Lessons from Morgan Stanley’s $1M Fine

Market Access Violations with Enhanced Controls

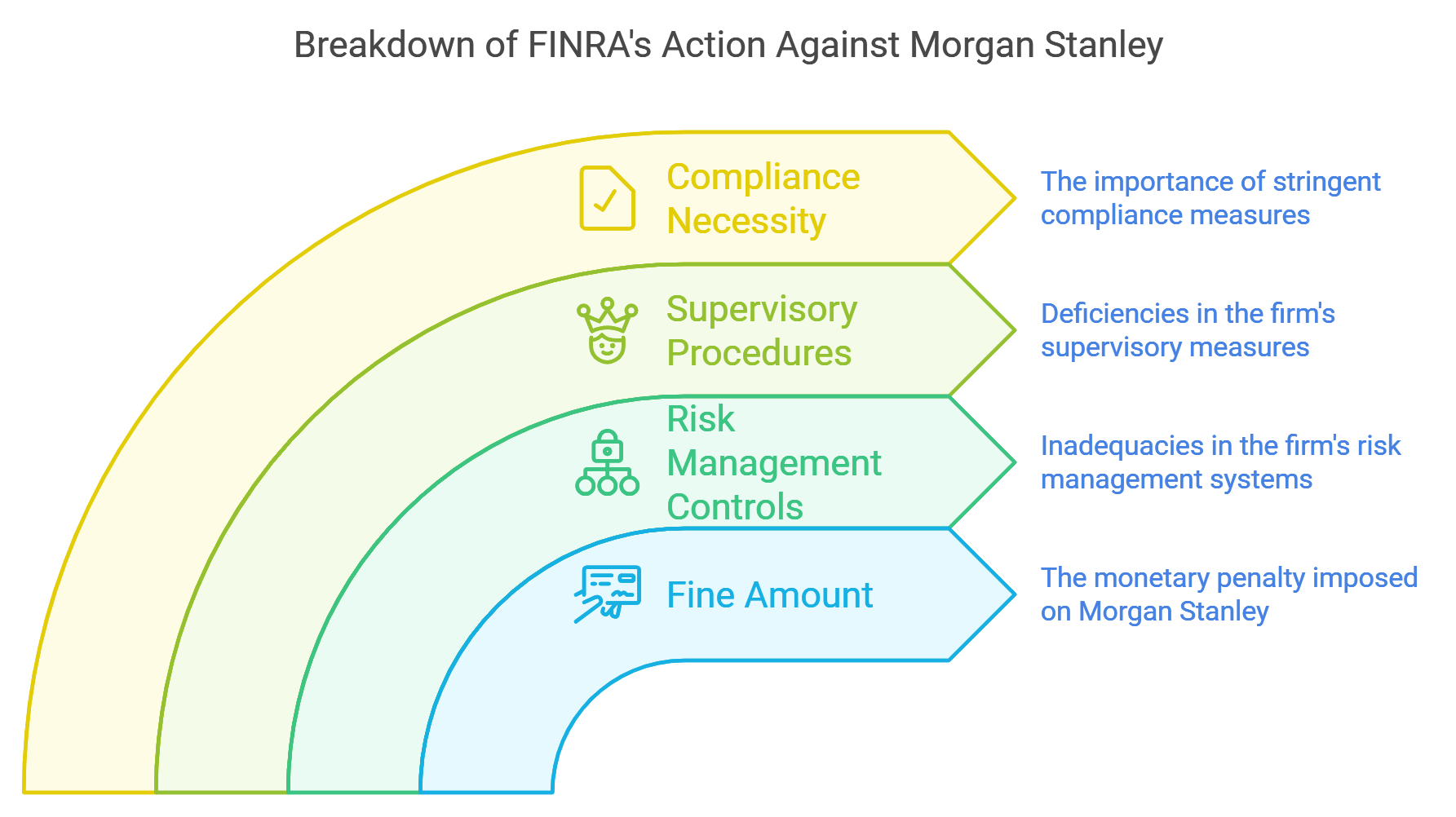

In a notable action that underscores the criticality of regulatory compliance within the financial sector, FINRA imposed a hefty $1 million fine on Morgan Stanley & Co LLC. This penalty was levied due to inadequacies in the firm’s risk management controls and supervisory procedures pertinent to its market access business. This incident, spanning from August 2019 to June 2023, accentuates the necessity for stringent compliance measures to safeguard the financial industry’s integrity.

The Morgan Stanley Oversight

The Morgan Stanley case underscores the crucial necessity for comprehensive risk management controls alongside lucid documentation of procedures. According to FINRA, Morgan Stanley failed to institute necessary risk management controls for its market access business. This included lapses in controls related to financial and regulatory risks and inadequate written procedures for client onboarding and order thresholds setting. Such oversight not only posed regulatory risks to Morgan Stanley but also risked market integrity through the potential issuance of erroneous orders and market disruptions.

