What Is SEC Rule 17a-4

Document & Records Compliant Automation Management

Established as part of the Securities Exchange Act of 1934, SEC Rule 17a-4 defines a set of records preservation and retention requirements for registered broker-dealers. Initially integrated into law in 1997, Rule 17a-4 has seen heightened enforcement in recent years, and the consequences for non-compliance have grown significantly. Ensuring compliance today is more critical than ever, with increased focus from regulatory bodies on robust electronic recordkeeping practices.

Recent Enforcement Actions

In 2023, the SEC continued to enforce Rule 17a-4 aggressively, emphasizing the importance of maintaining comprehensive and accessible records. As recently as 2022, the SEC fined 16 Wall Street firms a collective $1.1 billion for widespread recordkeeping failures. In 2024, the expectation for compliance remains high, as regulators seek transparency in the electronic storage of financial records. In 2023 alone, the SEC imposed fines totaling more than $763 million on multiple firms for widespread recordkeeping failures, highlighting the critical importance of adhering to these regulations.

Outlined in the SEC’s 14-page PDF, the implications of Rule 17a-4 are significant for your business. Below, we’ll break down each section and offer practical ways to meet the challenges, helping your organization save time, money, and staff resources:

Retention Periods: Rule 17a-4 (a), (b), (c), (d)

This section outlines records retention requirements for today’s broker-dealers. Firms must retain most records for 3-6 years, regardless of whether they are in hard-copy or electronic format, such as emails or transaction reports.

To comply, firms must classify and track records throughout their lifecycle—from creation, through retention, and eventually to final disposition or archiving. Effective records management tools can classify and store these records correctly, ensuring compliance across formats. Modern records management systems also provide retention schedules and policy enforcement at the folder level, streamlining the retention process for large volumes of data.

Audit Trail OR Write-Once-Read-Many (WORM): Rule 17a-4(f)(2)(ii)(A)

Audit Trail Requirement

The SEC updated Rule 17a-4 in 2022, offering broker-dealers the option to adopt an electronic recordkeeping system meeting either the audit trail requirement or the WORM requirement. An audit trail should provide a complete, time-stamped record of any modifications, deletions, or alterations to electronic records, ensuring the authenticity and reliability of data for auditing purposes.

The audit trail requirement applies to final records required by SEC rules, rather than drafts or iterations of records. Broker-dealers must implement systems that automatically verify the completeness and accuracy of their electronic storage processes, reducing manual oversight and enhancing data integrity.

