Quarterly Statements Demystified: A Broker’s Guide to SEC Rules 17a-13b3 and 17a-4

3 min read

Broker’s Guide to Quarterly Statements: Navigating SEC Regulations

Hey there, finance pros! Let’s dive into the world of quarterly statements and SEC regulations. If you’re a broker, you know the drill – it’s all about keeping investors in the loop and staying on the right side of the law. So, grab your coffee, and let’s break down this complex process into something a bit more digestible.

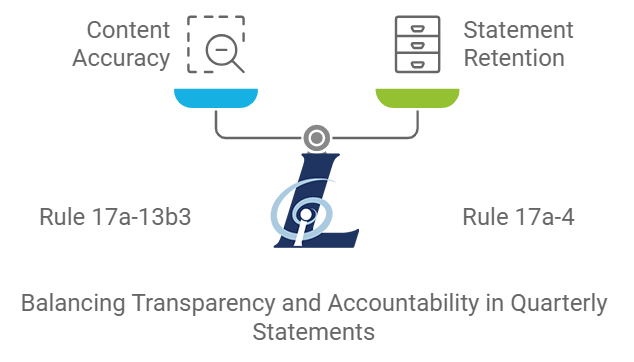

The Big Picture: SEC Rules 17a-13b3 and 17a-4

First things first, let’s talk about the regulatory heavyweights: SEC Rules 17a-13b3 and 17a-4. These bad boys are all about transparency and accountability in the financial world. They’re the reason you’re burning the midnight oil every quarter, making sure those statements are picture-perfect.

What’s the Deal with Rule 17a-4?

Rule 17a-4 is like the Marie Kondo of the financial world – it’s all about keeping your records tidy and accessible. Here’s the scoop:

- Records need to be tamper-proof (non-rewritable and non-erasable)

- Electronic records must be easy to access and backed up offsite

- As of October 2022, the SEC gave this rule a modern makeover, so stay tuned for updates!

Remember, just because you’ve gone digital doesn’t mean you’re automatically compliant. The SEC wants to make sure your electronic storage is up to snuff.

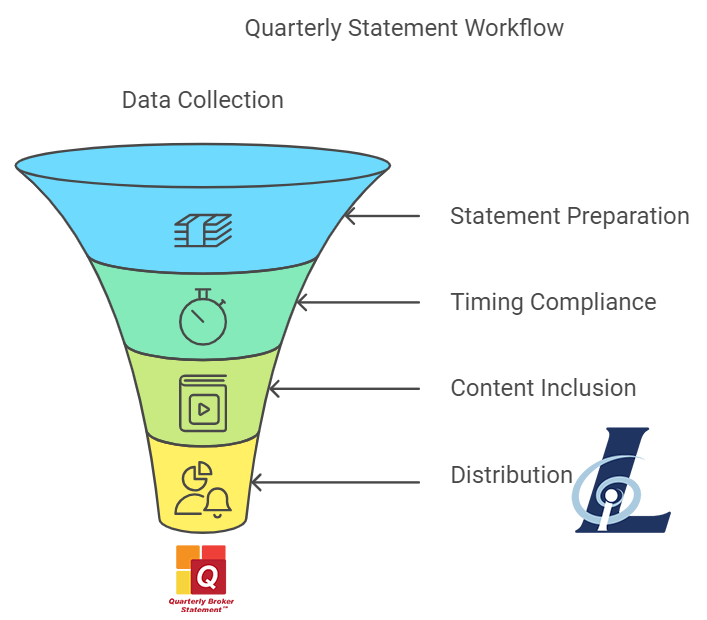

The Quarterly Statement Workflow: A Step-by-Step Guide

Now, let’s break down the process of creating and sending those all-important quarterly statements:

- Data Collection: Gather all the necessary info – fund performance, fees, expenses, the works.

- Statement Preparation: Crunch those numbers and format everything according to SEC guidelines.

- Timing is Everything:

- Regular funds: 45 days after the first three quarters, 90 days after the fiscal year-end

- Funds-of-funds: 75 days after the first three quarters, 120 days after the fiscal year-end

- New kids on the block: Start after your second full quarter of operations

- Content is King: Make sure you include:

- A clear breakdown of expenses and fees

- Performance-based compensation details (hello, distribution waterfalls!)

- Cross-references to your fund’s organizational documents

- A statement of contributions and distributions

- Distribution: Get those statements out to investors, whether by snail mail or email (just make sure your electronic delivery meets SEC standards).

