Reg-T Revealed: The Hidden Dance of Brokers and Free Fund Letters

Navigating Reg-T and Letters of Free Funds: A Broker’s Guide

Hey there, finance enthusiasts! Today, we’re diving into the world of securities trading, specifically the hoops brokers jump through to comply with Regulation T (Reg-T) and handle those all-important Letters of Free Funds. Buckle up, because this ride through the regulatory landscape is more exciting than you might think!

What’s the Big Deal with Reg-T?

Imagine Reg-T as the strict parent of the securities world. Established by the Federal Reserve Board, it’s all about keeping things in check when it comes to margin trading. Its main job? Making sure investors have enough skin in the game before diving into trades.

Enter the Letter of Free Funds

Now, picture the Letter of Free Funds as a VIP pass. It’s a document that says, “Hey, this person’s got the cash to back up their trades!” Brokers need this letter to prove their clients aren’t just making empty promises.

The Broker’s Regulatory Dance

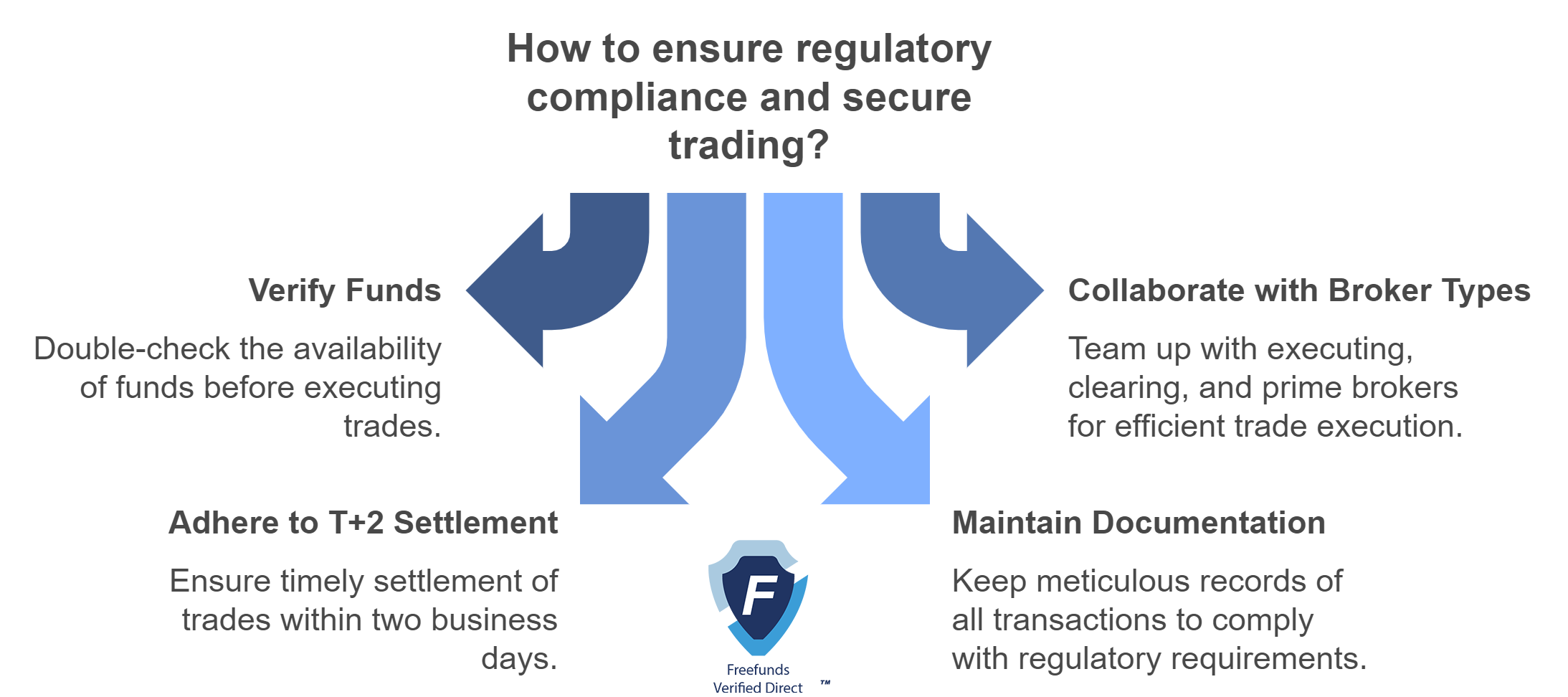

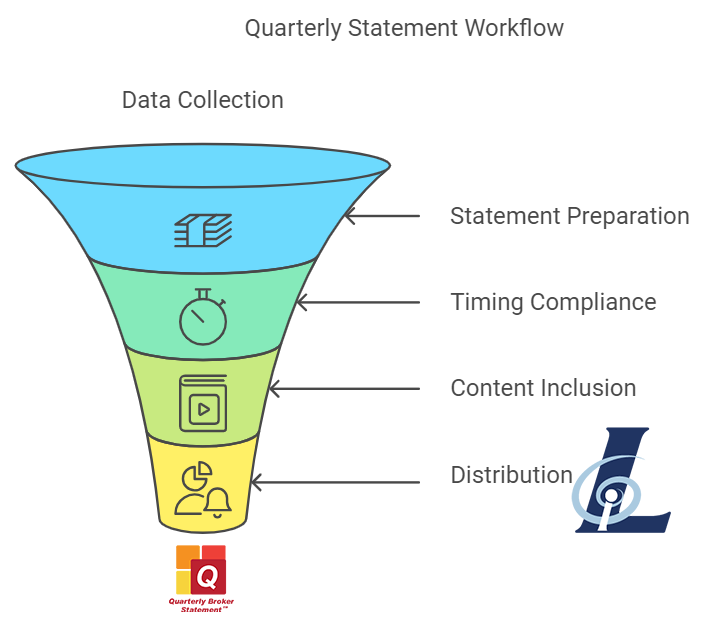

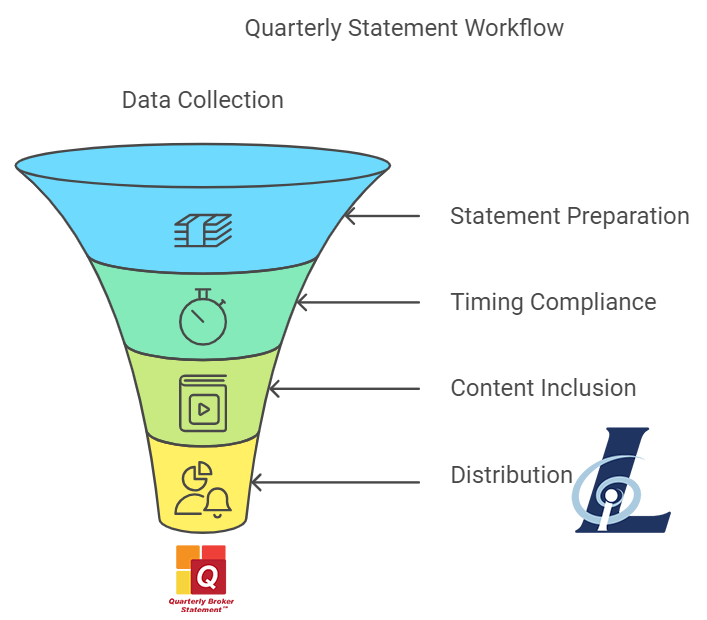

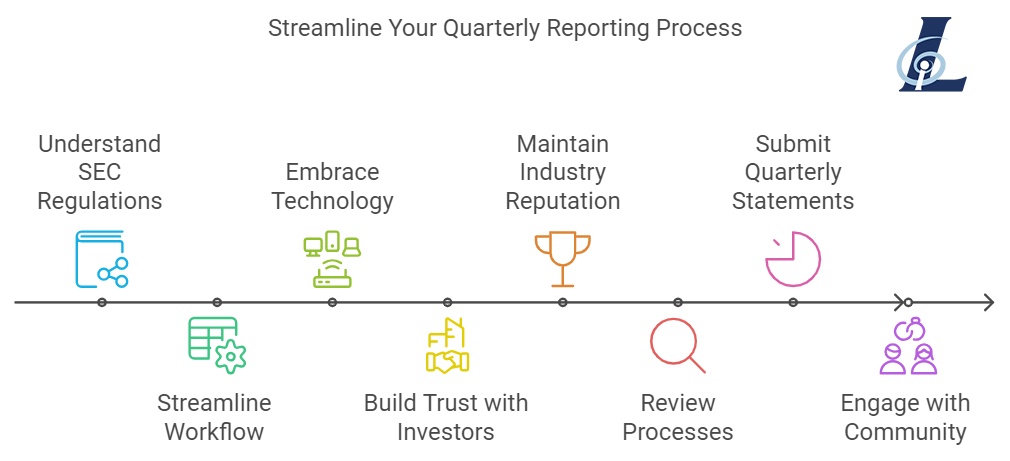

So, how do brokers navigate this regulatory maze? Let’s break it down:

- Verification Vibe Check: Before any trade goes down, brokers need to double-check that the funds are actually there. It’s like making sure you’ve got cash in your wallet before hitting the store.

- Broker Squad Assemble: Different types of brokers team up to make this work:

- Executing Brokers: The deal-makers who place orders.

- Clearing Brokers: The behind-the-scenes crew managing settlements.

- Prime Brokers: The big players facilitating complex trades.

- T+2 Tango: Most trades need to be settled within two business days. It’s a fast-paced dance where timing is everything!

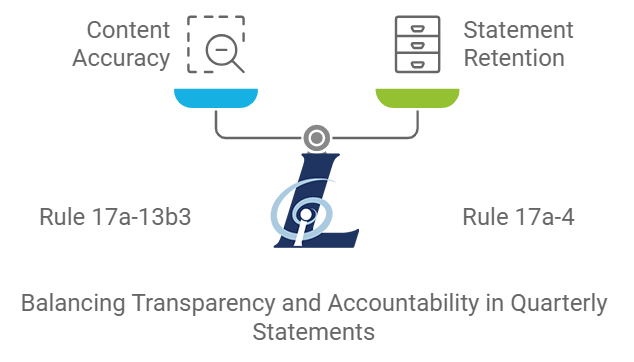

- Documentation Nation: Brokers need to keep meticulous records. It’s not just good practice; it’s the law (looking at you, SEC Rule 17a-4).

