Loffa Interactive: Leading the Charge in Secure Financial Digitization

Loffa Interactive: Revolutionizing Secure Digitization for the Financial Sector

In a world where digital transformation is not just buzzwords but pivotal to the success of financial services, Loffa Interactive Group has solidified its standing as a beacon of trust and innovation for Wall Street powerhouses.

In a world where digital transformation is not just buzzwords but pivotal to the success of financial services, Loffa Interactive Group has solidified its standing as a beacon of trust and innovation for Wall Street powerhouses.

Boasting over two decades of expertise in seamless technological revolutions, Loffa Interactive has positioned itself at the spearhead of broker transaction digitization with a security-first approach that sets them leagues apart.

The Bedrock of Security

Loffa Interactive doesn’t just prioritize security; they redefine it. Years of rigorous evaluations back their fortified stance, earning them a reputation as a steadfast partner in the data-sensitive landscape of financial services. This deep-rooted trust underscores their relentless pursuit of the pinnacle of security and operational excellence in a sector where stakes are high, and errors are not an option.

Simplifying Compliance, Maximizing Efficiency

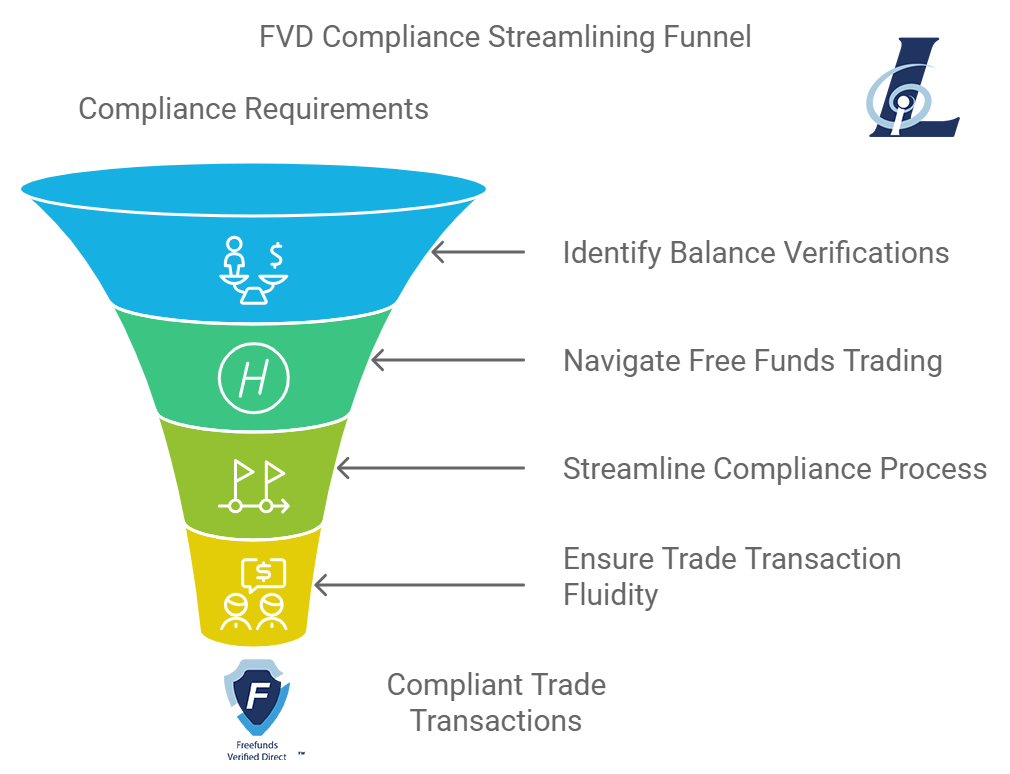

Freefunds Verified Direct (FVD)

