Mastering Compliance in the Financial Sector: Navigating SEC Reforms and Off-Channel Communication Challenges

The New Era of Financial Compliance: How Technology is Reshaping Regulatory Adherence

As we navigate through 2024, the financial services industry finds itself at a crucial intersection of regulatory reform and technological innovation. With recent Securities and Exchange Commission (SEC) enforcement actions exceeding $2 billion in fines, the message is clear: compliance is no longer just a checkbox exercise—it’s a fundamental business imperative.

Understanding the Shifting Landscape

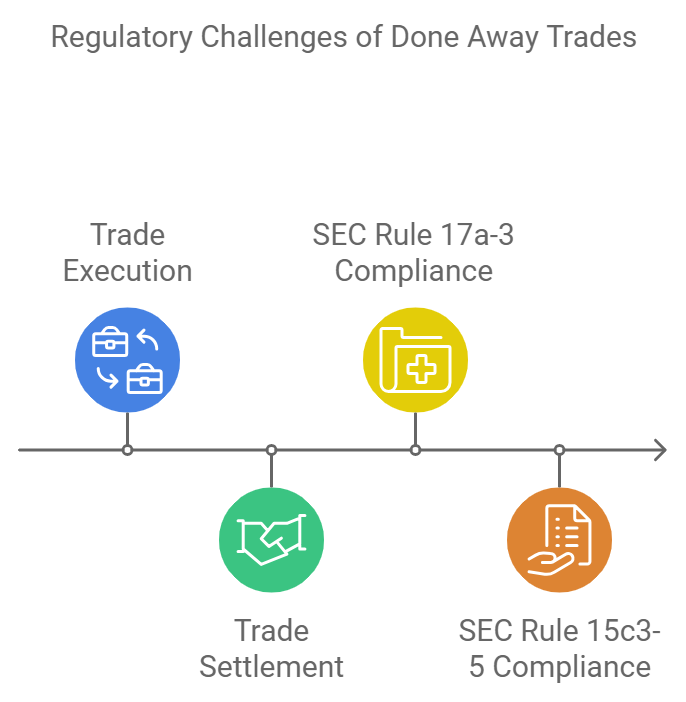

The financial industry is experiencing unprecedented change. The SEC’s recent initiatives under Chair Gary Gensler signal a transformative period in market structure and compliance requirements. From the implementation of T+1 settlement cycles to enhanced scrutiny of off-channel communications, firms face mounting pressure to modernize their compliance frameworks while maintaining operational efficiency.

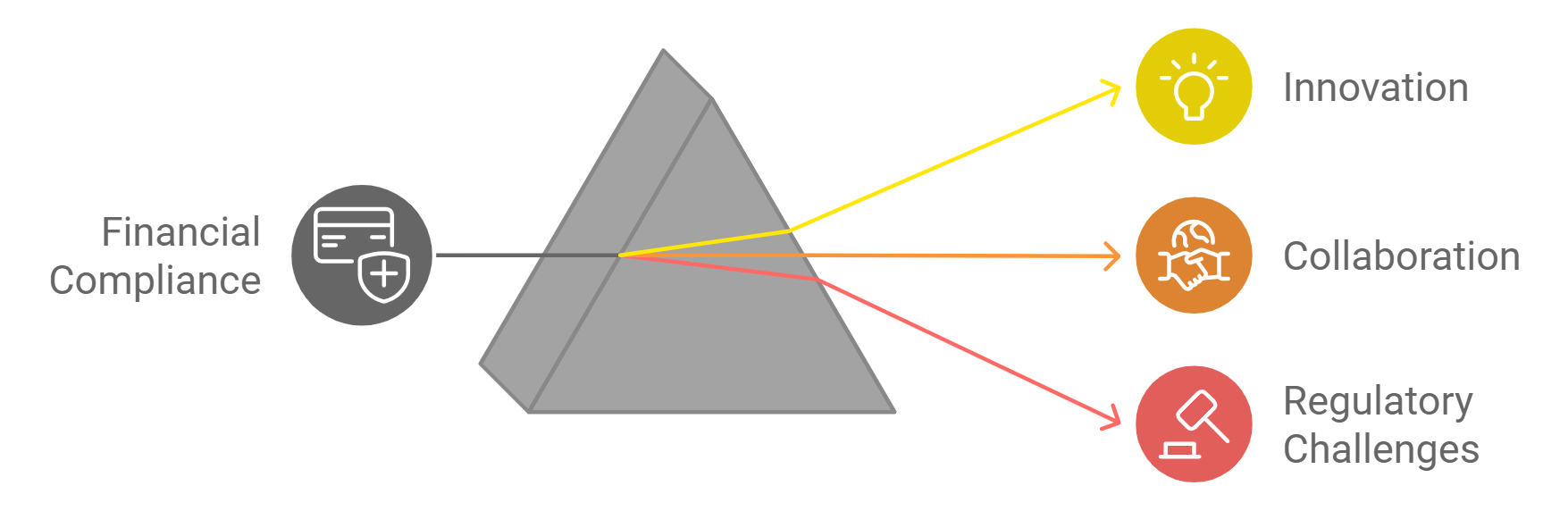

However, this regulatory evolution isn’t just about constraints—it’s creating opportunities for forward-thinking institutions to gain competitive advantages through strategic technology adoption.

