TD Bank’s $3 Billion Fine: A Stark Reminder of the Crucial Need for Robust AML Defenses

5 min read

TD Bank’s $3 Billion Lesson in Combating Money Laundering

TD Bank recently found itself at the center of a financial storm, agreeing to a landmark $3 billion fine to settle charges of money laundering. This penalty, unprecedented in its magnitude for a U.S. bank, shines a piercing light on the hazards of inadequate anti-money laundering (AML) defenses.

TD Bank recently found itself at the center of a financial storm, agreeing to a landmark $3 billion fine to settle charges of money laundering. This penalty, unprecedented in its magnitude for a U.S. bank, shines a piercing light on the hazards of inadequate anti-money laundering (AML) defenses.

The Hefty Price of Neglect

The crux of the matter lies in TD Bank’s lapse in closely monitoring and reporting questionable transactions — a foundational requirement under the Bank Secrecy Act. For years, the institution inadvertently became a conduit for criminal networks, channeling vast sums that fueled the machinations of drug operations and other illicit dealings.

In a shocking turn of events, TD Bank has been hit with a record-breaking $3 billion fine for violating the Bank Secrecy Act. This unprecedented penalty serves as a stark reminder of the critical importance of financial compliance in today’s regulatory landscape.

As a provider of compliance software solutions, Loffa Interactive Group understands the gravity of this situation and its implications for the financial industry. Our SaaS platforms, designed to keep clients within regulatory rails, have never been more relevant.

The Violations

TD Bank’s transgressions are both extensive and alarming. Over a period of years, the bank:

- Failed to monitor a staggering $18 trillion in customer activity

- Ignored red flags from high-risk customers

- Facilitated over $400 million in transactions linked to fentanyl sales

These failures allowed criminal networks to exploit TD Bank’s systems, using them as a conduit for money laundering on a massive scale.

The Consequences

The repercussions for TD Bank are severe and multifaceted:

- A $1.8 billion fine payable to the U.S. Justice Department

- An additional $1.3 billion penalty to the Treasury Department

- Imposition of an asset cap

- Independent monitoring for 4 years

- Restrictions on opening new branches and entering new markets

Beyond these direct penalties, TD Bank has suffered a 5% drop in stock value and incalculable reputational damage.

Why This Matters

For Loffa Interactive Group, this case underscores the vital importance of our work. Our suite of compliance tools, including automated Free Fund Letters, streamlined Quarterly Broker Statements, and efficient Prime Broker Agreement management, are designed precisely to prevent the kind of systemic failures that led to TD Bank’s downfall.

Financial institutions simply cannot afford to treat compliance as an afterthought. The cost of proper monitoring and adherence to regulations pales in comparison to the potential fines, restrictions, and reputational damage of non-compliance.

Lessons for the Financial Industry

TD Bank’s case offers several crucial lessons:

- Compliance must be prioritized over short-term profits.

- Robust monitoring systems are not optional – they’re essential.

- Employee training on compliance issues is critical.

- Regular audits can catch issues before they escalate to crisis levels.

The Role of Technology

Advanced software solutions, like those offered by Loffa Interactive Group, play a crucial role in maintaining compliance. Our platforms leverage AI and machine learning to enhance monitoring capabilities, reduce human error, and streamline compliance processes.

