Preventing AML Violations: Best Practices for Done Away Trades

6 min read

AML Risks & Done Away Trades with Prime Brokerage in the Spotlight:

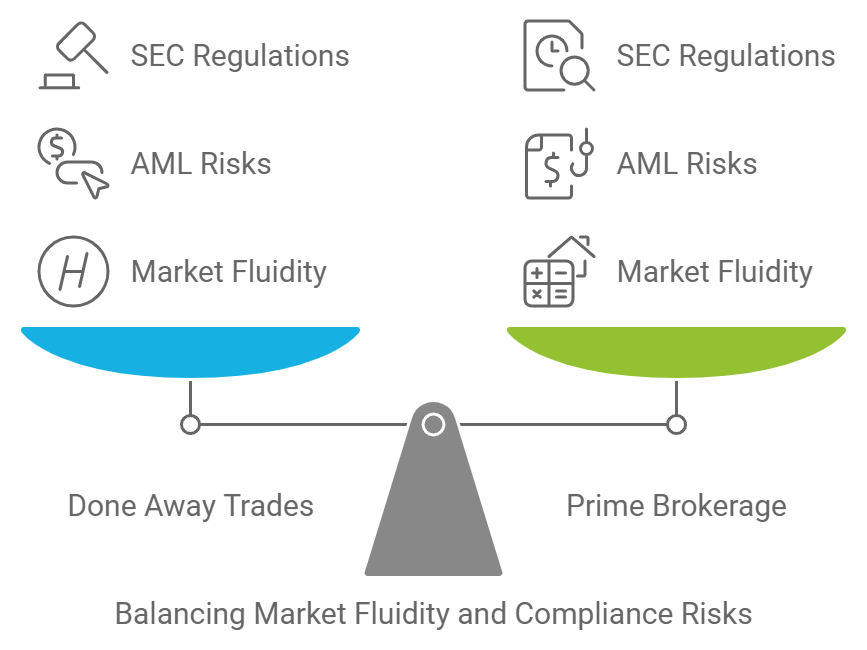

In the ever-evolving world of finance, operations managers find themselves at the crossroads of efficiency and compliance. The recent $3 billion settlement by TD Bank over AML-related issues has sent shockwaves through the industry, serving as a stark reminder of the high stakes involved in financial compliance. As we delve into the intricacies of done away trades and Prime Brokerage arrangements, it’s clear that these practices, while vital for market fluidity, can be double-edged swords when it comes to Anti-Money Laundering (AML) risks and SEC regulations.

The Invisible Threads of Done Away Trades

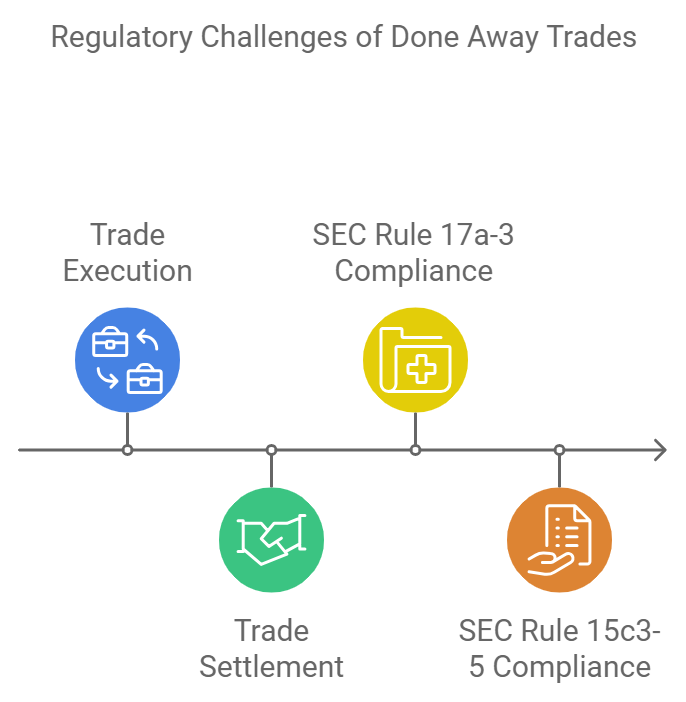

Done away trades, those transactions executed outside a firm’s primary trading platforms but settled through its clearing systems, are the financial equivalent of a magician’s sleight of hand. On the surface, they appear to be a seamless way to facilitate trades. However, dig a little deeper, and you’ll find a labyrinth of potential AML pitfalls and regulatory challenges.