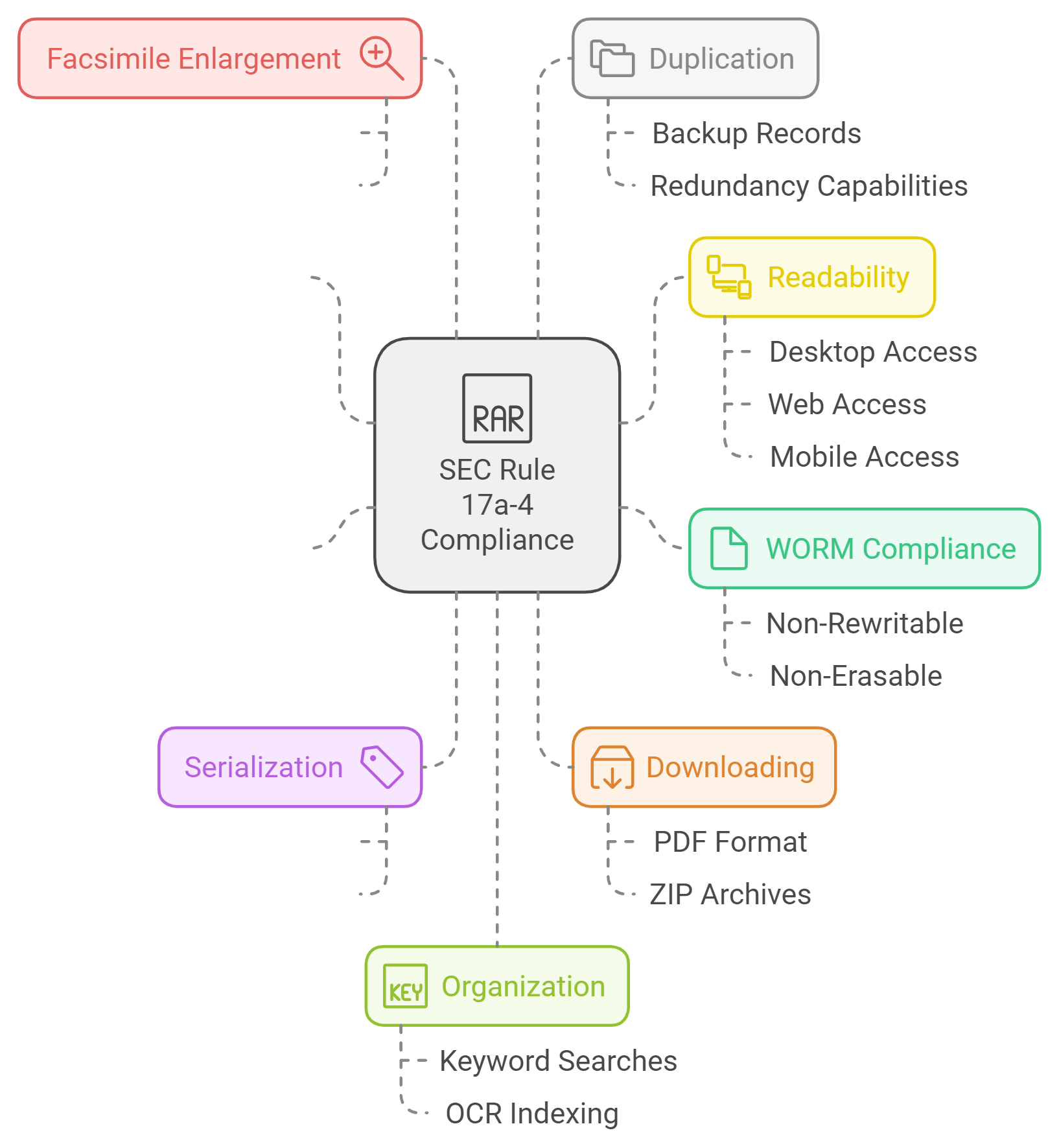

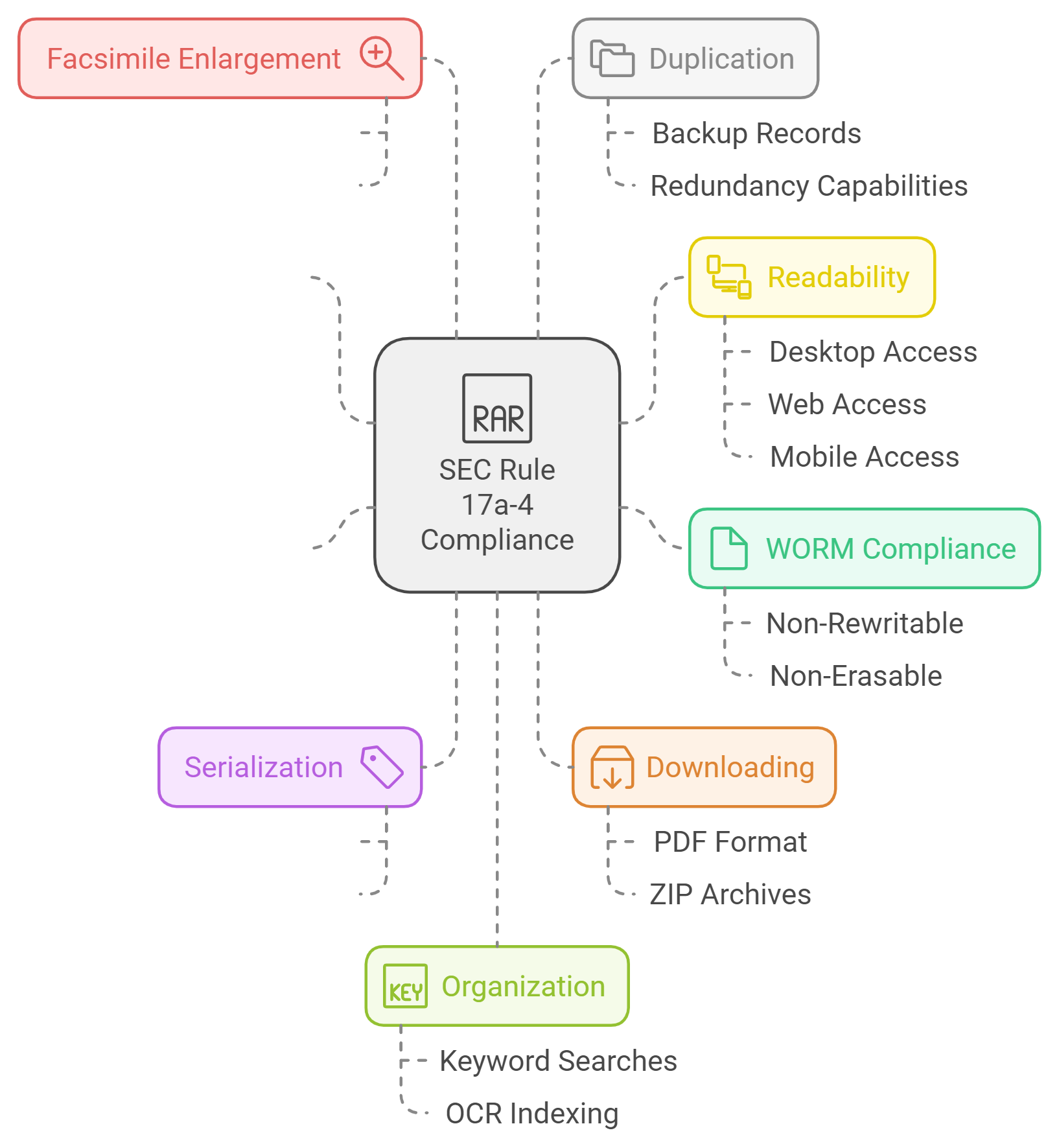

WORM Compliance

WORM (Write-Once-Read-Many) remains a core compliance option for broker-dealers. WORM-compliant records are maintained in a non-rewritable, non-erasable format to preserve integrity. The best records management solutions today can assist with maintaining WORM standards even before records enter their formal retention phase by setting up read-only access, minimizing risks of tampering.

Quality and Accuracy of Recording Process: Rule 17a-4(f)(2)(ii)(B)

SEC Rule 17a-4 requires broker-dealers to verify the quality and accuracy of recordkeeping processes automatically. This means systems must monitor data integrity, catching any errors during data input or output, and providing audit logs. Leading records management solutions include tools for data replication, backup automation, and corruption detection, giving firms confidence in the validity of their records.

Serialized Original and Duplicates: Rule 17a-4(f)(2)(ii)(C)

Firms are required to serialize electronic records and time-date the media for its retention period. Effective records management software can assign unique IDs and timestamps to each record, allowing auditors to easily track and verify records across their lifecycle. The ability to locate records chronologically and generate reports facilitates smooth regulatory examinations.

Downloading Indexes and Records: Rule 17a-4(f)(2)(ii)(D)

Electronic recordkeeping systems must allow records to be downloaded and transferred in both human-readable and usable electronic formats. Comprehensive records management solutions enable the export of files in various formats, including PDF and ZIP archives, making it easier for auditors to access information without compatibility issues.

Easily Readable: Rule 17a-4(f)(3)(i)

Easily Readable: Rule 17a-4(f)(3)(i)

Rule 17a-4 requires that firms maintain records in a manner that ensures auditors can access and view them upon request. Records management software should provide viewing options across multiple platforms—desktop, web, or mobile—to support easy accessibility for auditors and stakeholders alike.

Facsimile Enlargement: Rule 17a-4(f)(3)(ii)