Where Loffa Steps In

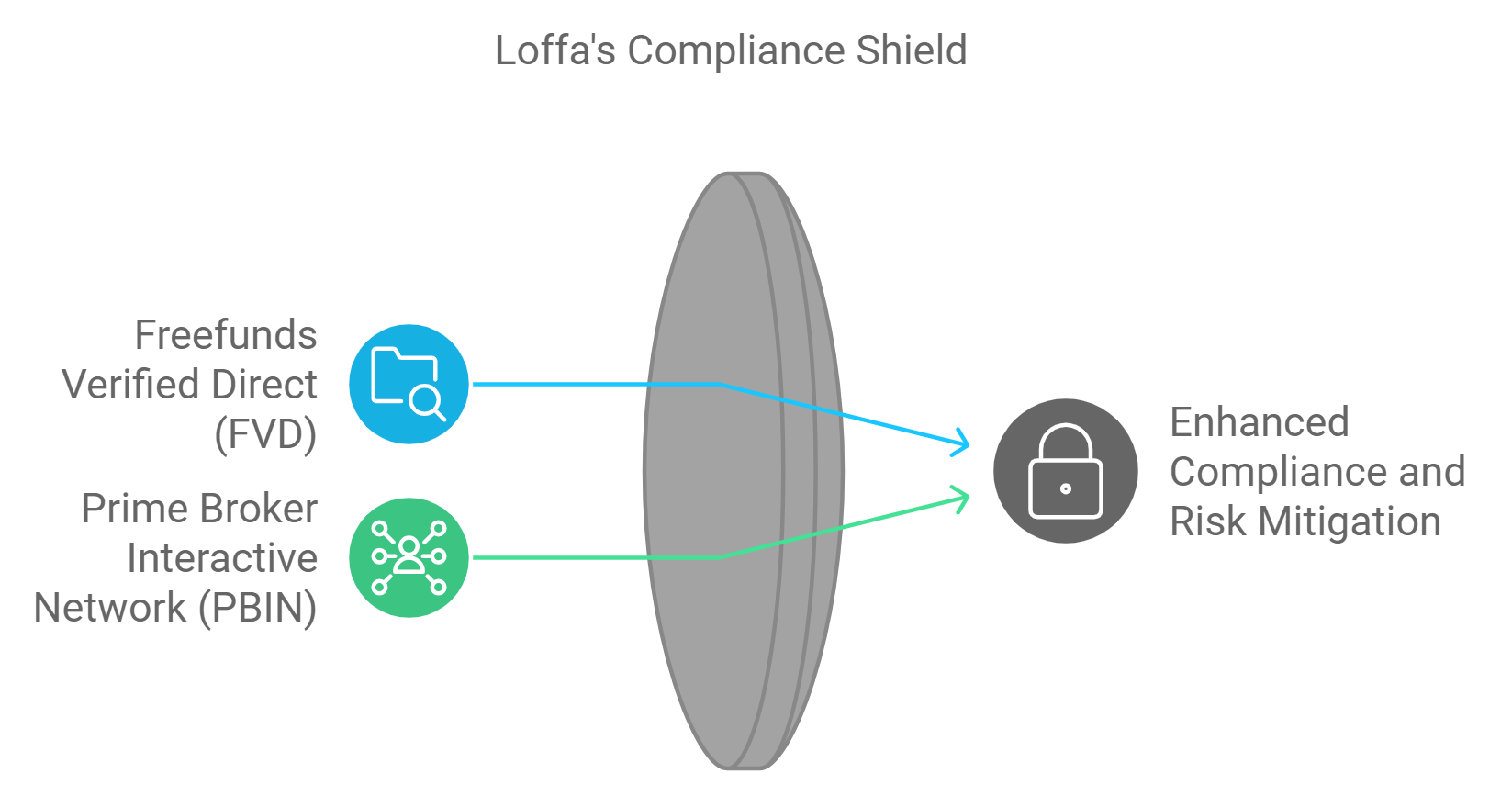

Aware of the formidable challenge that financial institutions face in thwarting money laundering, Loffa Interactive Group has positioned itself as a bulwark against such vulnerabilities. Loffa’s product suite, notably the Freefunds Verified Direct (FVD) and Prime Broker Interactive Network (PBIN), is meticulously engineered to empower firms in steering clear of compliance pitfalls and, by extension, punitive fines.

As TD Bank embarks on a multi-year overhaul of its compliance systems, the financial industry watches closely. This case serves as a powerful reminder that proactive compliance measures are far more cost-effective than dealing with the fallout of regulatory violations.

For financial institutions, now is the time to ask hard questions:

- Are your current compliance measures truly sufficient?

- How often do you review and update your monitoring systems?

- Do your employees fully understand the importance of compliance?

- Have you fully leveraged technology to improve your regulatory adherence?

At Loffa Interactive Group, we’re committed to helping financial institutions navigate these challenges. Our SaaS solutions provide the tools needed to stay within regulatory boundaries, reduce manual errors, and improve operational efficiency.

Don’t wait for a regulatory crisis to strike. Act now to strengthen your compliance framework. Contact Loffa Interactive Group today to learn how our solutions can protect your institution and ensure you stay on the right side of regulations.

In the wake of TD Bank’s cautionary tale, one thing is clear: in the world of finance, compliance isn’t just about following rules – it’s about safeguarding your institution’s future.

Spotlight on Loffa’s Solutions

Freefunds Verified Direct (FVD)

At the heart of efficient transaction management lies the Freefunds Verified Direct. This tool is indispensable for brokers, ensuring that transactions within cash accounts adhere to Regulation T guidelines. By automating the verification of free funds, FVD essentially acts as a compliance shield, safeguarding brokers from inadvertently transgressing trade regulations.