The crux of the issue lies in the disconnect between execution and settlement. This separation, while operationally efficient, can create a fog of uncertainty around transaction trails. It’s as if we’re trying to trace the path of a ghost – visible at the start and end but frustratingly elusive in between.

SEC Regulation: Rule 17a-3 under the Securities Exchange Act of 1934 requires broker-dealers to maintain detailed records of all transactions. For done away trades, this means meticulously documenting both the execution and settlement aspects, even when they occur on different platforms or with different entities.

Moreover, SEC Rule 15c3-5, known as the Market Access Rule, requires broker-dealers to have risk management controls to prevent erroneous orders and ensure compliance with regulatory requirements. This rule becomes particularly challenging to implement with done away trades, where the executing and clearing processes are separated.

Prime Brokerage: A Double-Edged Sword

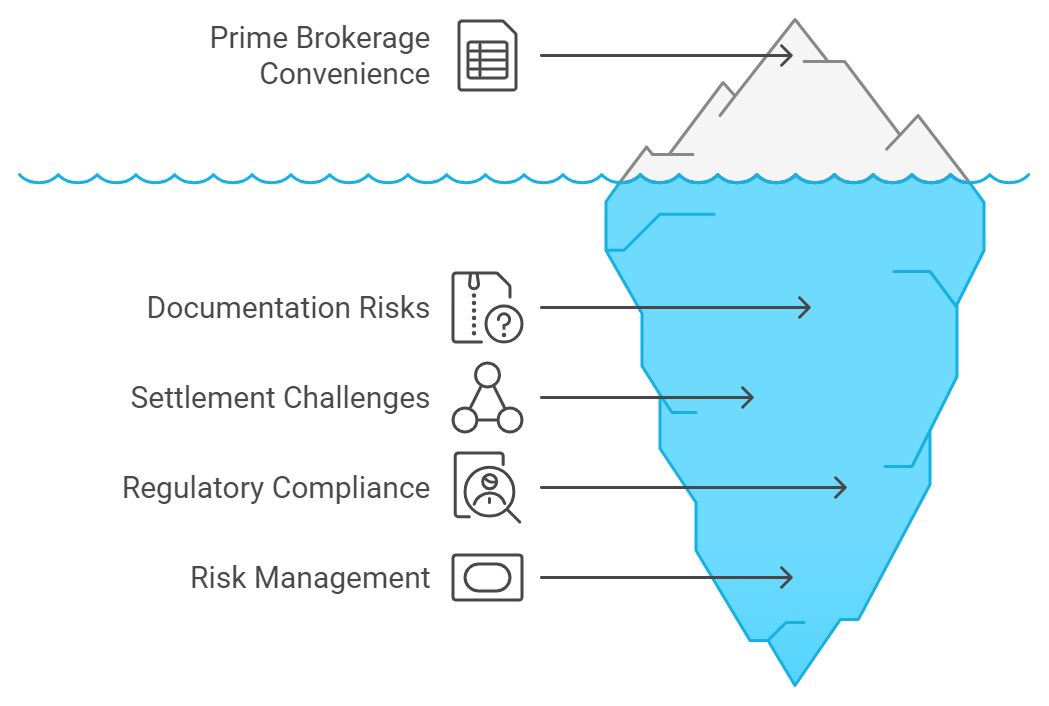

Prime Brokerage services, often seen as the Swiss Army knife of trading, offer clients the convenience of consolidating their trading activities through a single broker. It’s a beautiful concept in theory – streamlined, efficient, and centralized. But as with many things in finance, the devil is in the details.