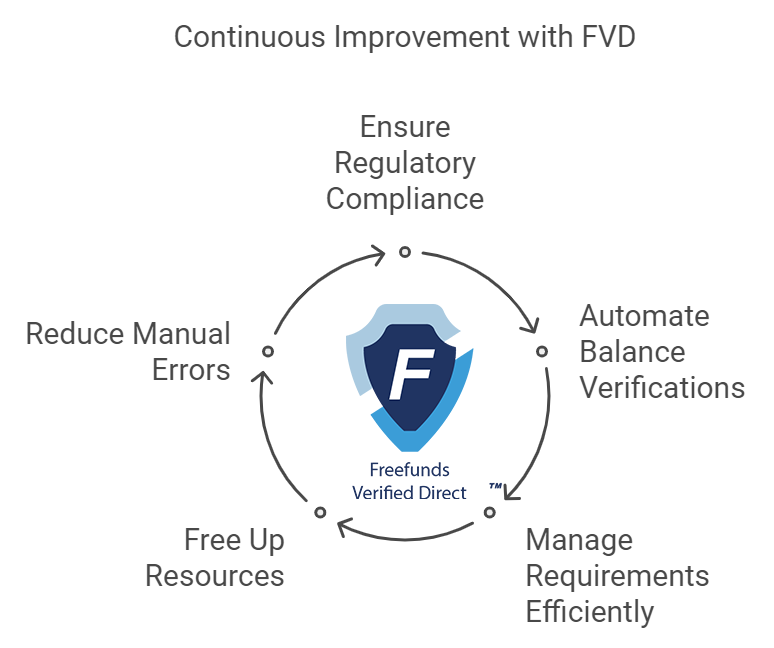

At the heart of Loffa Interactive’s innovative suite is the FVD tool, a game-changer for brokers navigating the complexities of Regulation T compliance. With FVD, the labyrinth of balance verifications and free funds trading requirements transforms into a streamlined, hassle-free pathway, ensuring trade transactions are as fluid as they are compliant.

Prime Broker Interactive Network (PBIN)

The brilliance of PBIN lies in its comprehensive approach to managing the intricate web of F1SA, SIA-150, and SIA-151 forms. For prime brokerage agreements and their constant amendments, PBIN is not just a tool but a beacon of simplification, making regulatory compliance less of an odyssey and more of a manageable journey.

Deep Dive: A Closer Look at Impactful Benefits

For Prime Brokers: The PBIN Advantage

- Streamlined Management: PBIN elegantly simplifies the prime brokerage agreement process, including amendments and clearance agreements. Its comprehensive nature means less time deciphering regulations and more time capitalizing on market opportunities.

- Enhanced Operational Efficiency: By automating and consolidating form management, PBIN significantly reduces the manual effort required in dealing with complex regulatory documentation, allowing prime brokers to operate more efficiently and focus on their core business strategies.

For Executing and Clearing Brokers: The Power of FVD

- Regulatory Compliance Made Easy: In a regulatory environment that is constantly evolving, FVD offers a steadfast solution for executing and clearing brokers to ensure they are always aligned with Regulation T requirements, without the operational headaches.

- Operational Streamlining: With FVD, the traditionally time-consuming tasks of balance verifications and requirements management for free funds trading become automated, freeing up valuable resources and reducing errors associated with manual processes.

In the dynamic terrain of financial services, Loffa Interactive stands out as a harbinger of efficiency and security. Their dedication not only to maintaining the gold standard of operational excellence but also to advancing the cause of digital transformation in the financial industry is what makes them an invaluable partner to Wall Street’s finest.

A significant development has emerged from the U.S. Supreme Court, fundamentally altering the Securities and Exchange Commission’s (SEC) enforcement capabilities. The latest ruling casts a shadow on the constitutionality of its in-house adjudication process. More than just impacting the SEC, this pivotal decision signals broader consequences for the operational landscape of various federal agencies.

A significant development has emerged from the U.S. Supreme Court, fundamentally altering the Securities and Exchange Commission’s (SEC) enforcement capabilities. The latest ruling casts a shadow on the constitutionality of its in-house adjudication process. More than just impacting the SEC, this pivotal decision signals broader consequences for the operational landscape of various federal agencies.

In the rapidly evolving landscape of the securities lending market, the SEC’s decision to postpone the approval of FINRA’s Rule 6500 Series, targeting the Securities Lending and Transparency Engine (SLATE), marks a significant pause in the stride toward enhanced market transparency and efficiency. The Rule 6500 Series, grounded in SEC Rule 10c-1a and the Dodd-Frank Act’s Section 984, had set its sights on mandating the reporting of securities loans and broadening the dissemination of loan information.

In the rapidly evolving landscape of the securities lending market, the SEC’s decision to postpone the approval of FINRA’s Rule 6500 Series, targeting the Securities Lending and Transparency Engine (SLATE), marks a significant pause in the stride toward enhanced market transparency and efficiency. The Rule 6500 Series, grounded in SEC Rule 10c-1a and the Dodd-Frank Act’s Section 984, had set its sights on mandating the reporting of securities loans and broadening the dissemination of loan information.