Prime Broker Interactive Network (PBIN)

Navigating prime brokerage agreements is no small feat, given their intricate stipulations. PBIN emerges as a beacon of simplicity, managing F1SA, SIA-150, and SIA-151 forms with unparalleled precision. This ensures executing and clearing brokers can focus on their core operations, fortified by the knowledge that they align with regulatory standards.

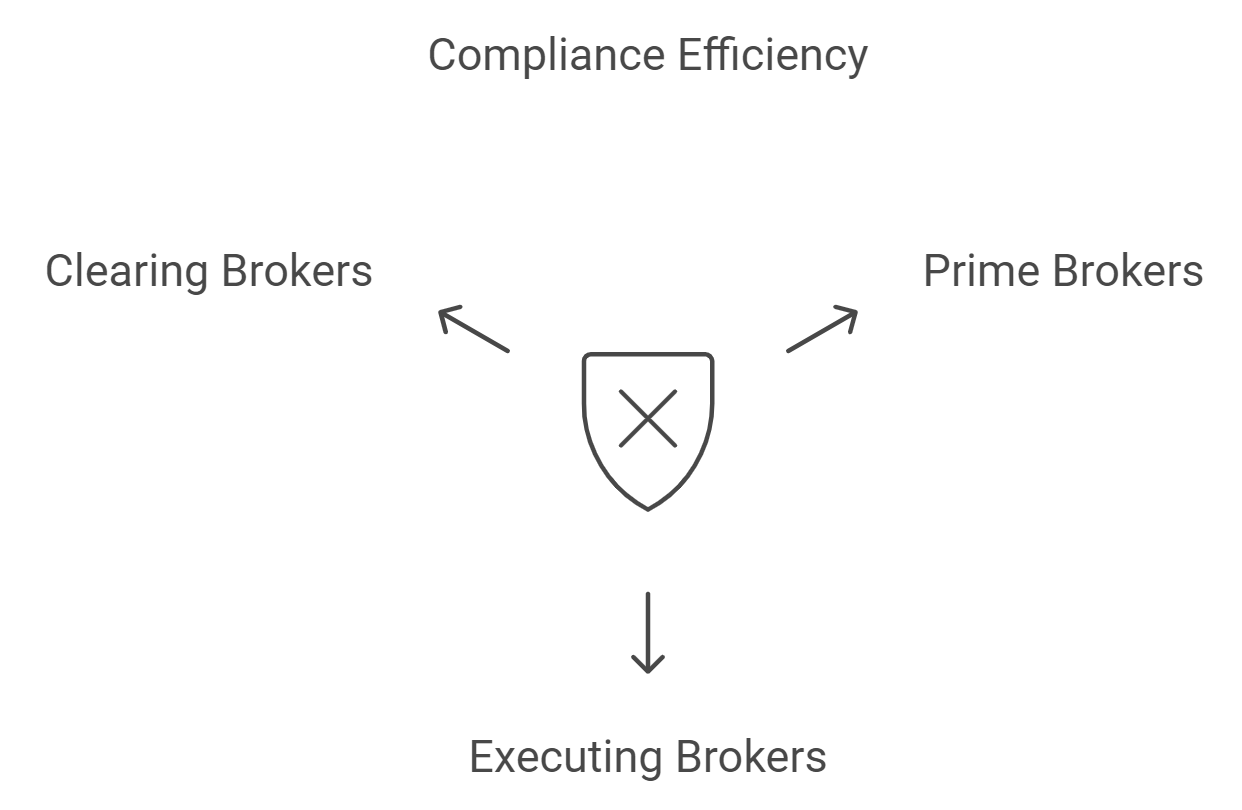

The Twin Pillars of Impact

Prime Brokers: A Gateway to Compliance Efficiency

For prime brokers, the allure of PBIN lies in its capacity to streamline the complex dynamics of agreement management. It’s not just about keeping up; it’s about staying ahead, anticipating changes, and adapting with agility. PBIN offers the foresight and control needed to manage prime brokerage agreements efficiently.

Executing and Clearing Brokers: Strengthening the Operational Backbone

Executing and clearing brokers find in FVD a robust ally. The meticulous verification of free funds prior to trading acts like a sentinel on the compliance frontier, averting the pitfalls of regulatory breaches. It’s about more than avoiding fines; it’s about reinforcing trust and integrity in every transaction.

