Supreme Court Ruling Redefines SEC Enforcement: Implications for Financial Firms and Compliance Strategies

4 min read

Supreme Court Ruling Shakes Up SEC’s Enforcement Muscle: What’s Next for Financial Firms?

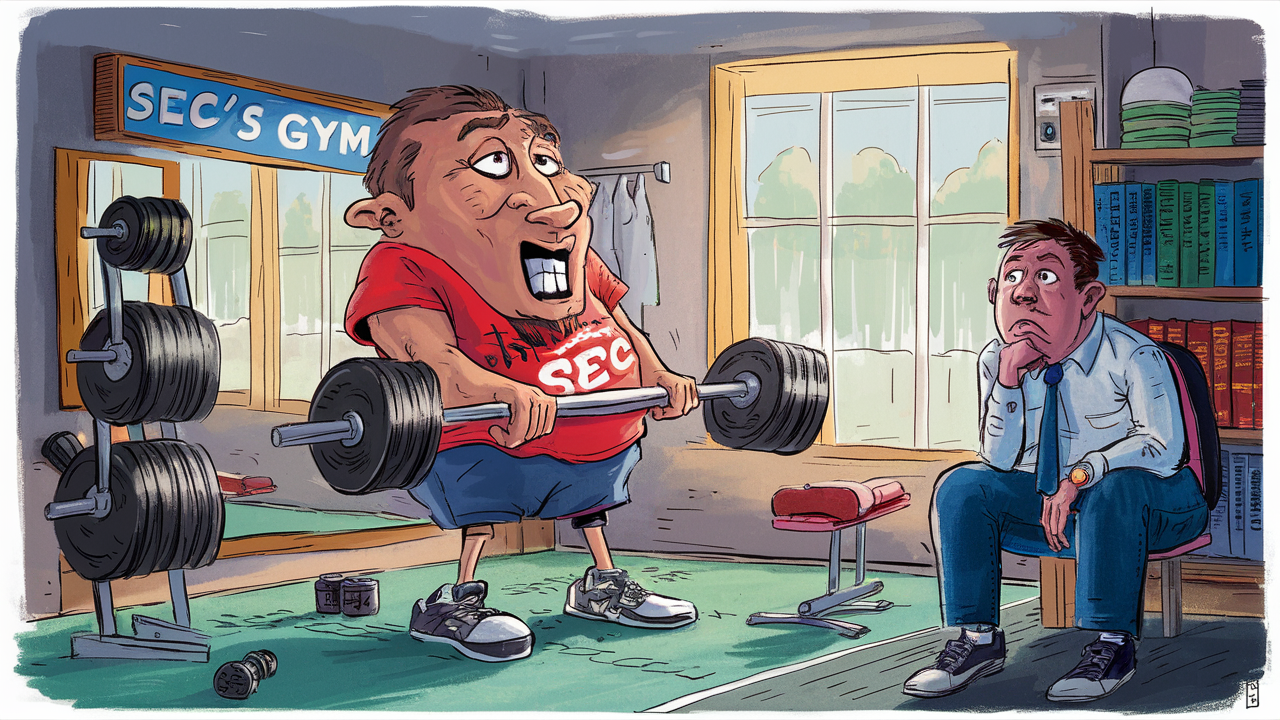

In a groundbreaking verdict, the Supreme Court clipped the wings of the Securities and Exchange Commission (SEC), transforming how enforcement disputes might play out in the future. The case of Securities and Exchange Commission v. Jarkesy changes the game, challenging the SEC’s method of leveraging in-house courts for adjudicating certain enforcement actions, especially those seeking civil penalties for alleged wrongdoings like fraud.

In a groundbreaking verdict, the Supreme Court clipped the wings of the Securities and Exchange Commission (SEC), transforming how enforcement disputes might play out in the future. The case of Securities and Exchange Commission v. Jarkesy changes the game, challenging the SEC’s method of leveraging in-house courts for adjudicating certain enforcement actions, especially those seeking civil penalties for alleged wrongdoings like fraud.

