How SEC’s New Leadership Could Remodel Crypto Regulations and Market Dynamics

3 min read

The Ripple Effect of New SEC Leadership on Crypto Regulations and Market Dynamics

In an era marked by rapid innovation and fluctuating market landscapes, the cryptocurrency sector finds itself at the heart of intense scrutiny and interest. With whispers of a new chair nomination for the Securities and Exchange Commission (SEC) under the Trump administration, the winds of change could sweep across the regulatory and operational norms of the crypto universe. Here’s a dive into what this pivotal shift could herald for the crypto industry, particularly through the lens of prime and executing brokers, as well as clearing firms.

The SEC’s Stewardship in Crypto Oversight

The SEC, a linchpin in the securities market’s regulatory framework, has historically cast a long shadow over the cryptocurrency sector’s evolution. Under Gary Gensler’s watch, the SEC adopted a proactive stance in sculpting crypto regulation to safeguard investors and uphold market integrity. Yet, the potential ushering in of a new chair promises to tilt the scales, possibly redrawing the boundaries of crypto regulation.

Potential Regulatory Paradigm Shifts

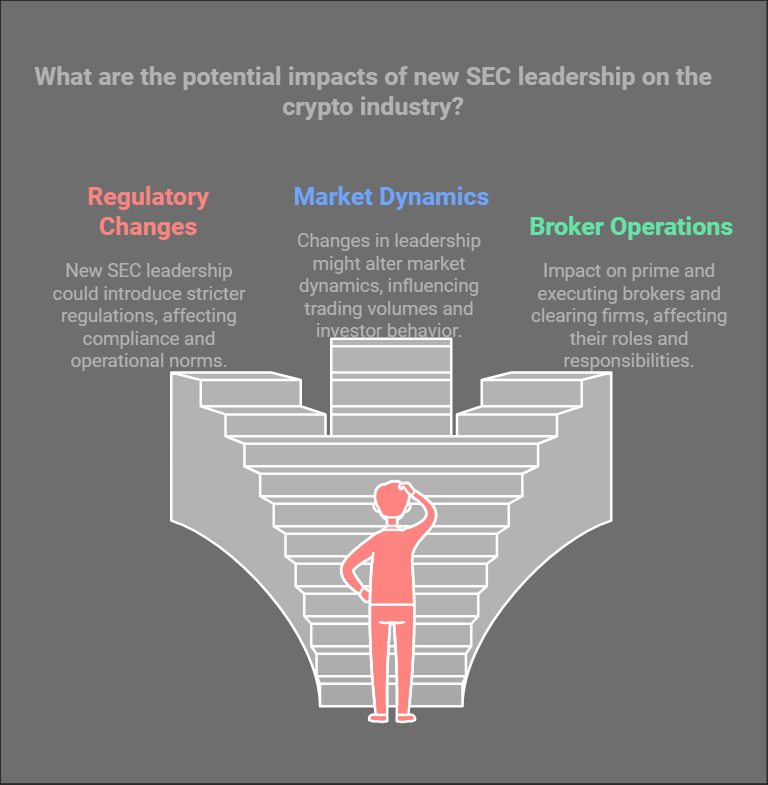

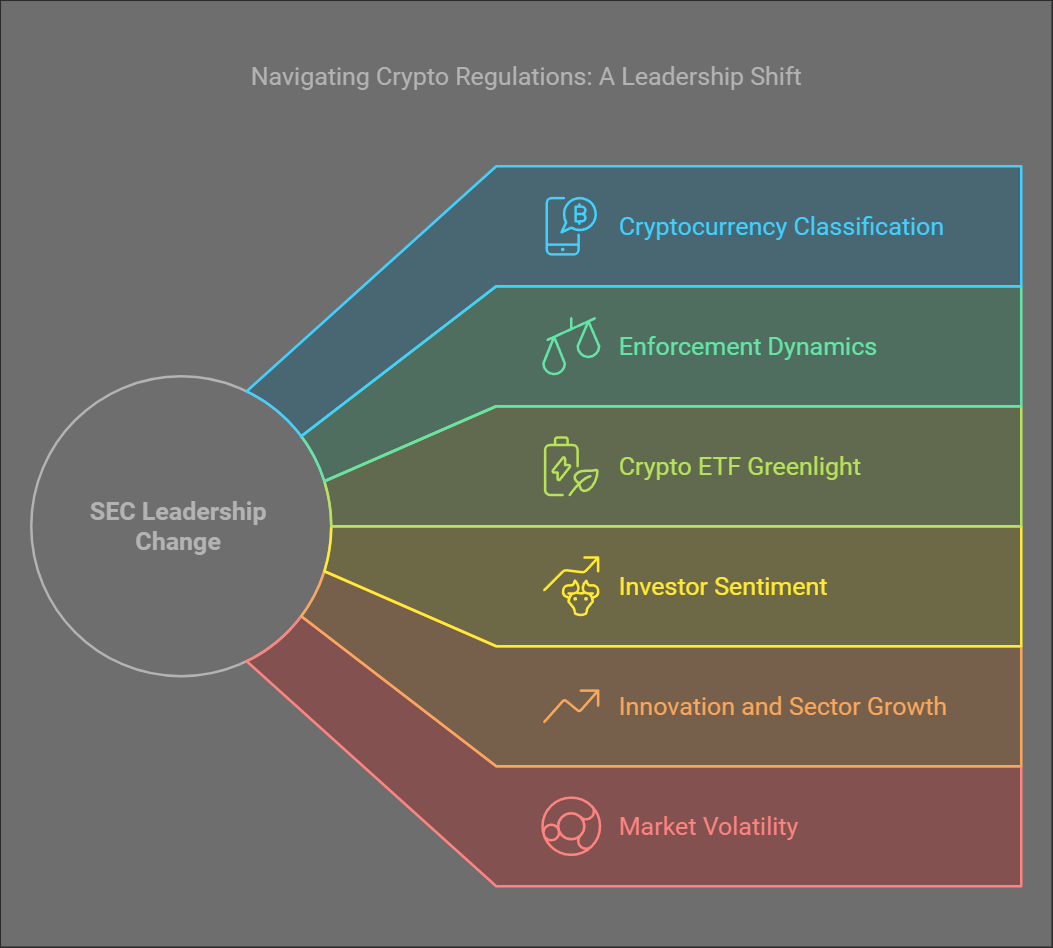

A novel leadership helm at the SEC portends a series of transformational shifts in crypto regulations:

A novel leadership helm at the SEC portends a series of transformational shifts in crypto regulations:

- Cryptocurrency Classification: Central to the industry’s regulatory ambiguity is the debate over whether digital assets should be deemed securities or commodities. A fresh perspective at the SEC’s helm could crystallize the regulatory framework, offering a more definitive classification pathway for cryptocurrencies.

