Loffa Research -AML Risk in Done-Away Trades

AML Risk in Done Away Trades –Loffa Research

The topic of Anti-Money Laundering (AML) risks associated with done away trades is critical within the financial industry, as brokers increasingly face scrutiny over their compliance practices. Done away trades, which are transactions executed outside conventional trading systems, can obscure transaction details, thereby elevating the risk of facilitating money laundering activities. This concern has gained prominence in recent years due to several high-profile cases and an evolving regulatory landscape aimed at strengthening AML protocols within financial institutions. Brokers engaging in done away trades must navigate complex AML compliance challenges, as these trades often lack transparency and can be manipulated for illicit purposes. The potential for non-compliance carries severe repercussions, including hefty fines and reputational damage, as evidenced by significant penalties imposed on firms failing to adhere to AML regulations.

The topic of Anti-Money Laundering (AML) risks associated with done away trades is critical within the financial industry, as brokers increasingly face scrutiny over their compliance practices. Done away trades, which are transactions executed outside conventional trading systems, can obscure transaction details, thereby elevating the risk of facilitating money laundering activities. This concern has gained prominence in recent years due to several high-profile cases and an evolving regulatory landscape aimed at strengthening AML protocols within financial institutions. Brokers engaging in done away trades must navigate complex AML compliance challenges, as these trades often lack transparency and can be manipulated for illicit purposes. The potential for non-compliance carries severe repercussions, including hefty fines and reputational damage, as evidenced by significant penalties imposed on firms failing to adhere to AML regulations.

In this context, the role of independent auditors has become increasingly vital, as they assess the effectiveness of AML measures and ensure that brokers maintain robust compliance frameworks to detect and report suspicious activities effectively. Notably, regulatory bodies have emphasized the importance of implementing comprehensive AML programs, including thorough customer due diligence and transaction monitoring systems, particularly in scenarios where trades may appear benign but pose underlying risks. The growing use of advanced technology in transaction monitoring highlights the need for brokers to adapt to new threats while enhancing their compliance capabilities. As the financial landscape continues to evolve, the focus on AML compliance in done away trades underscores the imperative for brokers to remain vigilant and proactive in their efforts to mitigate potential risks.

In summary, the intersection of done away trades and AML compliance represents a critical area of concern for brokers, necessitating ongoing diligence and adaptation to evolving regulatory requirements. By fostering a culture of compliance and utilizing effective auditing practices, brokers can contribute to the integrity of the financial system while protecting themselves from the repercussions of non-compliance.