Challenges: It’s Not All Smooth Sailing

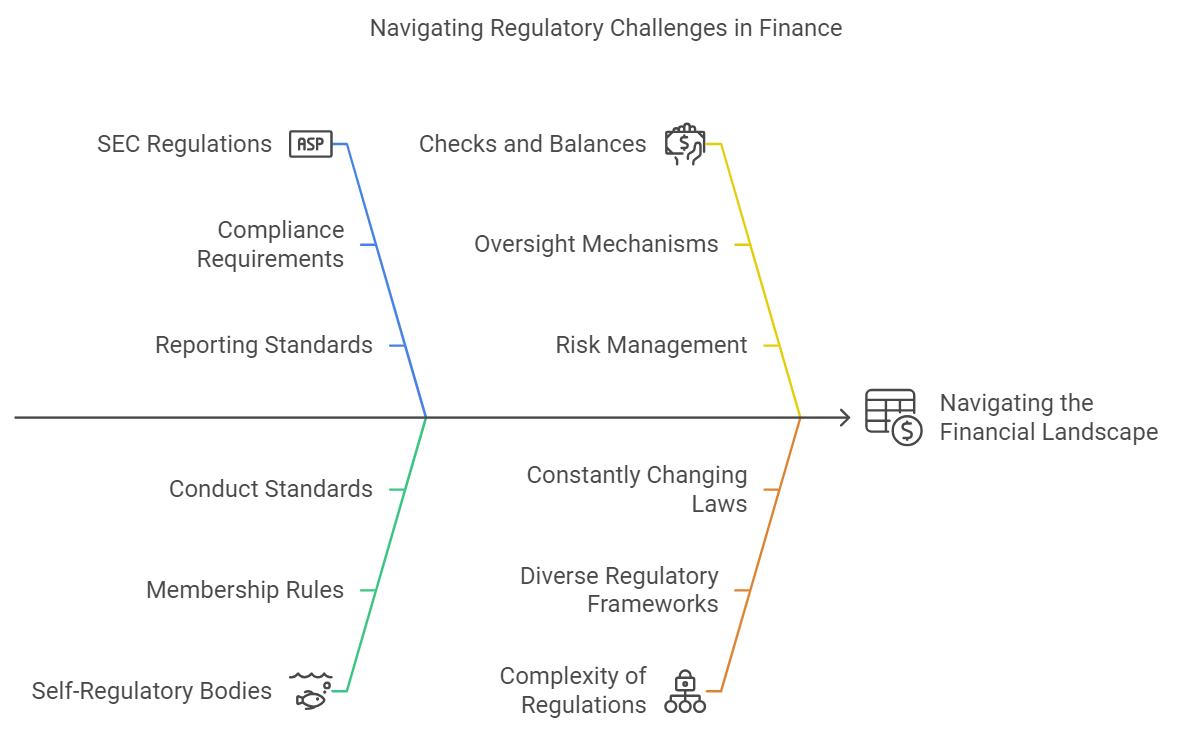

Compliance isn’t a walk in the park. Brokers face some real headaches:

- Complexity Overload: The rules are as intricate as a spider’s web.

- Control Freaks (In a Good Way): Implementing foolproof systems to catch any slip-ups is crucial.

- Paperwork Paradise: There’s a ton of documentation to manage and update constantly.

- Ticking Clock: With settlement times getting shorter (hello, T+1), the pressure’s on to move fast and stay accurate.

Why Should You Care?

Whether you’re a trader, an aspiring broker, or just curious about how the financial world turns, understanding this process is key. It’s all about maintaining market integrity and protecting investors (yes, that means you!) from unnecessary risks.

The Bottom Line

Navigating Reg-T and handling Letters of Free Funds is a complex but crucial part of a broker’s job. It’s a delicate balance of following rules, managing risks, and keeping the financial markets running smoothly.

Remember, in the world of trading, it’s not just about making deals—it’s about making them right. Stay informed, stay compliant, and may your trades always settle on time!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Always consult with a qualified professional for specific guidance on regulatory compliance.

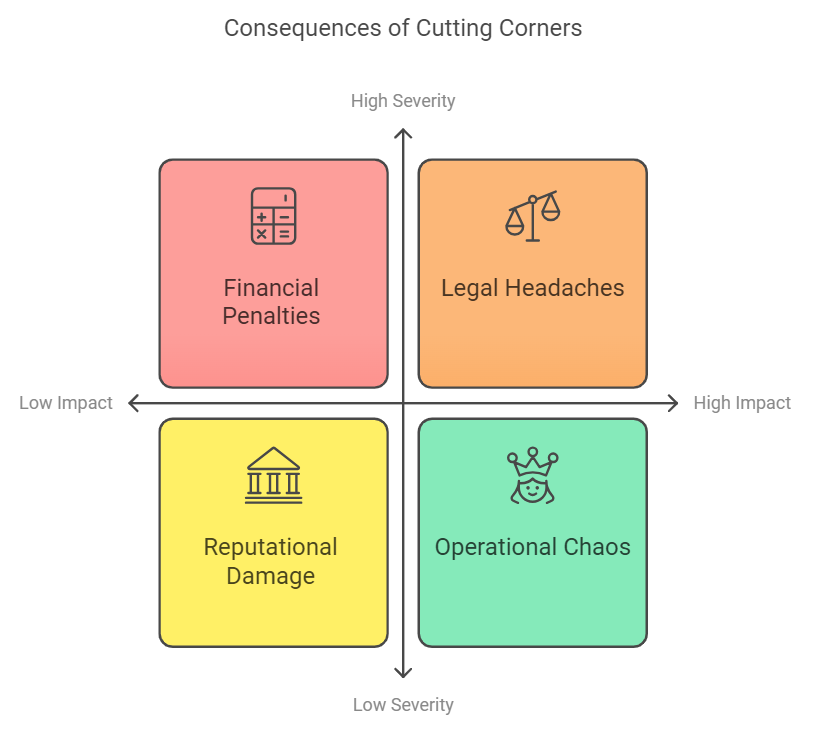

Now, you might be thinking, “So what if I miss a form or two?” Oh, my sweet summer child. The consequences of non-compliance are about as fun as a root canal. We’re talking:

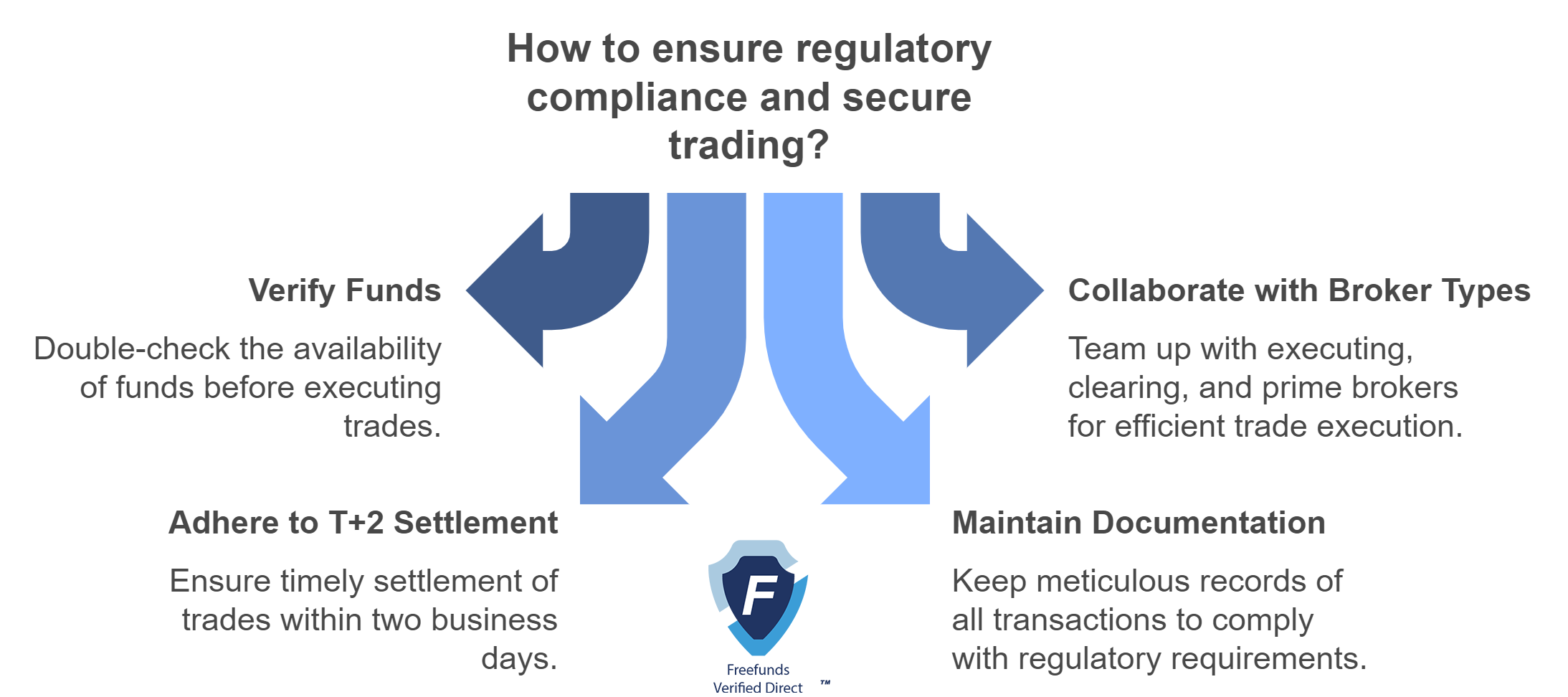

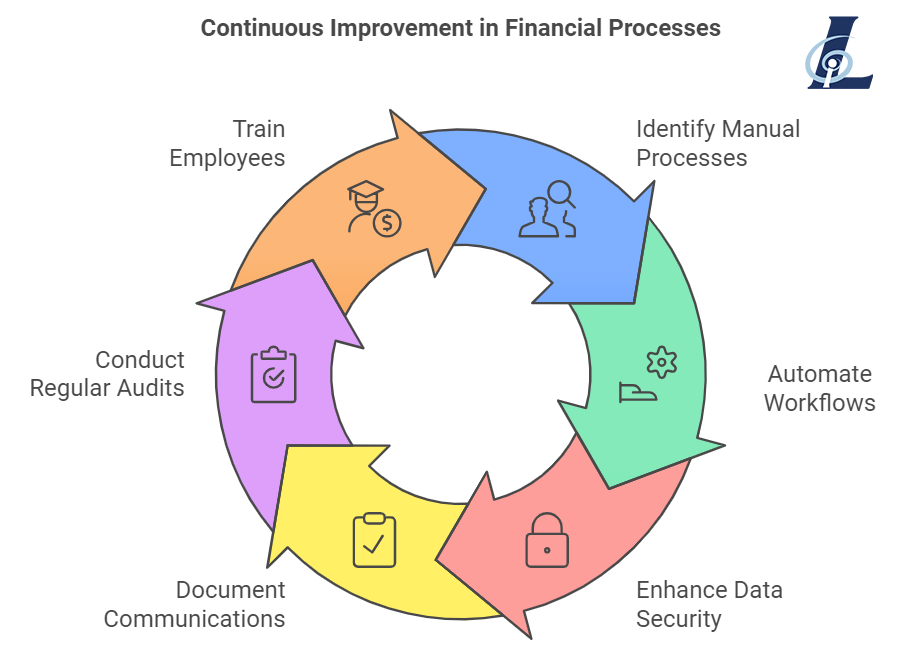

Now, you might be thinking, “So what if I miss a form or two?” Oh, my sweet summer child. The consequences of non-compliance are about as fun as a root