Under the microscope, this ruling could unsettle the terrain for financial services firms, shaking up compliance strategies and operations. But fear not, for enterprises woven into the fabric of Loffa Interactive Group’s ecosystem might find themselves at a vantage point. Known for their unyielding security posture and compliance-centric tech solutions, Loffa stands as a beacon for navigating these shifting sands. Let’s dissect what this all means, particularly through the lens of their flagship offerings, Freefunds Verified Direct (FVD) and Prime Broker Interactive Network (PBIN).

Deeper Dive: Crunch Points for Prime and Clearing Brokers

Within the echoing halls of financial firms, especially prime and clearing brokers, the seismic shifts of this ruling resonate with unique intensity. Here’s how:

Efficiency In Compliance and Operations

The abrupt changes in enforcement procedures underscore the criticality of rigid, yet agile, compliance frameworks. Prime Brokers, operating at the heart of transactions, and Clearing Brokers, ensuring smooth settlement of trades, find a reliable ally in Loffa’s tech armor. With FVD, the visage of compliance with Regulation T is no longer a Herculean endeavor – it’s streamlined, ensuring that trades are above board and free funds are properly verified.

SaaS solutions, epitomized by FVD, gift these firms with operational efficiencies unheard of in the traditional compliance models. They slice through the compliance complexity with the precision of a scalpel, minimizing manual oversight, and ramping up transaction speeds.

Risk Management and Regulatory Compliance

The court’s decision casts new shadows on old paths, pushing firms to reassess risk management frameworks. Here, PBIN shines, catered to manage the intricacies of prime brokerage agreements, amendments, and the nuanced dance of compliance with regulations like the Dodd-Frank Act.

For prime and clearing brokers, this means an elevated stance on risk management. PBIN offers a panoramic view over the regulatory horizon, ensuring that every contract, every agreement, whispers compliance. The strength of a SaaS solution here is resilience – the ability to adapt to regulatory twists with the agility of a cat, ensuring firms aren’t just reacting to regulations but are steps ahead.

The Supreme Court Ruling’s Aftermath: Charting the Future

With the SEC now urged to press charges in public courts, a possible deceleration in enforcement momentum could spell a strategic pause for financial firms. This is the juncture where depth in compliance strategy, fortified by tech solutions like those provided by Loffa, transitions from advantage to necessity.

With the SEC now urged to press charges in public courts, a possible deceleration in enforcement momentum could spell a strategic pause for financial firms. This is the juncture where depth in compliance strategy, fortified by tech solutions like those provided by Loffa, transitions from advantage to necessity.

Justice Neil Gorsuch’s remarks stitch a silver lining – the SEC is down but not out, with the liberty to pursue justice, albeit through a more traditional judicial pathway. This might translate to a slow burn on enforcement actions, with implications rippling through prime and clearing brokers’ domains. Here, the agility offered by SaaS solutions like FVD and PBIN becomes not just strategic but critical, imbuing firms with the flexibility to navigate a landscape where the legal goalposts may continue to shift.

Moreover, this landmark decision ignites conversations beyond the confines of the SEC, perhaps foreshadowing a broader reevaluation of the “administrative state’s” power dynamics. For financial services firms, this is a clarion call to reassess, realign, and reequip with technologies and partnerships that promise not just compliance, but competitive edge.

In the swirling aftermath of the Supreme Court’s ruling, the financial ecosystem stands on the brink of a new era. Partners like Loffa Interactive Group, armed with solutions engineered for these precise challenges, offer a beacon for firms wrestling with the dual demands of agility and unwavering compliance. Amidst the shifting sands of regulation and enforcement, the path forward is clear – embrace technology, strengthen compliance frameworks, and navigate the future with confidence.

In essence, the world of financial compliance and risk management isn’t just changing; it’s evolving, with prime and clearing brokers at the epicenter of this transformation. In this journey, the allyship with pioneering solution providers like Loffa isn’t just beneficial; it’s indispensable.