa Interactive’s Compliance Crusade

At Loffa Interactive, weaving through the regulatory labyrinth is second nature. Our suites, particularly the Prime Broker Interactive Network (PBIN), stand as testaments to our commitment to streamlining compliance. Bolstered by our unwavering focus on security, we’ve become the go-to for financial entities aiming to steer clear of the punitive radar while elevating their operational efficacy.

Concluding Insights

The narrative around Raymond James’ penalization by FINRA underscores the non-negotiable essence of supervision in the digitized financial domain. As catalysts for technological empowerment, Loffa Interactive remains at the forefront, enabling our partners to rise above the regulatory fray. With our eyes set on innovation and operational excellence, we’re not just responding to the current landscape; we’re shaping the future of financial compliance and security.

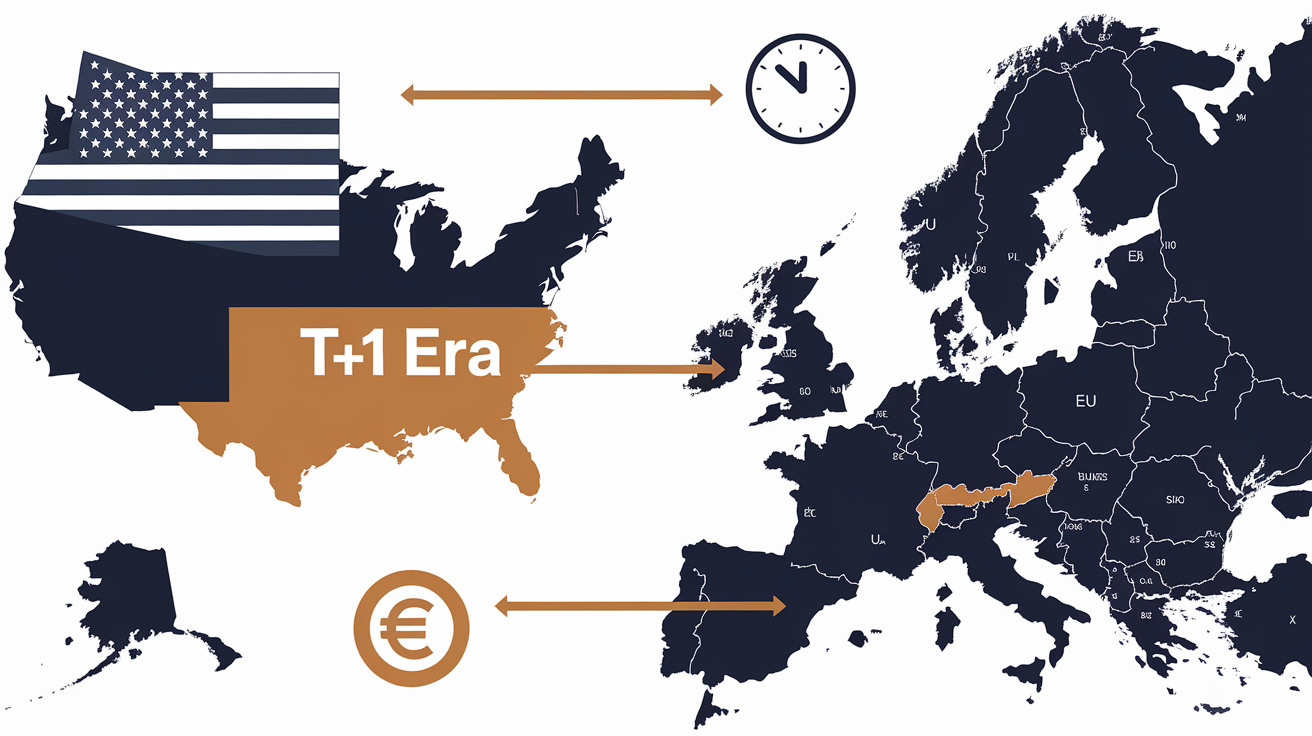

The push towards a T+1 settlement cycle in the United States has thrown a spanner in the works for financial institutions straddling the U.S. and European Union (E.U.) markets. With the E.U. chilling on its T+2 cycle, we’re seeing some real head-scratchers pop up—think FX funding headaches, ETF gymnastics, and corporate actions conundrums. These misalignments aren’t just academic puzzles; they’re real-world challenges that can ratchet up operational inefficiencies and dial-up risk levels for firms trying to keep their footing in the shifting sands of international finance.

The push towards a T+1 settlement cycle in the United States has thrown a spanner in the works for financial institutions straddling the U.S. and European Union (E.U.) markets. With the E.U. chilling on its T+2 cycle, we’re seeing some real head-scratchers pop up—think FX funding headaches, ETF gymnastics, and corporate actions conundrums. These misalignments aren’t just academic puzzles; they’re real-world challenges that can ratchet up operational inefficiencies and dial-up risk levels for firms trying to keep their footing in the shifting sands of international finance. For prime brokers, the crux of navigating U.S. & E.U. settlement misalignments lies in harnessing real-time data. In a landscape where timing is everything, being a step ahead is the game-changer. Loffa’s solutions are tailored to give prime brokers this edge. With real-time visibility, they can preempt funding gaps, manage collateral efficiently, and optimize their clients’ trading strategies without skipping a beat.

For prime brokers, the crux of navigating U.S. & E.U. settlement misalignments lies in harnessing real-time data. In a landscape where timing is everything, being a step ahead is the game-changer. Loffa’s solutions are tailored to give prime brokers this edge. With real-time visibility, they can preempt funding gaps, manage collateral efficiently, and optimize their clients’ trading strategies without skipping a beat.

In a stark reminder that compliance is not just a check-box exercise, the Financial Industry Regulatory Authority (FINRA) slapped StoneX Financial Inc. with a $70,000 fine. Between July 2017 and March 2020, StoneX found itself in hot water over its over-the-counter (OTC) securities trading practices, shedding light on the non-negotiable nature of compliance requirements.

In a stark reminder that compliance is not just a check-box exercise, the Financial Industry Regulatory Authority (FINRA) slapped StoneX Financial Inc. with a $70,000 fine. Between July 2017 and March 2020, StoneX found itself in hot water over its over-the-counter (OTC) securities trading practices, shedding light on the non-negotiable nature of compliance requirements.