canal. We’re talking: Now that we’ve scared you straight, here’s how to keep your compliance game strong:

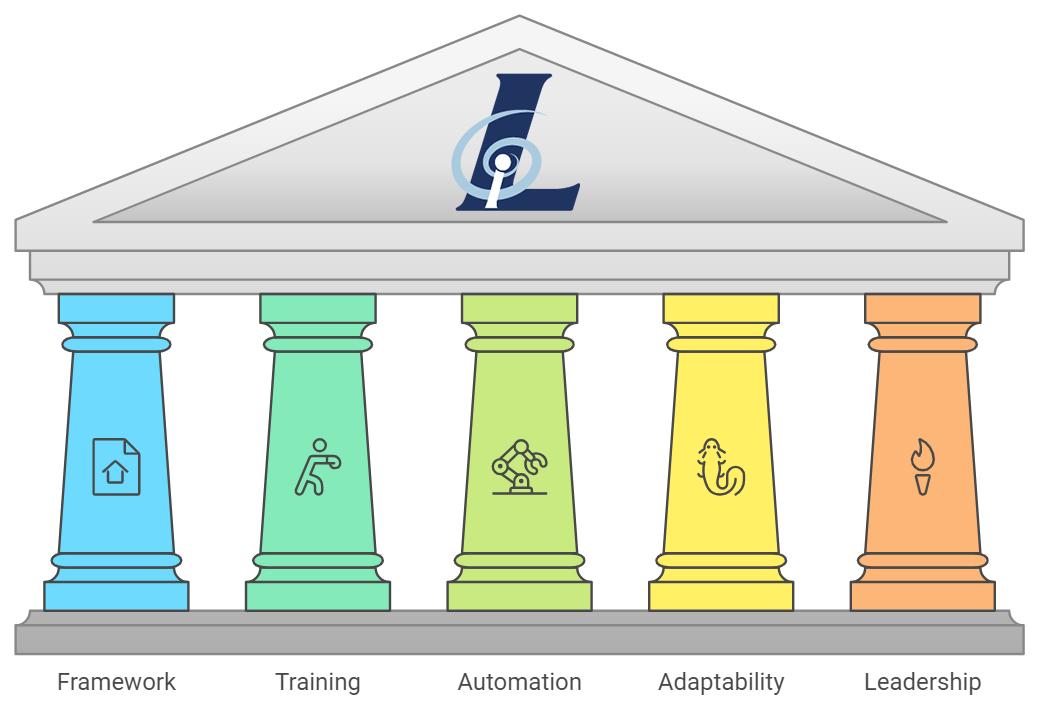

Now that we’ve scared you straight, here’s how to keep your compliance game strong: