Navigating Compliance: How Fidelity’s FINRA Fine Highlights the Need for Advanced Solutions

3 min read

Staying Ahead: Key Takeaways from Fidelity’s $600K FINRA Fine for Enhanced Compliance

In the dynamic and ever-stringent realm of financial regulations, keeping a step ahead in compliance is more than crucial—it’s foundational for firms to safeguard their reputation and sidestep hefty penalties. The recent $600,000 slap by the Financial Industry Regulatory Authority (FINRA) on Fidelity Brokerage Services LLC is a wake-up call emphasizing the non-negotiable need for solid compliance frameworks.

In the dynamic and ever-stringent realm of financial regulations, keeping a step ahead in compliance is more than crucial—it’s foundational for firms to safeguard their reputation and sidestep hefty penalties. The recent $600,000 slap by the Financial Industry Regulatory Authority (FINRA) on Fidelity Brokerage Services LLC is a wake-up call emphasizing the non-negotiable need for solid compliance frameworks.

Loffa Interactive Group digs deep into this challenge, bringing over twenty years of partnership with Wall Street elite, focusing sharply on crafting secure and compliance-first solutions.

The Fidelity Episode: A Closer Look

The snag Fidelity hit sheds light on why ironclad supervisory protocols and systems to surveil and ensure FINRA rule compliance can’t be overlooked. Their oversight, failing to adequately supervise the execution of over 70,000 trades sans prior written nods from clients, rings alarm bells on the need for foolproof solutions in managing and monitoring client authorizations and transactions.

Loffa Interactive’s Toolbox: FVD and PBIN at Your Service

Loffa Interactive steps up with its Freefunds Verified Direct (FVD) and Prime Broker Interactive Network (PBIN)—two ingenious creations aiming to tackle these very challenges head-on.

- FVD simplifies handling Letters of Free Funds, seamlessly aligning with Regulation T necessities and broker needs for an undisturbed flow of free funds trading in cash accounts.

- PBIN unfolds as a comprehensive platform for the meticulous management of prime brokerage agreements, amendments, and clearance agreements, ensuring no stone is left unturned in regulatory adherence.

These tools aren’t just about ticking compliance checkboxes. They’re about revolutionizing how firms streamline their procedures, minimize errors, and keep a lucid audit trail, inevitably staving off fines and bolstering client trust and confidence.

Deeper Dive: Impact on Prime and Clearing Brokers

For Prime Brokers:

- Operational Efficiency: Leveraging Loffa’s FVD means more than compliance—it’s about enhancing operational efficiency. Prime brokers benefit from a tool that not only ticks the regulatory boxes but also provides a seamless workflow for managing free funds, making the complex simple.

- Client Confidence: With the robust foundation of PBIN, prime brokers can navigate agreements and clearances with unmatched precision. This not only satisfies regulatory requirements but significantly raises the bar on client trust, portraying the Prime Broker as not just a service provider but a compliance-conscious partner.

For Clearing and Executing Brokers:

For Clearing and Executing Brokers:

- Error Minimization: FVD’s streamlined approach drastically reduces the potential for errors in transaction management and regulatory reporting, a critical factor that clearing and executing brokers can’t afford to overlook.

- Audit Trail Clarity: The clarity in audit trails that PBIN provides ensures that clearing brokers can easily demonstrate compliance, a key to avoiding fines and, more importantly, maintaining a clean compliance slate.

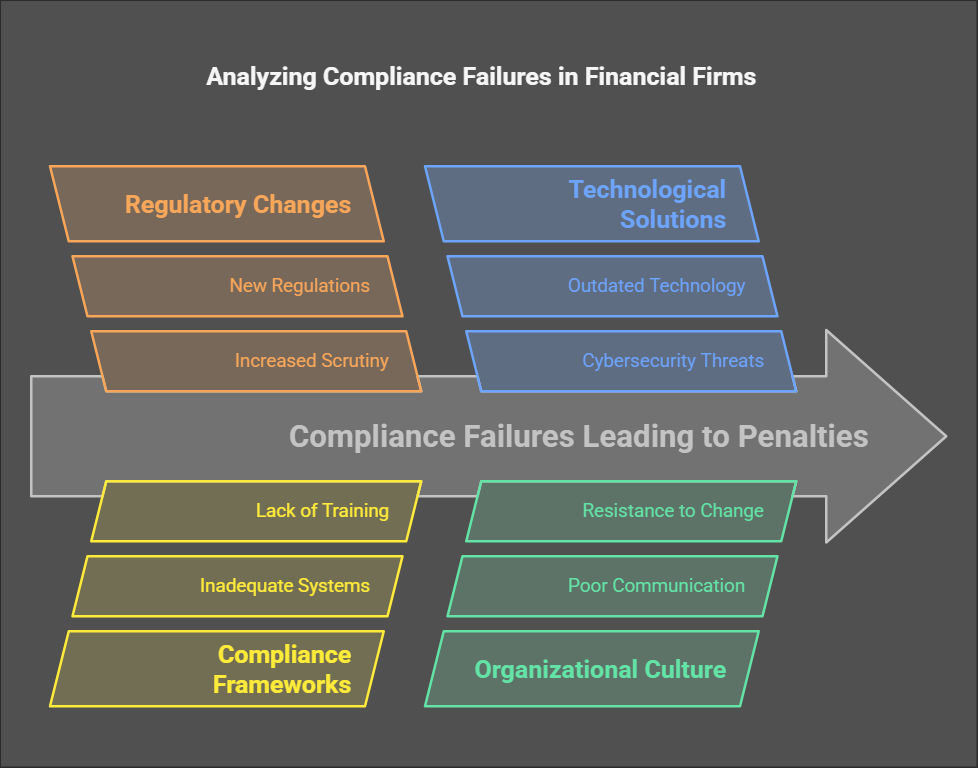

Emphasizing Education and Compliance Culture

The Fidelity narrative also shines a beam on the indispensable role of continual employee training and fostering a culture deeply rooted in compliance. It’s about keeping the crew on their toes, with compliance not as a box-ticking afterthought but woven into the fabric of daily operations.

Loffa Interactive stands firm on the frontlines, engineering stellar solutions that empower financial services firms to chart through the regulatory maze with confidence. By staying proactive and compliance-focused, firms are not just avoiding penalties—they’re building unwavering trust with clients and regulators, and that’s the real win.

In this landscape, where regulatory demands are as unpredictable as they are stringent, the Fidelity fine is a stark reminder: stay ahead with compliance, or pay the price. With tools like FVD and PBIN, Loffa Interactive is your ally, turning compliance from challenge into opportunity.