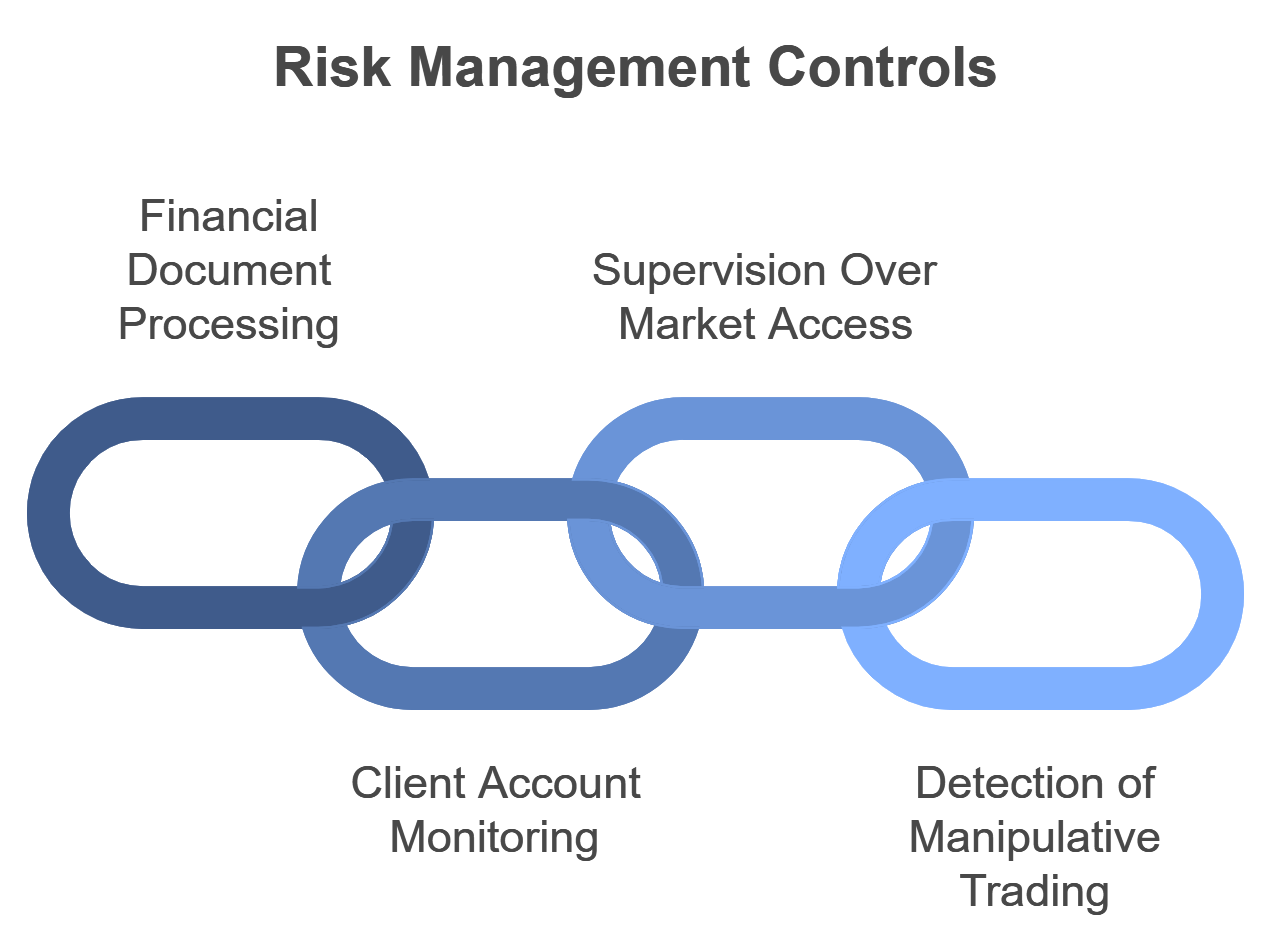

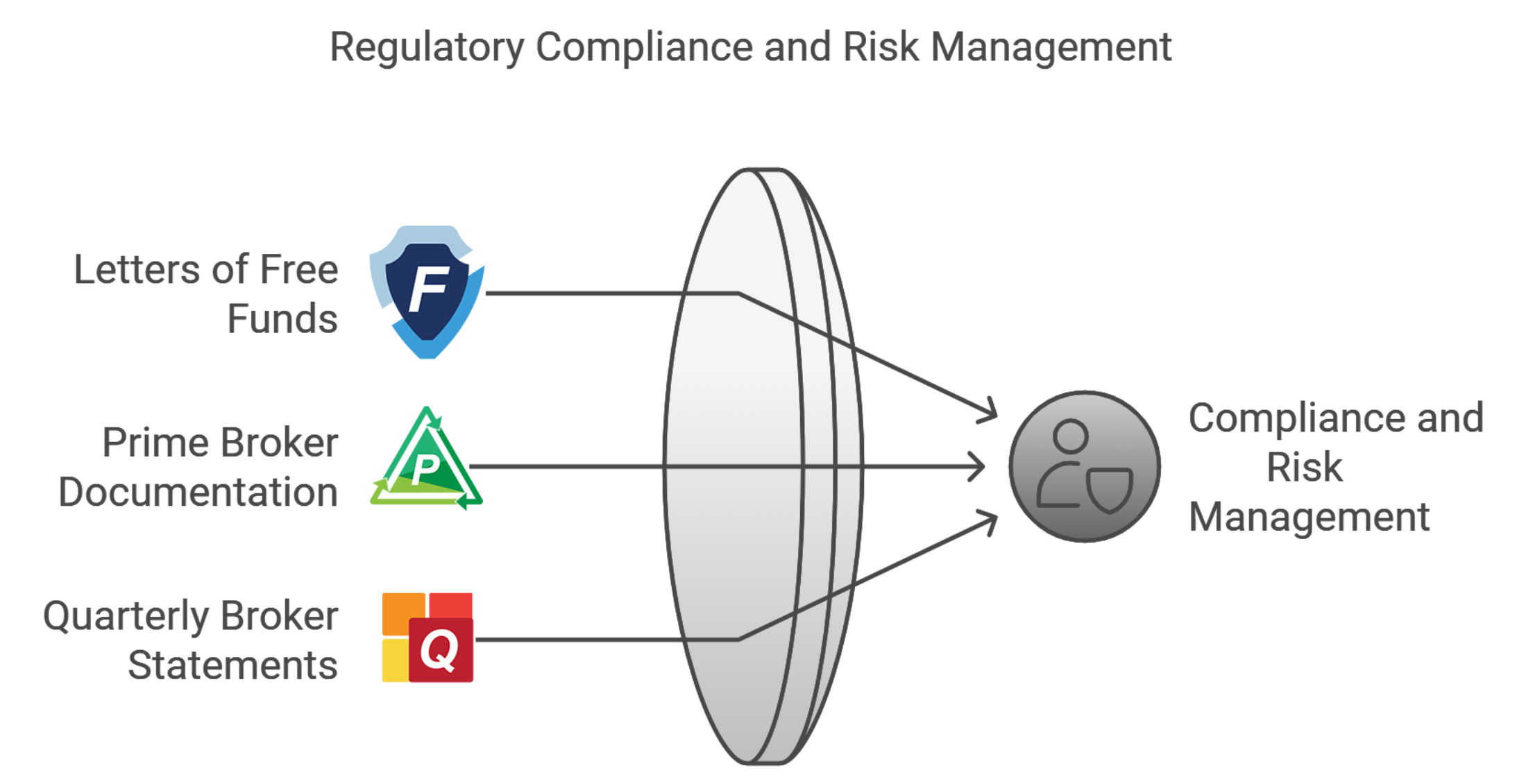

There is a way that improper processing of Letters of Free Funds, Prime Broker documents, or Quarterly Broker statements can create risks exposing a firm to violations of FINRA Rule 15c3-5. While these documents and processes are governed by other specific regulations, mishandling them can undermine the risk management controls and supervisory procedures required by Rule 15c3-5, potentially leading to violations.

Understanding the Connection

FINRA Rule 15c3-5 mandates broker-dealers to implement robust risk management controls and supervisory procedures to manage financial and regulatory risks associated with market access. Improper handling of critical financial documents can impact a firm’s ability to effectively monitor and control these risks, leading to non-compliance with Rule 15c3-5.

Ways Improper Processing Can Lead to Violations:

Ways Improper Processing Can Lead to Violations:

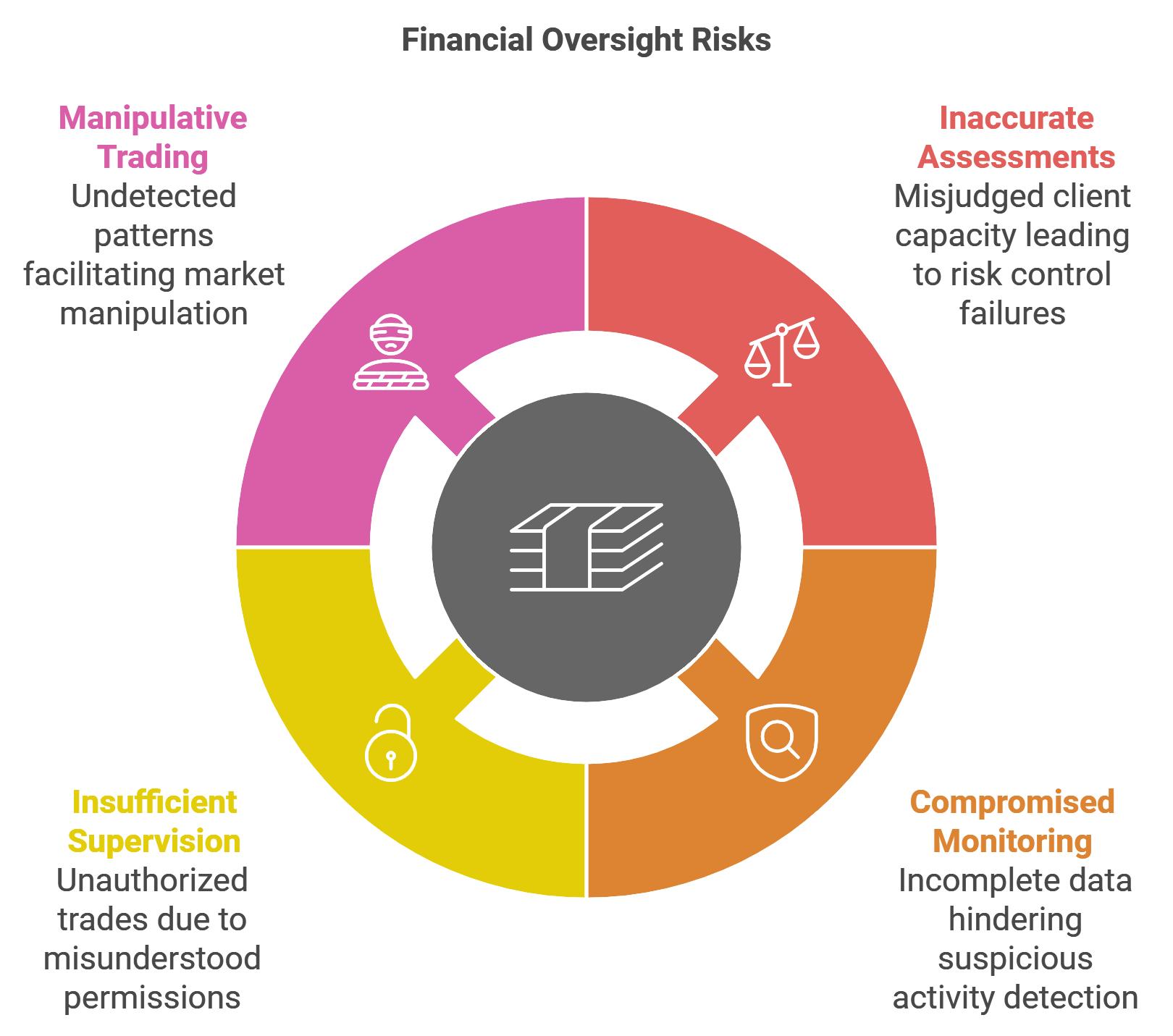

- Inaccurate Financial Assessments Affecting Risk Controls:

- Letters of Free Funds:

- Purpose: Confirm the availability of funds for trading.

- Risk: If processed incorrectly, they may overstate or understate a client’s available capital.

- Impact on 15c3-5: Misjudging a client’s financial capacity can result in inadequate pre-trade financial risk controls, allowing orders that exceed credit or capital thresholds, violating Rule 15c3-5(a)(1)(i).

- Letters of Free Funds:

- Compromised Client Account Monitoring:

- Quarterly Broker Statements:

- Purpose: Provide detailed records of client transactions and holdings.

- Risk: Errors or delays in processing can lead to incomplete or inaccurate client data.

- Impact on 15c3-5: Inaccurate data hampers the firm’s ability to monitor for suspicious or erroneous trading activities, violating the requirement for effective regulatory risk management controls under Rule 15c3-5(c)(1)(ii).

- Quarterly Broker Statements:

- Insufficient Supervision Over Market Access:

- Prime Broker Documentation (F1SA/SIA-150, SIA-151):

- Purpose: Establish terms and conditions of prime brokerage relationships.

- Risk: Improper documentation can lead to misunderstandings about client permissions and risk profiles.

- Impact on 15c3-5: This can result in clients gaining inappropriate market access or executing unauthorized trades, breaching the supervisory procedures mandated by Rule 15c3-5(b).

- Prime Broker Documentation (F1SA/SIA-150, SIA-151):

- Failure to Detect and Prevent Manipulative Trading:

- All Documents:

- Risk: Collectively, improper processing can prevent the detection of patterns indicative of market manipulation or fraud.

- Impact on 15c3-5: The firm may fail to prevent orders that could facilitate manipulative acts, violating Rule 15c3-5(c)(2)(i).

- All Documents:

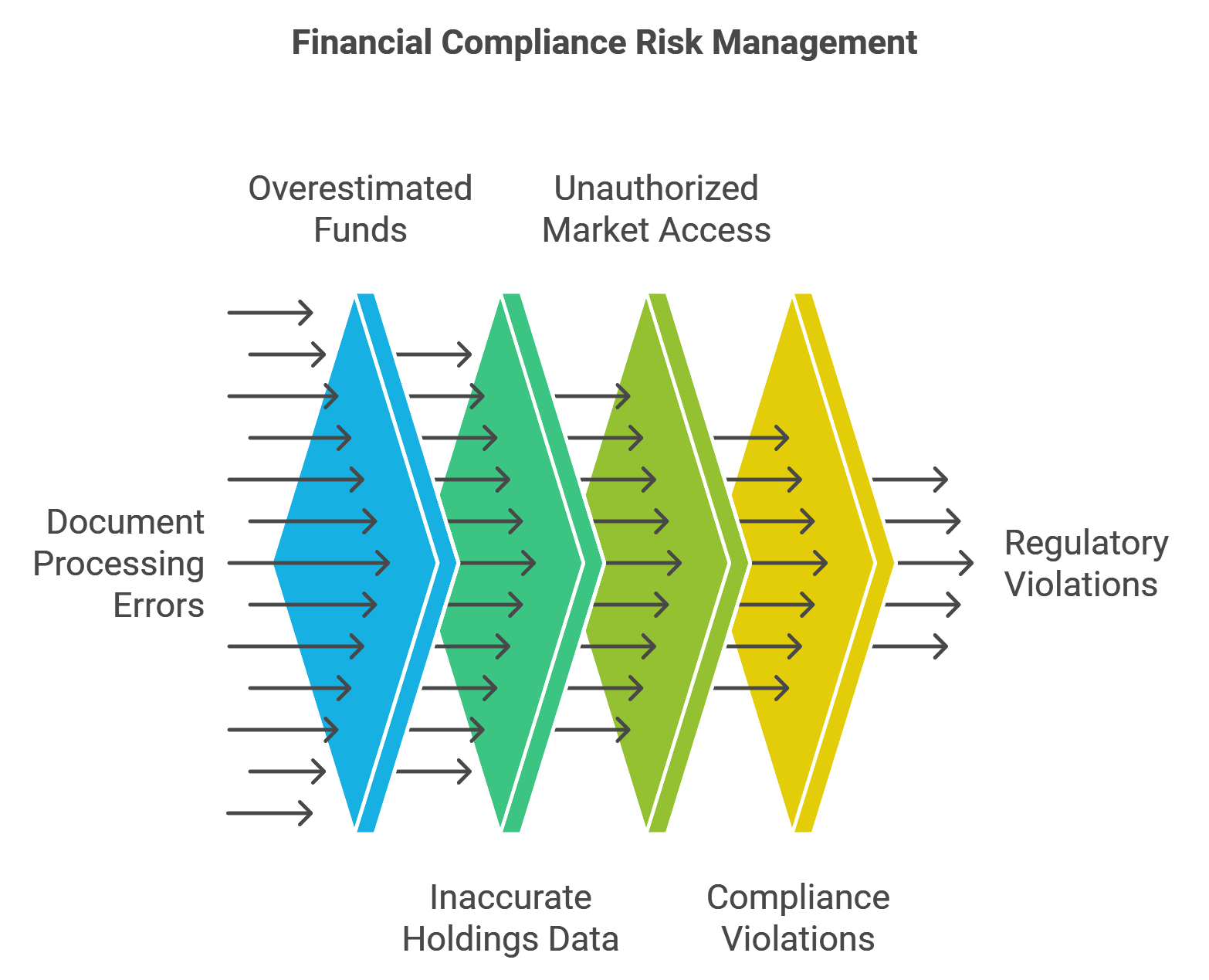

Specific Scenarios Illustrating the Risks

- Scenario 1: Overestimated Available Funds

- Issue: A Letter of Free Funds is processed with errors, overstating a client’s available capital.

- Consequence: The client places orders exceeding their true financial capacity.

- Violation: The firm fails to prevent orders that exceed credit thresholds, violating Rule 15c3-5(a)(1)(i).

- Scenario 2: Inaccurate Client Holdings Data

- Issue: Quarterly Broker Statements contain processing errors, leading to inaccurate client holdings information.

- Consequence: The firm cannot accurately assess the client’s portfolio risk.

- Violation: Ineffective risk management controls under Rule 15c3-5(c)(1)(ii).

- Scenario 3: Unauthorized Market Access

- Issue: Prime Broker documents are improperly processed, granting a client access to restricted markets or instruments.

- Consequence: The client executes trades beyond their authorization.

- Violation: Failure in supervisory procedures required by Rule 15c3-5(b).

Preventative Measures for Firms

- Enhance Document Processing Accuracy:

- Verification Systems: Implement checks to ensure data accuracy when processing financial documents.

- Technology Integration: Use automated systems to reduce human error in data entry and processing.

- Strengthen Risk Management Controls:

- Real-Time Monitoring: Employ systems that monitor trading activities in real-time to detect anomalies.

- Risk Thresholds: Set appropriate credit and capital thresholds based on accurate financial data.

- Improve Supervisory Procedures:

- Regular Audits: Conduct internal audits to ensure compliance with all regulatory requirements.

- Employee Training: Educate staff on the importance of accurate document processing and its impact on compliance.

- Ensure Compliance Across Regulations:

- Integrated Compliance Approach: Recognize that compliance with one regulation supports compliance with others.

- Cross-Departmental Collaboration: Encourage communication between departments responsible for different compliance areas.

Improper processing of critical financial documents like Letters of Free Funds, Prime Broker documents, and Quarterly Broker statements can significantly impair a firm’s risk management controls and supervisory procedures. This impairment can lead to violations of FINRA Rule 15c3-5 by allowing erroneous, unauthorized, or non-compliant trades to enter the market.

Key Takeaways:

Key Takeaways:

- Interconnected Compliance: Proper handling of all regulatory requirements is essential, as deficiencies in one area can affect compliance in another.

- Risk Management Integrity: Accurate financial data is foundational to effective risk management controls required by Rule 15c3-5.

- Proactive Measures: Firms must proactively ensure that all processes are executed correctly to maintain compliance and protect market integrity.

By addressing these risks through diligent processing and robust controls, firms can uphold their obligations under FINRA Rule 15c3-5 and contribute to a fair and orderly market.