Background

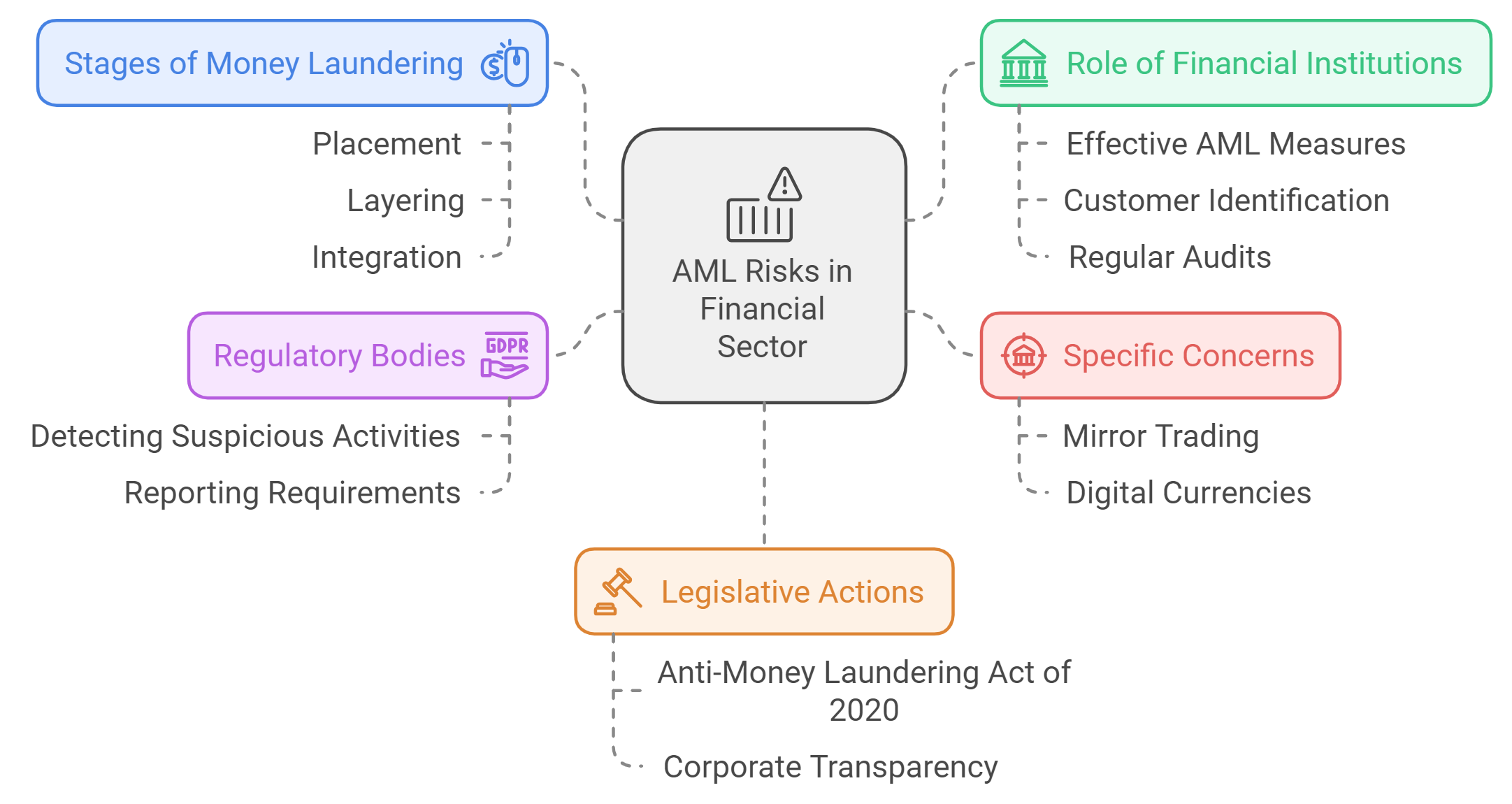

The concept of Anti-Money Laundering (AML) is pivotal in the financial sector, as it helps mitigate risks associated with illegal activities such as money laundering and terrorist financing. Money laundering itself is the illicit process of disguising money obtained from criminal activity as legitimate, involving three key stages: placement, layering, and integration. Financial institutions are crucial in preventing these activities through effective AML measures. One significant area of concern is “mirror trading,” which has gained attention due to its potential use in money laundering schemes. Mirror trading occurs when a trader simultaneously buys and sells the same number of securities to create a misleading impression of market activity, often to facilitate the movement of illicit funds. High-profile cases, such as those involving Deutsche Bank, have highlighted the vulnerabilities within the financial ecosystem that criminals exploit through such tactics. The risks associated with ineffective AML compliance have been underscored by studies indicating that deficiencies in AML frameworks contribute to the persistence of financial crimes, ultimately fracturing economic and social development.

Additionally, the evolving landscape of technology has further complicated AML efforts, with criminals increasingly utilizing digital currencies and other online methods to launder money. In 2022 alone, illicit use of cryptocurrency reached $20.1 billion, illustrating the need for enhanced regulatory measures in the face of these emerging threats. Regulatory bodies and financial institutions must thus navigate these complexities while upholding their obligations to detect and report suspicious activities. Given these factors, brokers and financial institutions must be vigilant in understanding their AML risks, particularly in trades that may seem innocuous but could pose underlying threats. This necessitates a robust AML program that includes comprehensive customer identification protocols and regular audits to detect any inconsistencies or potential abuses within trading practices. The increasing emphasis on AML compliance is further illustrated by recent legislative actions, such as the Anti-Money Laundering Act of 2020, which established new reporting requirements for corporate entities, thereby enhancing transparency and accountability in the financial sector.