Prime Brokerage services, often seen as the Swiss Army knife of trading, offer clients the convenience of consolidating their trading activities through a single broker. It’s a beautiful concept in theory – streamlined, efficient, and centralized. But as with many things in finance, the devil is in the details.

The Achilles heel of Prime Brokerage arrangements often lies in documentation and settlement processes. Imagine a scenario where a counterparty claims to use a Prime Broker but lacks the proper paperwork. It’s like being handed a blank check – the potential for risk is enormous.

SEC Regulation: Rule 15c3-3, the Customer Protection Rule, is crucial in Prime Brokerage arrangements. It requires broker-dealers to segregate customer securities and funds from the firm’s proprietary business activities. In the complex web of Prime Brokerage, ensuring compliance with this rule becomes a intricate dance of record-keeping and asset management.

Furthermore, the SEC’s Net Capital Rule (15c3-1) requires broker-dealers to maintain a minimum amount of liquid assets. In Prime Brokerage arrangements, where large transactions and credit extensions are common, adhering to this rule while managing client needs requires constant vigilance.

The Regulatory Tightrope

Regulators, ever vigilant, have set their sights firmly on these practices. Their expectations are clear: firms must weave comprehensive AML controls into the very fabric of their trading activities. This isn’t just about ticking boxes; it’s about fundamental change in how we approach risk.

SEC Regulation: The SEC’s Rule 17a-8 requires broker-dealers to comply with the Bank Secrecy Act, including having an effective AML program. This rule intersects with FinCEN’s requirements, creating a complex regulatory landscape that firms must navigate, especially when dealing with done away trades and Prime Brokerage arrangements.

Enhanced Due Diligence (EDD) is no longer a luxury – it’s a necessity. We’re being asked to scrutinize high-risk transactions and counterparties with the precision of a jeweler examining a rare diamond. The days of surface-level checks are long gone. Now, we must dive deep, understanding not just the ‘what’ of a transaction, but the ‘why’ and ‘how’.

Transaction monitoring systems need to evolve from simple alert generators to sophisticated analytical tools. They must be capable of tracking and analyzing trades that are executed externally but settled internally – a task akin to solving a complex puzzle with pieces from different sets.

Charting a Course Through Choppy Waters

Charting a Course Through Choppy Waters

At Loffa Interactive Group, we’ve taken on the challenge of navigating these complex waters. Our approach is rooted in the belief that technology, when properly harnessed, can be a powerful ally in the fight against financial crime and regulatory non-compliance.

Take our Freefunds Verified Direct (FVD) system, for instance. It’s not just about managing Letters of Free Funds; it’s about creating a transparent, verifiable record of transactions. In a world where opacity can be a breeding ground for misconduct, FVD shines a light into the darkest corners of financial operations, helping firms comply with the detailed record-keeping requirements of SEC Rule 17a-3.

The Prime Broker Interactive Network (PBIN) goes a step further. It’s our answer to the documentation and communication challenges that plague Prime Brokerage arrangements. By facilitating clear, verifiable communication between executing brokers and Prime Brokers, we’re closing the gaps where risks often hide and helping firms navigate the complexities of rules like 15c3-3 and 15c3-1.

A Call to Action for Operations Managers

As operations managers, we stand at the frontlines of this battle against financial crime and regulatory non-compliance. Our role extends beyond mere process management; we are the guardians of integrity in the financial system.

Strengthening Know Your Customer (KYC) and Enhanced Due Diligence (EDD) procedures isn’t just about compliance – it’s about building a culture of vigilance. Every client, every counterparty, every transaction tells a story. Our job is to read between the lines, to question, to verify, all while ensuring we meet the stringent requirements of rules like 17a-8 and the Bank Secrecy Act.

The implementation of advanced technology solutions is no longer optional. We need to leverage analytics tools that can handle the complexity of modern trading patterns and the intricacies of SEC regulations. These tools should be our partners in identifying risks proactively, helping us stay ahead of those who would exploit the system and ensuring we remain on the right side of regulations like the Market Access Rule (15c3-5).