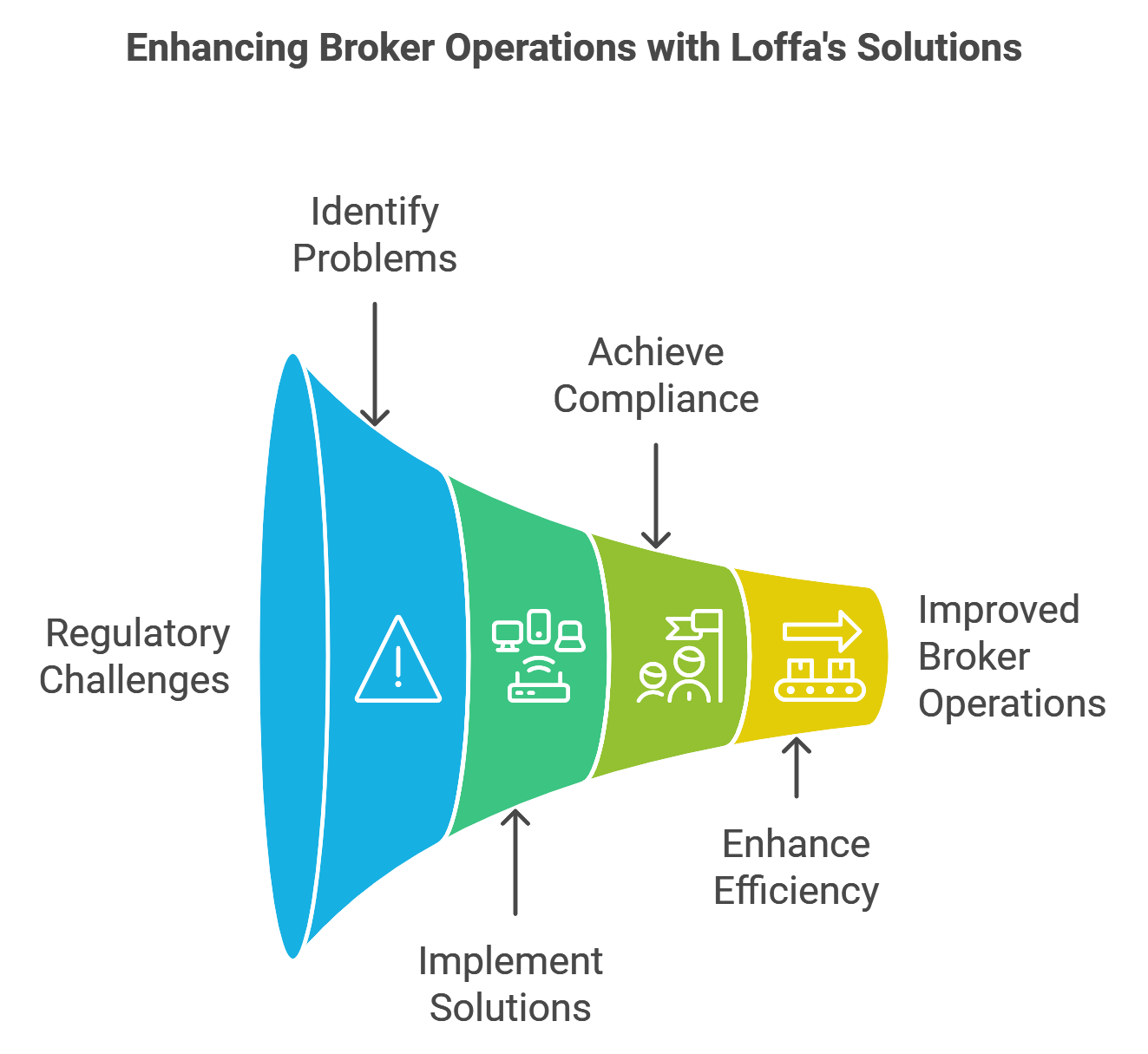

At Loffa Interactive Group, our ethos is rooted in understanding and addressing the complex terrain of financial regulations. Our premium solutions, like Freefunds Verified Direct (FVD), Quarterly Broker Statement (QBS), and the Prime Broker Interactive Network (PBIN), are deliberately engineered to guide firms through navigating regulatory intricacies with ease, ensuring they adhere to pivotal regulations, including Regulation T.

Deep Dive: Critical Impacts on Prime Brokers and Clearing Agents

For Prime Brokers:

- Adherence to Regulation T Requirements:

- Problem: The main challenge here involves managing the Letters of Free Funds to ensure compliance with Regulation T requirements, a task that is undeniably complex and time-consuming.

- Solution: Loffa’s Freefunds Verified Direct (FVD) significantly simplifies this process, allowing prime brokers to efficiently manage balance verifications needed for free funds trading in cash accounts.

- Impact: Reducing the risk of non-compliance with Regulation T, ensuring trades are promptly and efficiently settled without regulatory hiccups.

- Streamlining Form Management:

- Problem: The management of F1SA, SIA-150, and SIA-151 forms is a logistical nightmare, often fraught with errors due to manual intervention.

- Solution: Our Prime Broker Interactive Network (PBIN) serves as an all-encompassing platform to ease these processes, ensuring prime brokerage agreements and amendments are seamlessly managed and compliant.

- Impact: Prime brokers benefit from a streamlined operation that enhances efficiency and minimizes the risk of compliance errors.

For Executing or Clearing Brokers:

- Regulatory Compliance Assurance:

- Challenge: Executing and clearing brokers face the daunting task of adhering to a myriad of regulatory requirements, with the risk of substantial fines for non-compliance.

- Loffa’s Edge: Leveraging Loffa Interactive’s suite ensures operational processes are in strict alignment with regulations, including SEC Rule 17a-4 regarding the electronic storage of financial records and FINRA’s guidelines.