The Cost of Non-Compliance

Recent enforcement actions have demonstrated that the price of compliance failures extends far beyond monetary penalties. Financial institutions face:

- Reputational damage affecting client relationships

- Operational disruptions during regulatory investigations

- Increased scrutiny from regulators on future operations

- Potential loss of market access and business opportunities

The magnitude of recent fines serves as a stark reminder that traditional approaches to compliance are no longer sufficient in today’s digital-first environment.

Technology as the Compliance Catalyst

As regulatory requirements grow more complex, technology emerges as the critical enabler of effective compliance. Modern solutions are revolutionizing how firms approach regulatory adherence through:

1. Automated Verification Systems

Advanced platforms now automate crucial compliance processes, such as Letters of Free Funds verification, reducing human error and accelerating transaction flows while maintaining regulatory compliance.

2. Integrated Documentation Management

2. Integrated Documentation Management

Digital solutions streamline the handling of essential forms and agreements, ensuring consistent compliance while reducing administrative overhead. This integration is particularly crucial for prime brokers and clearing firms managing multiple relationship types.

3. Real-Time Monitoring Capabilities

Modern compliance platforms offer continuous oversight of trading activities and communications, enabling proactive risk management rather than reactive problem-solving.

The Path Forward: Strategic Implementation

For financial institutions looking to strengthen their compliance frameworks, success lies in adopting a strategic approach to technology implementation:

- Assessment and Planning

- Evaluate current compliance gaps

- Identify high-risk areas requiring immediate attention

- Develop a phased implementation strategy

- Technology Selection

- Focus on scalable solutions that can evolve with regulatory changes

- Prioritize platforms offering integration capabilities

- Consider solutions with proven track records in regulatory compliance

- Implementation and Training

- Ensure systematic rollout across operations

- Invest in comprehensive staff training

- Establish clear protocols for ongoing compliance monitoring

Embracing Compliance as a Competitive Advantage

Forward-thinking institutions are recognizing that robust compliance isn’t just about avoiding penalties—it’s about building trust, enhancing operational efficiency, and creating sustainable competitive advantages. Key benefits include:

- Accelerated transaction processing through automated compliance checks

- Reduced operational risks through standardized procedures

- Enhanced client confidence through demonstrable compliance frameworks

- Improved ability to adapt to regulatory changes

Looking Ahead

As regulatory requirements continue to evolve, the integration of compliance technology will become increasingly crucial for financial institutions. Success will depend on:

- Maintaining flexibility in compliance frameworks

- Investing in scalable technology solutions

- Building strong relationships with technology providers

- Fostering a culture of continuous compliance improvement

Conclusion

The financial services industry stands at a pivotal moment where regulatory compliance and technological innovation converge. Those who embrace this transformation, investing in robust compliance technology and processes, will be best positioned to thrive in an increasingly complex regulatory environment.

As we move forward, the question isn’t whether to invest in compliance technology, but how to leverage it most effectively to create lasting competitive advantages while ensuring regulatory adherence. The firms that answer this question successfully will define the future of financial services.

This article reflects market conditions and regulatory requirements as of early 2024. Financial institutions should consult with compliance experts and legal counsel when developing their regulatory compliance strategies.

In the ever-evolving landscape of financial regulations, one trend has become unmistakably clear: Anti-Money Laundering (AML) enforcement is on a steep upward trajectory. Recent high-profile cases, from TD Bank’s staggering $3 billion settlement to China International Capital Corporation (CICC) US Securities’ $300,000 FINRA fine, serve as stark reminders of the intensifying regulatory scrutiny in the financial sector. Let’s dive into how these cases exemplify the ramping up of AML enforcements and what it means for financial institutions moving forward.

In the ever-evolving landscape of financial regulations, one trend has become unmistakably clear: Anti-Money Laundering (AML) enforcement is on a steep upward trajectory. Recent high-profile cases, from TD Bank’s staggering $3 billion settlement to China International Capital Corporation (CICC) US Securities’ $300,000 FINRA fine, serve as stark reminders of the intensifying regulatory scrutiny in the financial sector. Let’s dive into how these cases exemplify the ramping up of AML enforcements and what it means for financial institutions moving forward. Connecting the Dots: The Escalation of AML Enforcement