Brokers and Done Away Trades

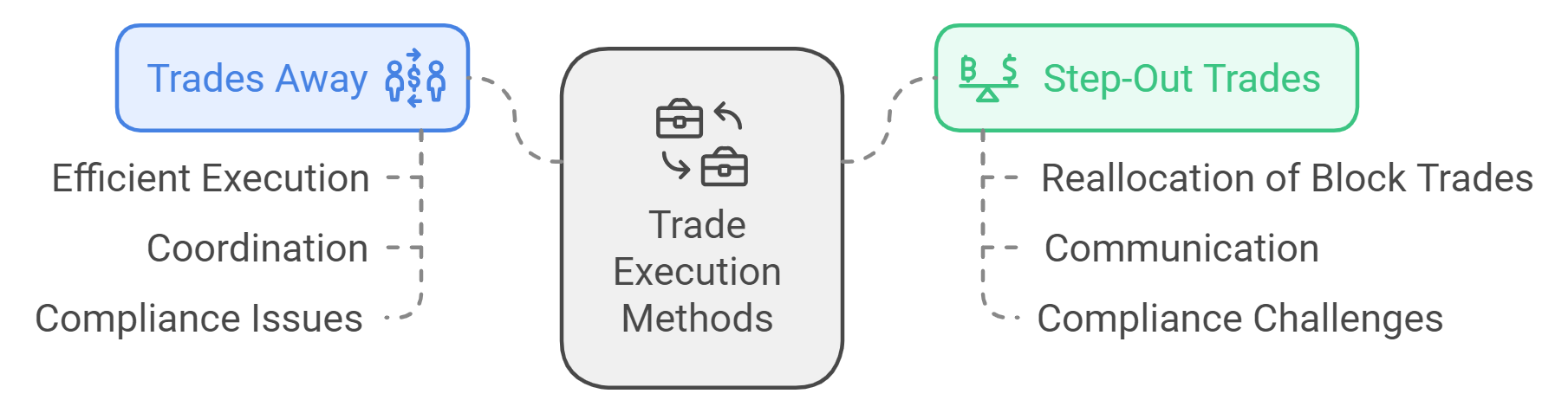

In the financial industry, the concepts of “trades away” and “step-out trades” are critical in understanding the clearing and settlement processes, especially concerning the potential Anti-Money Laundering (AML) risks associated with these practices.

Trades Away

A trade away occurs when a broker executes a trade on behalf of a client through another firm that is better positioned for efficient execution, often due to superior pricing or faster execution times. After executing the trade, the executing firm sends the trade details back to the original broker for clearing and settlement, necessitating precise coordination to ensure accurate record-keeping and fund transfers. This practice has gained traction as it allows investors to benefit from localized knowledge and expertise, potentially improving investment outcomes. However, the use of trades away can raise compliance concerns. As broker-dealers manage large volumes of transactions across various platforms, ensuring that all transactions comply with AML regulations becomes more complex. This includes adhering to the Know Your Customer (KYC) requirements, customer due diligence (CDD), and monitoring transactions for suspicious activity. Failure to properly implement these compliance measures may expose brokers to risks of facilitating money laundering, particularly in cases where transaction details are not fully transparent or documented.

Step-Out Trades

Conversely, step-out trades involve reallocating portions of a block trade to other firms post-execution while maintaining the original execution details. This approach enables brokers to manage large orders more efficiently, facilitating compliance with client mandates and regulatory requirements. The need for clear communication and agreement among participating parties is paramount in this scenario to ensure the correct allocation and settlement of trades. Similar to trades away, step-out trades present compliance challenges. Broker-dealers must ensure that their processes for identifying and managing clients adhere to AML regulations and that transaction monitoring systems are in place to detect any unusual activities that may indicate money laundering risks. Inadequate oversight can lead to severe penalties and reputational damage for the firms involved.