- Outcome: Enhanced operational reliability, with a robust framework that virtually immunizes against regulatory penalties.

- Operational Efficiency and Risk Management:

- Hurdle: Managing the nuanced risks inherent in executing and clearing operations without compromising efficiency is a delicate balancing act.

- Loffa’s Approach: By adopting Loffa Interactive’s technologies, brokers can significantly improve workflow efficiencies through our SaaS solutions, ensuring a streamlined and risk-aware operational landscape.

- Result: A notable reduction in operational risk paired with an increase in process efficiency, driving businesses towards greater profitability and risk mitigation.

Understanding the Hidden Risks in Workflow Management and the Importance of Robust Solutions

In the world of brokerage and financial services, compliance is often viewed through the lens of immediate regulatory requirements and the risk of fines. Firms tend to allocate resources to workflows that are directly associated with high-profile regulations like Anti-Money Laundering (AML) or Market Access rules. However, this approach can overlook vulnerabilities in seemingly unrelated workflows that, if exploited, can lead to significant risks and regulatory penalties.

The Cybersecurity Parallel

Think of this like cybersecurity. In cybersecurity, a vulnerability in a non-critical system can be exploited by malicious actors to gain access to critical assets. Even if the system doesn’t seem important on its own, its compromise can have cascading effects throughout the entire organization. Similarly, in brokerage operations, workflows that appear low-risk can harbor vulnerabilities that impact broader compliance and risk management efforts.

Hidden Vulnerabilities in Common Workflows

- Letters of Free Funds:

- Perceived Role: Primarily associated with SEC Rule 17a-4, focusing on record-keeping.

- Hidden Risk: If processed improperly, these letters can be manipulated to misrepresent a client’s available funds. This can lead to unauthorized trading activities that violate Market Access rules (FINRA Rule 15c3-5) or facilitate money laundering schemes.

- Prime Broker Documentation:

- Perceived Role: Compliance with specific documentation requirements under FINRA Rule 2231 and SEC Rule 15c3-3.

- Hidden Risk: Inadequate documentation can result in unclear terms of engagement with clients, leading to unauthorized market access or trading activities. This exposes the firm to violations of Market Access rules and increases AML risks.

- Quarterly Broker Statements:

- Perceived Role: Meeting reporting obligations under SEC Rule 17a-13b-3.

- Hidden Risk: Errors or delays in statements can obscure unusual trading patterns or discrepancies, hindering the detection of suspicious activities that may be related to AML concerns or regulatory violations.

Why Proper Workflow Management Matters

Why Proper Workflow Management Matters

Poorly managed workflows in these areas can:

- Create Exploitation Opportunities: Just as hackers exploit software vulnerabilities, malicious actors can exploit gaps in your workflows to engage in fraudulent or illegal activities.

- Lead to Regulatory Fines: Regulatory bodies may impose fines not just for direct violations but also for inadequate controls that allow violations to occur.

- Damage Reputation: Beyond fines, public disclosure of compliance failures can erode client trust and damage your firm’s reputation.

How Our SaaS Solutions Mitigate These Risks

Our SaaS solutions are designed with built-in workflow limitations and guardrails that enforce compliance and reduce the risk of exploitation:

- Standardized Processes: By guiding users through standardized workflows, we minimize the chance of errors or omissions that could lead to compliance breaches.

- Automated Controls: Our systems include automated checks for compliance with various regulations, ensuring that actions taken are within legal and regulatory boundaries.

- Real-Time Monitoring: We provide real-time monitoring and alerts for activities that deviate from established norms, enabling swift action to address potential issues.

- Audit Trails: Comprehensive records of all actions are maintained, facilitating easy audits and demonstrating compliance to regulators.

Reframing Workflow Prioritization

We encourage firms to adopt a holistic view of compliance and risk management:

- Integrated Risk Assessment: Consider how each workflow, no matter how routine, fits into the broader risk landscape of your firm.

- Resource Allocation: Allocate resources not just based on the immediate risk of fines but also on the potential for exploitation and indirect risks.

- Continuous Improvement: Regularly review and update workflows to address new vulnerabilities and adapt to evolving regulatory requirements.

Conclusion

By understanding that every workflow is a potential vulnerability point, firms can better protect themselves against exploitation and regulatory risks. Our SaaS solutions don’t just help you meet specific regulatory requirements—they provide a framework that enhances overall compliance and security across your operations.

Key Takeaways:

- Holistic Risk Management: View all workflows as interconnected components of your firm’s risk profile.

- Preventative Measures: Utilize solutions that enforce compliance through built-in controls and standardized processes.

- Proactive Approach: Don’t wait for a regulatory fine or security breach to address vulnerabilities in your workflows.

By adopting this perspective, brokers can not only avoid fines but also strengthen their operational integrity, protect their reputation, and build trust with clients.

The Morgan Stanley case is a potent reminder of the crucial stakes involved in maintaining proper risk management controls and supervisory procedures. With the financial landscape continuously evolving, the need for robust compliance measures has never been more pronounced. Partnering with adept technology providers like Loffa Interactive Group equips financial services firms with the necessary tools and expertise to satisfy the dynamic demands of regulatory compliance, ensuring they stay ahead of the curve.