Broker-dealers must ensure records are readable and accessible, even requiring zoom or print functionality for review purposes. Leading solutions include built-in document viewers with zoom options to meet these accessibility standards, making it possible for auditors to analyze records thoroughly.

Separate Duplicate Copies: Rule 17a-4(f)(3)(iii)

The amended Rule 17a-4 requires broker-dealers to maintain either a backup recordkeeping system or employ redundancy capabilities to ensure data remains accessible in case of technical disruptions. By creating duplicate sets of records across servers or geographic locations, firms can meet compliance requirements while safeguarding business continuity.

Organize and Index Original and Duplicate Records: Rule 17a-4(f)(3)(iv)

The rule mandates accurate indexing of both original and duplicate records for efficient retrieval. Records management systems with robust search capabilities, including keyword-based searches and OCR indexing, allow for fast and organized access to critical information during audits.

Audit System: Rule 17a-4(f)(3)(v)

Broker-dealers must have audit systems in place to ensure accountability for records input. The best records management systems offer extensive audit trails to track activity, with options to filter and export these logs for auditing purposes, even after records have reached the end of their lifecycle.

Access to Records by Regulators: Rule 17a-4(f)(3)(vi)

Upon request, broker-dealers must provide prompt access to stored records. Some software vendors offer continued access to records for a limited time even after a firm ceases to use their services, ensuring data remains available for regulatory purposes.

A Comprehensive Package

Navigating the complexities of SEC Rule 17a-4 requires a robust records management solution that fits the needs of both broker-dealers and auditors. To simplify compliance and achieve the best results, choose a system that supports comprehensive record tracking, flexible accessibility, and robust audit capabilities.

To learn more about simplifying Rule 17a-4 compliance, watch this webinar conducted by Loffa for valuable insights into how to leverage modern records management solutions to support your firm’s compliance needs in 2024 and beyond.