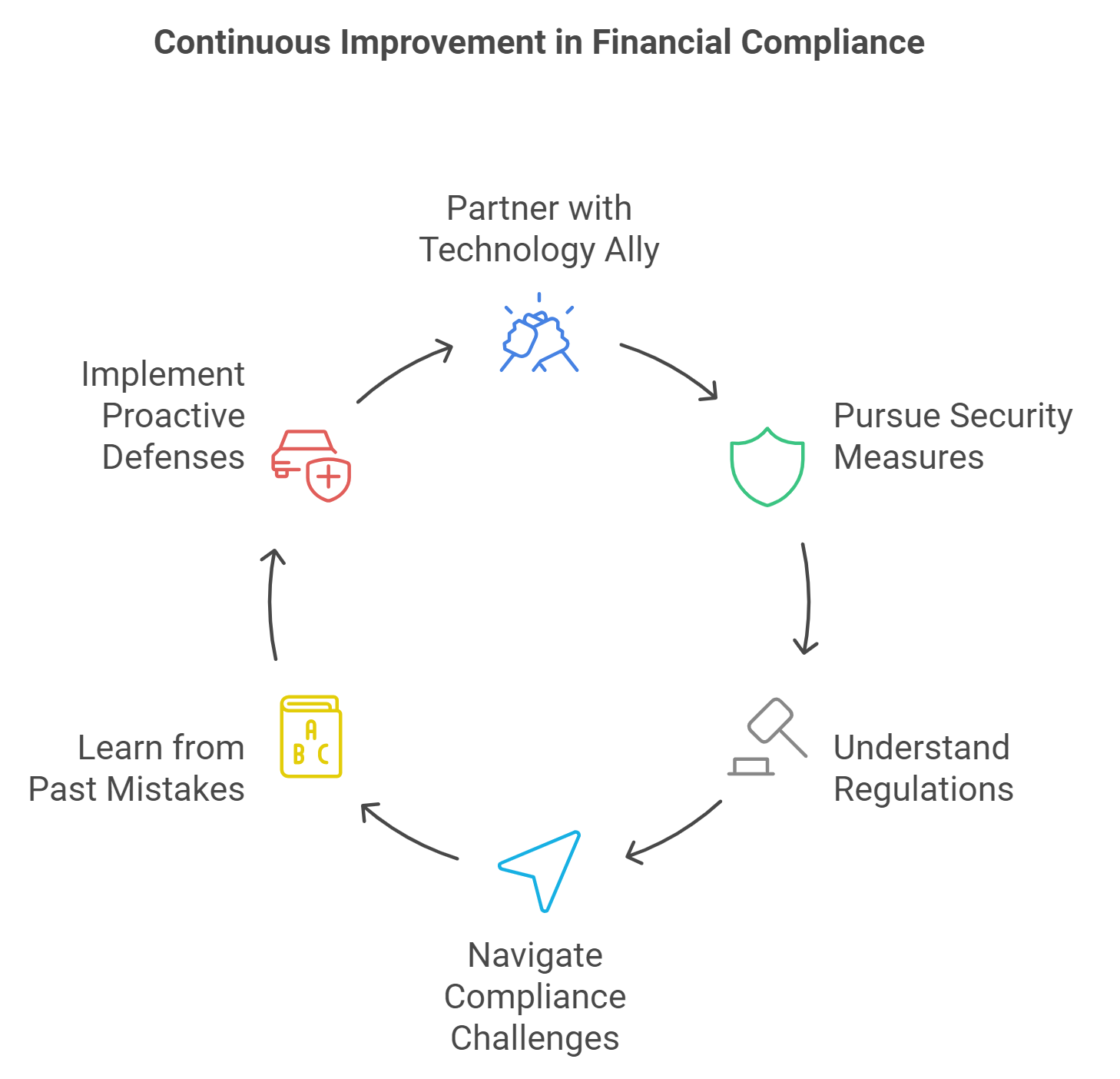

The Way Forward

In an era where the financial sector is consistently tested by fraudsters and regulations alike, the partnership with a technology ally like Loffa Interactive Group becomes not just beneficial, but essential. Loffa’s relentless pursuit of security, married to their deep regulatory understanding, offers a beacon of hope for firms navigating the murky waters of financial compliance. This TD Bank saga, costly as it was, imparts a valuable lesson on the price of compliance complacency and the worth of proactive, tech-driven defenses.