Connecting the Dots: The Escalation of AML Enforcement

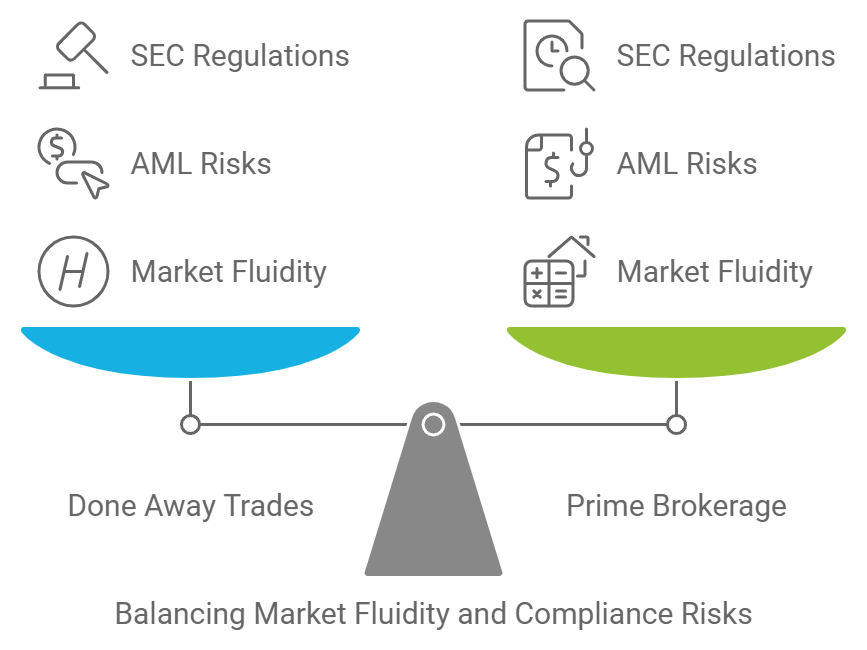

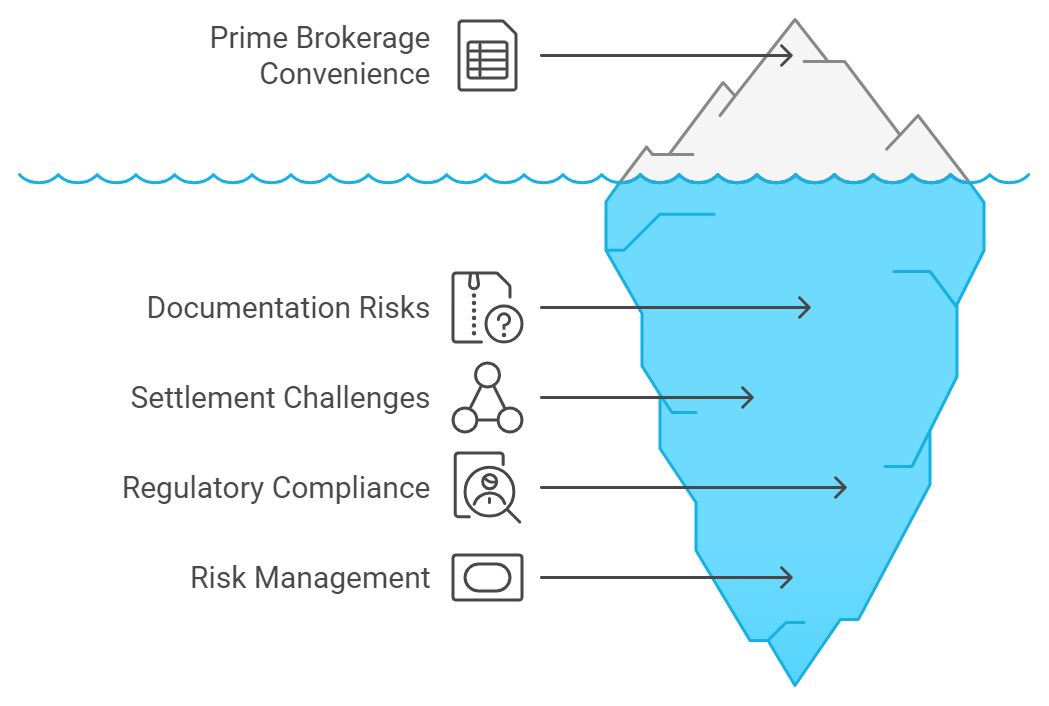

Prime Brokerage services, often seen as the Swiss Army knife of trading, offer clients the convenience of consolidating their trading activities through a single broker. It’s a beautiful concept in theory – streamlined, efficient, and centralized. But as with many things in finance, the devil is in the details.

Prime Brokerage services, often seen as the Swiss Army knife of trading, offer clients the convenience of consolidating their trading activities through a single broker. It’s a beautiful concept in theory – streamlined, efficient, and centralized. But as with many things in finance, the devil is in the details. Charting a Course Through Choppy Waters

Charting a Course Through Choppy Waters The landscape of financial operations is constantly evolving, and with it, the nature of AML risks and regulatory requirements. Staying informed about regulatory changes and industry best practices isn’t just about avoiding penalties – it’s about being part of the solution to a global problem.

The landscape of financial operations is constantly evolving, and with it, the nature of AML risks and regulatory requirements. Staying informed about regulatory changes and industry best practices isn’t just about avoiding penalties – it’s about being part of the solution to a global problem.