Compliance Impacts

Both trades away and step-out trades require robust compliance frameworks to mitigate AML risks effectively. Industry professionals must be well-versed in the nuances of these practices to navigate the complexities of regulatory requirements, ensuring that all trading activities remain compliant and transparent. As the financial landscape evolves, maintaining clarity in these operational practices is crucial for industry integrity and client trust. This ongoing necessity highlights the importance of diligence in understanding and implementing compliance protocols in the context of trades away and step-out trades.

AML Risks Associated with Done Away Trades

Done away trades, which involve transactions that are not recorded through conventional trading systems, present significant Anti-Money Laundering (AML) risks for brokers. These transactions can obscure the true nature of the trade, making it easier for individuals or entities to engage in money laundering activities. Given the lack of transparency, brokers must exercise heightened vigilance to detect and mitigate these risks.

The Importance of AML Compliance in Done Away Trades

The evolving landscape of AML regulations has heightened the need for insurance brokers to ensure compliance when dealing with done away trades. The AML audit process plays a crucial role in safeguarding against potential legal and financial repercussions associated with these transactions. By implementing robust AML measures, brokers not only protect their businesses but also contribute to the overall integrity of the financial system. Non-compliance can lead to severe consequences, including reputational damage and significant financial penalties, which have seen a marked increase in recent years due to stringent regulatory scrutiny.

Key Risks and Red Flags

Brokers engaging in done away trades must be particularly aware of several risks and red flags that may indicate money laundering activity. For instance, transactions that are structured to avoid AML reporting requirements, such as splitting large trades into smaller, less scrutinized transactions, can be a warning sign. Additionally, brokers should remain cautious of clients who rapidly deposit and then liquidate securities without a clear rationale, as these behaviors can indicate attempts to obscure the origin of illicit funds.

Regulatory Oversight and Best Practices

Regulatory bodies have increasingly focused on the risks posed by done away trades, emphasizing the necessity for brokers to maintain a culture of compliance. Implementing a risk-based approach to AML assessments is vital, where brokers categorize clients based on their risk profiles and adapt their due diligence processes accordingly. This approach ensures that higher-risk clients, particularly those involved in complex transactions or operating in high-risk jurisdictions, undergo more thorough scrutiny. Furthermore, continuous monitoring of customer activities and regular audits are essential components of an effective AML compliance program. By conducting these measures, brokers can better identify suspicious activities and report them to the relevant authorities, thereby playing a pivotal role in the prevention of money laundering.