Last week, I was on a call with one of our prime broker clients discussing their recent SEC examination. “The landscape has completely changed,” their head of compliance told me. “We’re not just checking boxes anymore.” After two decades in securities operations, I couldn’t agree more. The SEC’s 2025 examination priorities signal a fundamental shift in how our industry operates, and it’s one that deserves a deeper look.

Last week, I was on a call with one of our prime broker clients discussing their recent SEC examination. “The landscape has completely changed,” their head of compliance told me. “We’re not just checking boxes anymore.” After two decades in securities operations, I couldn’t agree more. The SEC’s 2025 examination priorities signal a fundamental shift in how our industry operates, and it’s one that deserves a deeper look.

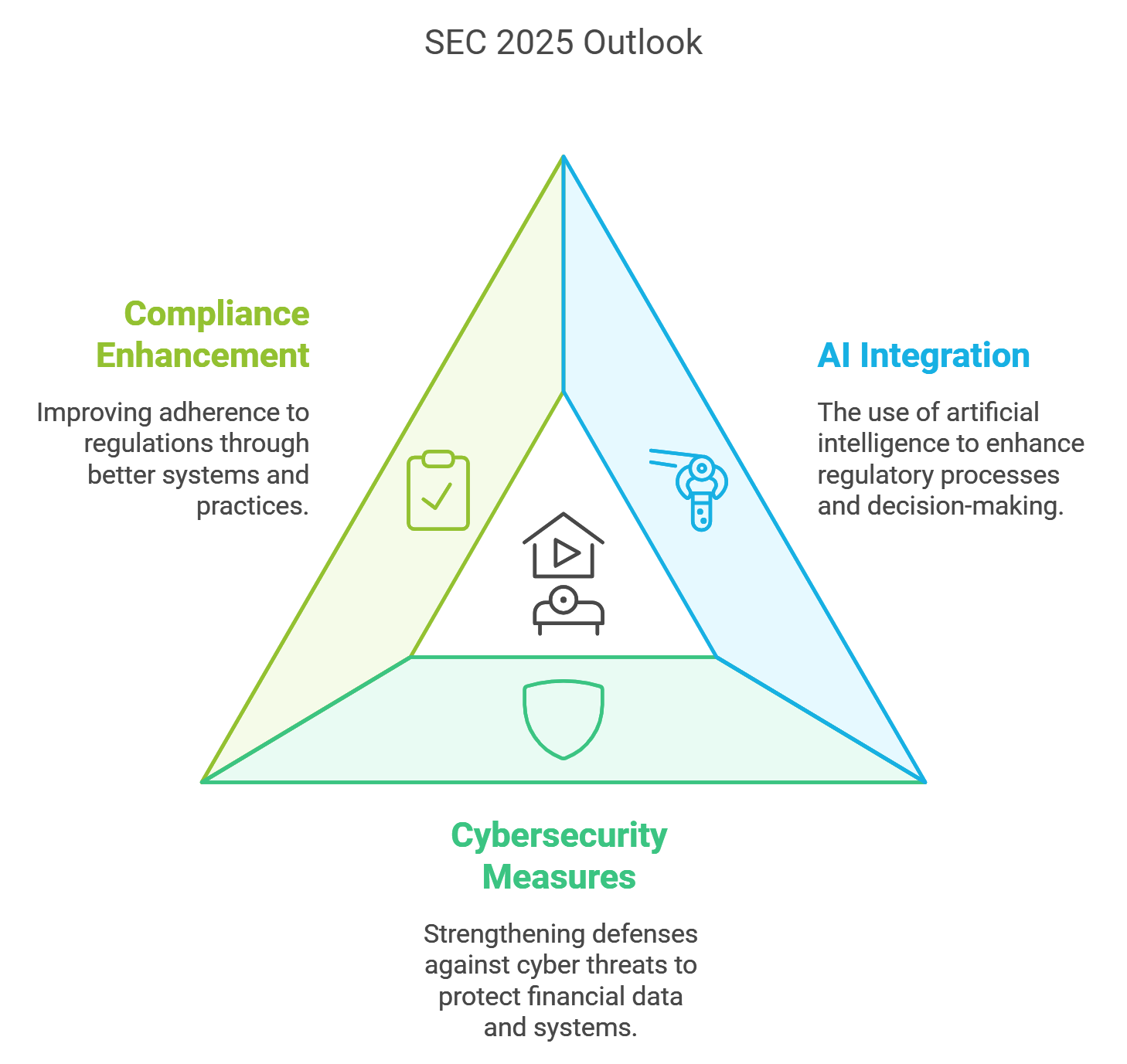

In the fast-paced world of finance, staying in tune with regulatory updates is not just smart; it’s essential for survival and growth. The SEC has laid out its 2025 priorities, targeting key areas like artificial intelligence (AI), cybersecurity, outsourcing, and fresh regulations. For financial services firms, especially Prime Brokers or Clearing Brokers, these areas are more than just buzzwords—they are integral components of their operational and strategic plans.

In the fast-paced world of finance, staying in tune with regulatory updates is not just smart; it’s essential for survival and growth. The SEC has laid out its 2025 priorities, targeting key areas like artificial intelligence (AI), cybersecurity, outsourcing, and fresh regulations. For financial services firms, especially Prime Brokers or Clearing Brokers, these areas are more than just buzzwords—they are integral components of their operational and strategic plans.