Looking Ahead

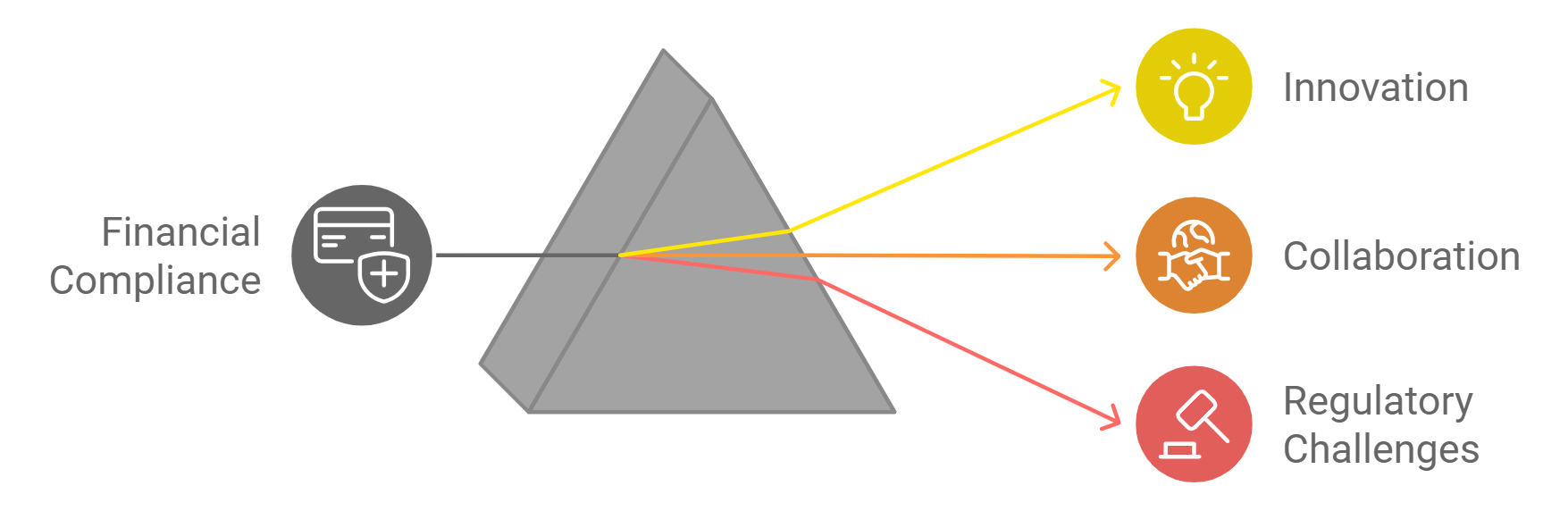

The landscape of financial operations is constantly evolving, and with it, the nature of AML risks and regulatory requirements. Staying informed about regulatory changes and industry best practices isn’t just about avoiding penalties – it’s about being part of the solution to a global problem.

The landscape of financial operations is constantly evolving, and with it, the nature of AML risks and regulatory requirements. Staying informed about regulatory changes and industry best practices isn’t just about avoiding penalties – it’s about being part of the solution to a global problem.

At Loffa Interactive Group, we see ourselves as partners in this journey. Our solutions are designed not just to meet today’s challenges, but to anticipate tomorrow’s. We believe that by combining cutting-edge technology with human insight and expertise, we can create a more transparent, secure, and compliant financial ecosystem.

The path ahead may be challenging, but it’s also filled with opportunity. As operations managers, we have the power to shape the future of financial compliance. By embracing innovation, fostering collaboration, and maintaining unwavering vigilance, we can turn the tide against financial crime and regulatory pitfalls.

In the end, our goal is not just compliance for compliance’s sake. It’s about building a financial system that is robust, transparent, and trustworthy. It’s about creating an environment where legitimate businesses can thrive without fear of being inadvertently entangled in illicit activities or regulatory missteps.

The journey of a thousand miles begins with a single step. Let’s take that step together, towards a future where financial integrity and regulatory compliance are not just aspirations, but realities.

See Loffa research paper for more specifics.