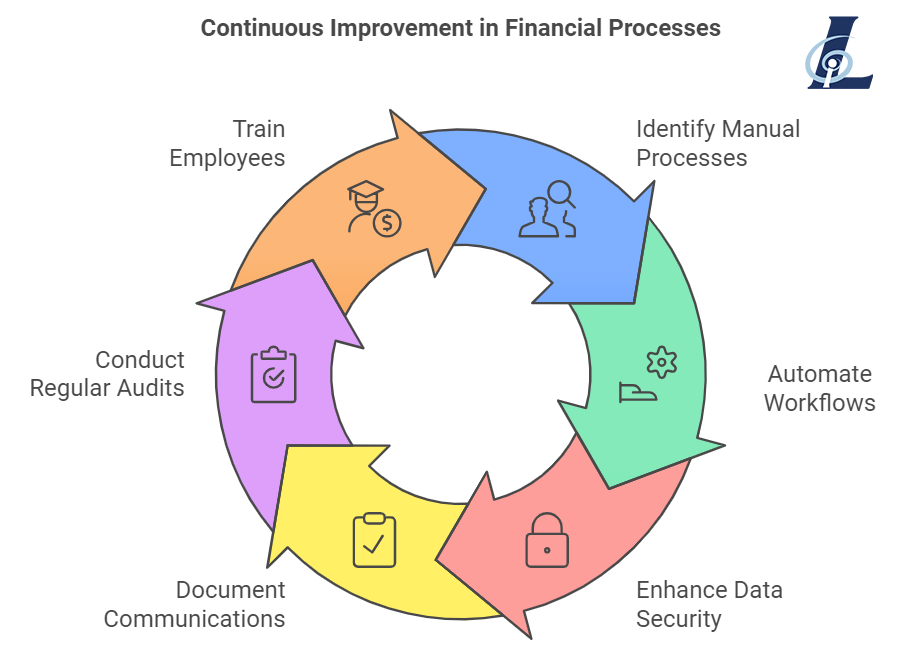

The Challenges: It’s Not All Smooth Sailing

Let’s be real – this process isn’t without its hurdles. Here are some common pain points:

- Manual Processes: If you’re still collecting printed statements by hand, you’re making life harder than it needs to be.

- T+1 Settlement: With the move to T+1 settlement in 2024, you’ll need to step up your game and automate those workflows.

- Data Security: Protecting sensitive info while staying compliant is like walking a tightrope.

- Communication Gaps: Those casual chats on messaging apps? They could be a compliance nightmare if not properly documented.

- Constant Vigilance: Regular audits and employee training are crucial to keep everything running smoothly.

The Solution: Embrace Technology

The key to tackling these challenges? Technology, my friends. Investing in automated systems can help you:

- Streamline data collection and reporting

- Ensure accuracy and compliance

- Meet those tight deadlines without breaking a sweat

- Keep all communications properly documented

Wrapping It Up

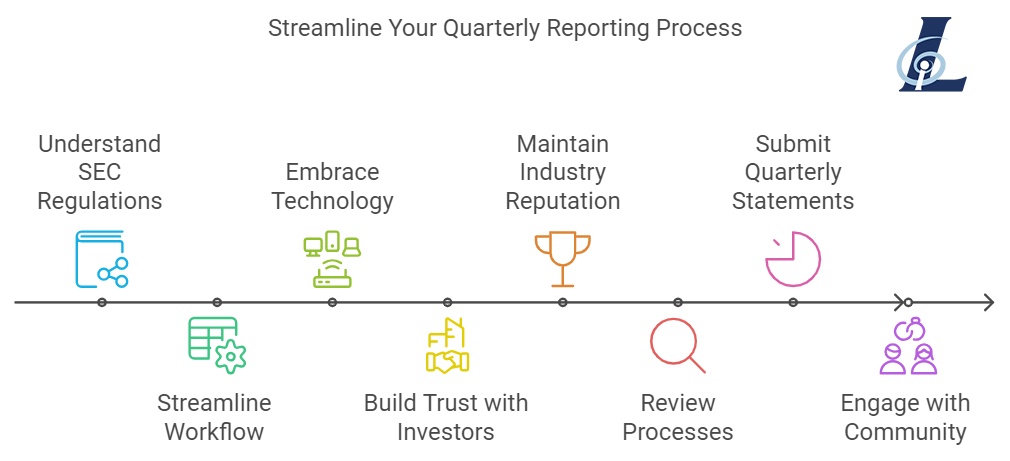

Navigating SEC regulations for quarterly statements doesn’t have to be a nightmare. By understanding the rules, streamlining your workflow, and embracing technology, you can turn this quarterly chore into a well-oiled machine.

Remember, staying compliant isn’t just about avoiding fines – it’s about building trust with your investors and maintaining your reputation in the industry. So, take a deep breath, review your processes, and get ready to rock those quarterly statements!

Got questions? Want to share your own experiences with quarterly reporting? Drop a comment below – let’s keep the conversation going!