Auditor’s Role in AML Compliance

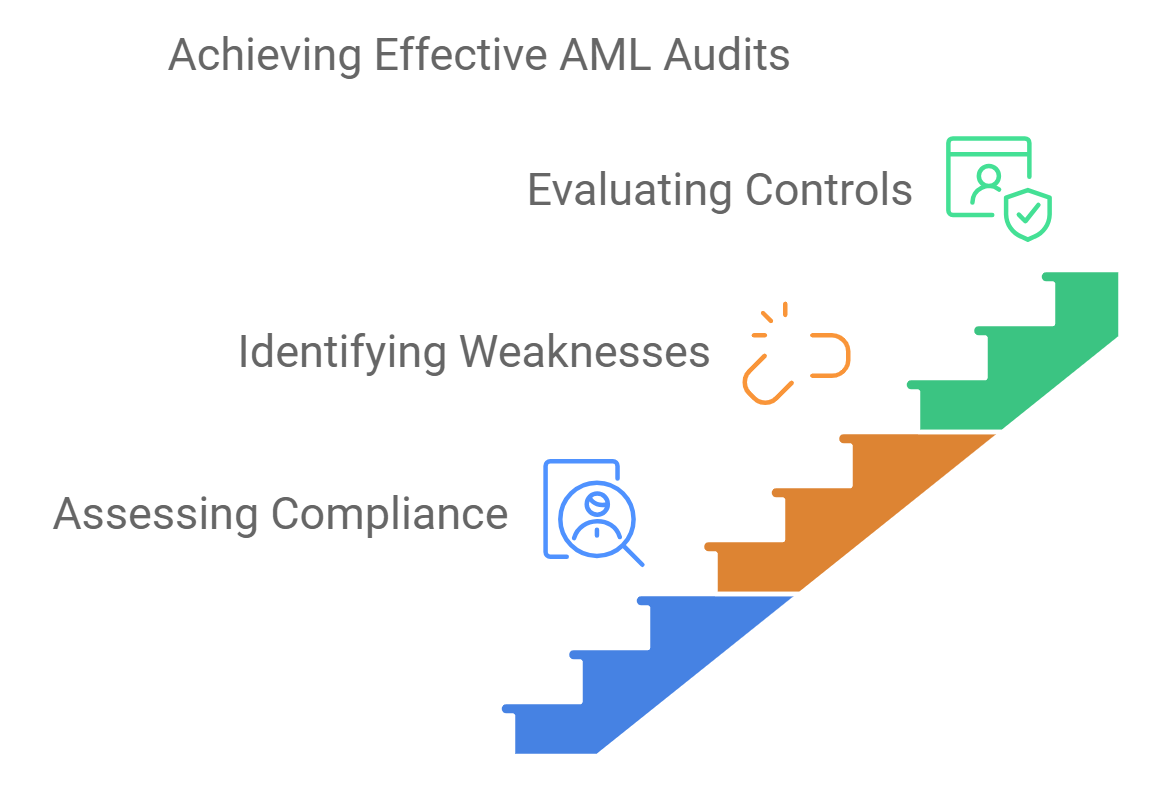

Auditors play a critical role in enhancing Anti-Money Laundering (AML) compliance within financial institutions by conducting independent audits that evaluate the effectiveness of existing AML programs. These audits are essential for identifying weaknesses, assessing controls, and providing recommendations for improvement, thereby ensuring that AML frameworks are robust and effective in detecting and preventing money laundering activities.

Objectives of AML Audits

The primary objectives of AML audits include:

Assessing Compliance

Auditors evaluate an organization’s adherence to applicable AML laws, regulations, and best practices. This involves a thorough assessment of policies, procedures, and internal controls designed to prevent money laundering.

Identifying Weaknesses

AML audits aim to pinpoint deficiencies within the AML program. This includes a review of risk assessments, transaction monitoring systems, and customer due diligence processes to identify areas that require enhancement.

Evaluating Controls

An important aspect of the audit process is evaluating the effectiveness of internal controls. Auditors review mechanisms in place, such as segregation of duties and reporting procedures, to ensure that they adequately prevent and detect money laundering activities.

Risk-Based Approach

When conducting audits, auditors often adopt a risk-based approach. This method prioritizes the evaluation of higher-risk areas, allowing auditors to allocate resources effectively and target their examinations to where vulnerabilities are most likely to exist. By focusing on these areas, auditors can make informed recommendations that enhance the institution’s ability to combat money laundering. Independent Oversight, AML audits are typically performed by independent auditors or regulatory bodies to ensure objectivity and impartiality. Independent auditors possess specialized expertise in AML compliance practices, providing an unbiased evaluation of an institution’s adherence to regulatory requirements. Regulatory bodies may also conduct audits to ensure compliance with specific standards, further emphasizing the importance of independent oversight in maintaining the integrity of AML programs.

Enhancing Program Effectiveness

Through comprehensive evaluations, auditors not only identify weaknesses but also recommend improvements to the AML framework. Suggested enhancements may include updates to internal controls, better policies and procedures, and improved transaction monitoring systems. These recommendations aim to bolster the institution’s ability to detect and deter money laundering, thus reinforcing regulatory compliance and protecting the organization’s reputation.