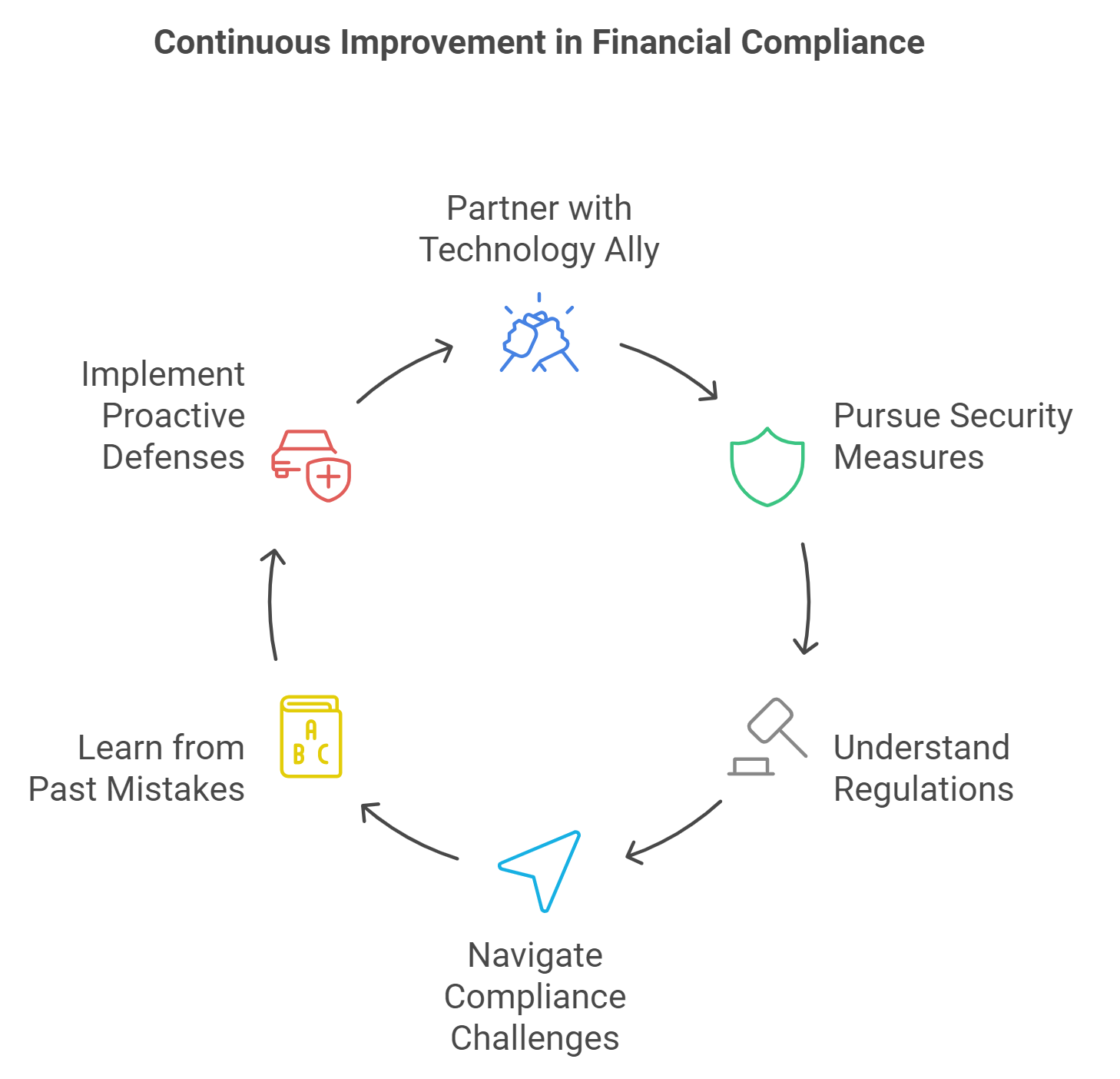

In an eye-opening regulatory action, the Financial Industry Regulatory Authority (FINRA) has slapped TradeUP Securities with a hefty $300,000 fine for significant lapses in reporting. This incident serves as a potent wake-up call for financial services firms. It’s crystal clear: sturdy compliance frameworks aren’t just important; they’re non-negotiable.

In an eye-opening regulatory action, the Financial Industry Regulatory Authority (FINRA) has slapped TradeUP Securities with a hefty $300,000 fine for significant lapses in reporting. This incident serves as a potent wake-up call for financial services firms. It’s crystal clear: sturdy compliance frameworks aren’t just important; they’re non-negotiable.

TD Bank recently found itself at the center of a financial storm, agreeing to a landmark $3 billion fine to settle charges of money laundering. This penalty, unprecedented in its magnitude for a U.S. bank, shines a piercing light on the hazards of inadequate anti-money laundering (AML) defenses.

TD Bank recently found itself at the center of a financial storm, agreeing to a landmark $3 billion fine to settle charges of money laundering. This penalty, unprecedented in its magnitude for a U.S. bank, shines a piercing light on the hazards of inadequate anti-money laundering (AML) defenses.