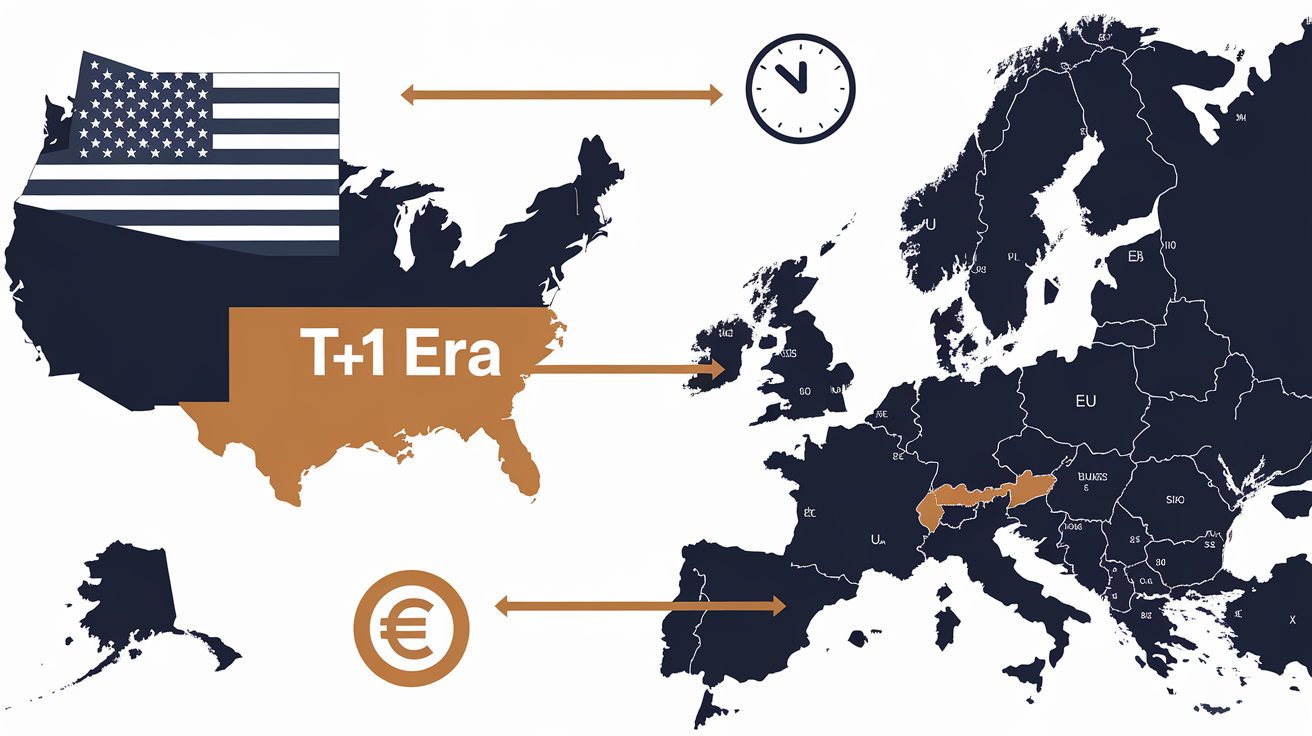

Overcoming U.S. & E.U. Settlement Cycle Disparities in the T+1 Era: Loffa Interactive’s Innovative Solutions

3 min read

Navigating the Challenges of U.S. & E.U. Settlement Misalignments in the T+1 Era

The push towards a T+1 settlement cycle in the United States has thrown a spanner in the works for financial institutions straddling the U.S. and European Union (E.U.) markets. With the E.U. chilling on its T+2 cycle, we’re seeing some real head-scratchers pop up—think FX funding headaches, ETF gymnastics, and corporate actions conundrums. These misalignments aren’t just academic puzzles; they’re real-world challenges that can ratchet up operational inefficiencies and dial-up risk levels for firms trying to keep their footing in the shifting sands of international finance.

The push towards a T+1 settlement cycle in the United States has thrown a spanner in the works for financial institutions straddling the U.S. and European Union (E.U.) markets. With the E.U. chilling on its T+2 cycle, we’re seeing some real head-scratchers pop up—think FX funding headaches, ETF gymnastics, and corporate actions conundrums. These misalignments aren’t just academic puzzles; they’re real-world challenges that can ratchet up operational inefficiencies and dial-up risk levels for firms trying to keep their footing in the shifting sands of international finance.

Enter Loffa Interactive Group. With its reputation built on hard rock, secure technology solutions for the finance sector, Loffa’s stepping up to the plate to help companies cut through the Gordian knot of settlement disparities. Here’s how they’re turning the tide:

FX Funding: Filling the Gaps

One major snag in this transition period is FX funding. Where the U.S. and E.U. cycles don’t sync, you find yourself staring into the abyss of funding gaps and liquidity quicksand. But Loffa’s not just watching from the sidelines. They’re on the field with solutions that sharpen your visibility into funding needs and make cash management across different timelines not just possible, but efficient.

ETFs and Corporate Actions: Dodging the Pitfalls

Then there’s the knotty problem of ETFs and corporate actions getting tangled in cross-market timing disparities. Reconciling these activities when settlement cycles are out of sync is like trying to juggle while riding a unicycle. Thankfully, Loffa’s tech, including tools like Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN), streamlines these processes, keeping your operations smooth and your compliance on point.

Digging Deeper: Prime and Clearing Brokers’ Perspectives

The Crucial Role of Real-Time Data for Prime Brokers

For prime brokers, the crux of navigating U.S. & E.U. settlement misalignments lies in harnessing real-time data. In a landscape where timing is everything, being a step ahead is the game-changer. Loffa’s solutions are tailored to give prime brokers this edge. With real-time visibility, they can preempt funding gaps, manage collateral efficiently, and optimize their clients’ trading strategies without skipping a beat.

For prime brokers, the crux of navigating U.S. & E.U. settlement misalignments lies in harnessing real-time data. In a landscape where timing is everything, being a step ahead is the game-changer. Loffa’s solutions are tailored to give prime brokers this edge. With real-time visibility, they can preempt funding gaps, manage collateral efficiently, and optimize their clients’ trading strategies without skipping a beat.

Safeguarding Margin and Liquidity for Clearing Brokers

Clearing brokers face their own set of challenges amidst settlement misalignments. Margin management and liquidity safeguarding become Herculean tasks when dealing with asynchronized settlements. Here, Loffa shines again. Their platforms enable clearing brokers to have a bird’s-eye view of margin requirements and liquidity positions across different markets in real-time. This visibility isn’t just nice to have; it’s critical for ensuring smooth settlements and maintaining regulatory compliance without breaking a sweat.

Wrapping It Up

In the twisty journey towards T+1 settlement in the U.S., having a stalwart tech ally like Loffa Interactive can make all the difference. Their deep dive into the critical pain points for prime, executing, and clearing brokers showcases their expertise and commitment to easing the path forward. As financial landscapes evolve, riding shotgun with a seasoned navigator like Loffa isn’t just smart; it’s essential for keeping your operations nimble and your risk management tight. Here’s to not just surviving but thriving in the fast-paced world of finance.