Impact of AML Risks on Brokers

The increasing focus on anti-money laundering (AML) regulations has significant implications for brokers, particularly in the context of done away trades. As broker-dealers engage in high volumes of low-priced, over-the-counter securities, they become prime targets for money laundering activities, necessitating stringent compliance measures. Regulatory Compliance Challenges, Brokers are required to implement robust AML compliance programs as mandated by the USA Patriot Act and the Bank Secrecy Act. These programs must include customer due diligence, transaction monitoring, and suspicious activity reporting. The failure to establish adequate AML procedures can lead to severe penalties; for instance, a major broker-dealer recently faced a $17 million fine for non-compliance, highlighting the financial stakes involved. The reputational damage from such violations can be even more detrimental, as brokers risk losing client trust and incurring long-term impacts on their business relationships.

Prime Broker Trades and Elevated AML Risks

Prime Brokerage services, which cater to sophisticated clients such as hedge funds and institutional investors, present a higher level of AML risk due to several factors:

- Complex Trading Structures: Prime Broker arrangements often involve intricate trading structures and multiple parties, making it more challenging to maintain transparency and track the flow of funds.

- High-Volume Transactions: The large volume and frequency of trades associated with Prime Broker clients can make it difficult to identify suspicious patterns or anomalies.

- Cross-Border Activities: Prime Brokers often facilitate international trades, increasing exposure to varying regulatory environments and potentially high-risk jurisdictions.

- Sophisticated Clients: Clients utilizing Prime Brokerage services are often well-versed in financial markets, potentially enabling them to devise more sophisticated money laundering schemes.

- Aggregation of Positions: The ability to aggregate positions across multiple executing brokers can obscure the true nature and origin of trades.

To mitigate these elevated risks, brokers must implement enhanced due diligence procedures, sophisticated transaction monitoring systems, and regular risk assessments specific to Prime Broker activities.

Five Types of Done-Away Trades

Done-away trades encompass various transaction types, each with unique characteristics and potential AML risks:

- Cash DVP (Delivery Versus Payment):

- Description: Involves the simultaneous exchange of securities for cash.

- AML Considerations: Requires vigilance in verifying the source of funds and ensuring the legitimacy of both parties involved.

- Prime Broker Trades:

- Description: Executed by an executing broker on behalf of a client, with settlement occurring through the client’s Prime Broker.

- AML Considerations: Presents heightened risks due to the involvement of multiple parties and potential for complex, cross-border transactions.

- Step-Out Trades:

- Description: Allows for the allocation of a single block trade among multiple brokers.

- AML Considerations: Requires careful monitoring to ensure transparency in trade allocation and to prevent potential manipulation.

- Direct Trades:

- Description: Executed directly between two parties without an intermediary.

- AML Considerations: May lack the oversight provided by traditional trading platforms, necessitating enhanced due diligence.

- Broker-to-Broker Trades:

- Description: Transactions conducted between two brokerage firms.

- AML Considerations: Requires thorough vetting of counterparties and ongoing monitoring of inter-broker relationships.

Audit and Monitoring Practices

The AML audit plays a crucial role in helping brokers navigate the regulatory landscape. It involves thorough data collection, analysis of transactions, and adherence to documentation requirements. By leveraging advanced technologies and SaaS solutions, brokers can automate monitoring processes, making it easier to detect suspicious activities and report them to the appropriate authorities. This proactive approach not only enhances compliance but also strengthens the overall integrity of the financial system by mitigating risks associated with money laundering. Economic and Reputational Consequences, Non-compliance with AML regulations can lead to significant economic repercussions for brokers, including fines that can reach upwards of $15 million. Additionally, the costs associated with reputational damage can far exceed those of compliance efforts, creating an environment where the stakes for adhering to AML guidelines are exceedingly high. Brokers face the risk of being sanctioned by international bodies, which can severely restrict their operations and hinder their ability to serve global clients.