- Enforcement Dynamics: The SEC’s enforcement playbook against various crypto initiatives has sparked debate. A leadership change could recalibrate the enforcement rigor, shaping the landscape to be either more forgiving or stringent based on the new chair’s regulatory philosophy.

- Crypto ETF Greenlight: Amidst hesitations rooted in concerns over market manipulation and investor safeguards, the approval of cryptocurrency exchange-traded funds (ETFs) remains a critical SEC threshold. A reformative chair could potentially pave the way for crypto ETF approvals, potentially magnetizing institutional investors to the cryptosphere.

The Impact on Market Dynamics

Regulatory overhauls wield the power to profoundly impact market dynamics:

- Investor Sentiment: Predictable and transparent regulations are likely to bolster investor confidence, spurring enhanced participation from both retail and institutional sectors.

- Innovation and Sector Growth: An accommodating regulatory framework could fertilize the ground for innovation and expansion within the crypto industry, nurturing the birth of novel products and services.

- Market Volatility: Regulatory transitions could stir the market volatility pot, as investors recalibrate strategies in response to emerging developments.

Special Spotlight: Impact on Prime and Executing/Clearing Brokers

Enhanced Regulatory Compliance and Operational Efficiency

The potential regulatory recalibration under a new SEC chair bears significant implications for prime brokers, and executing or clearing brokers:

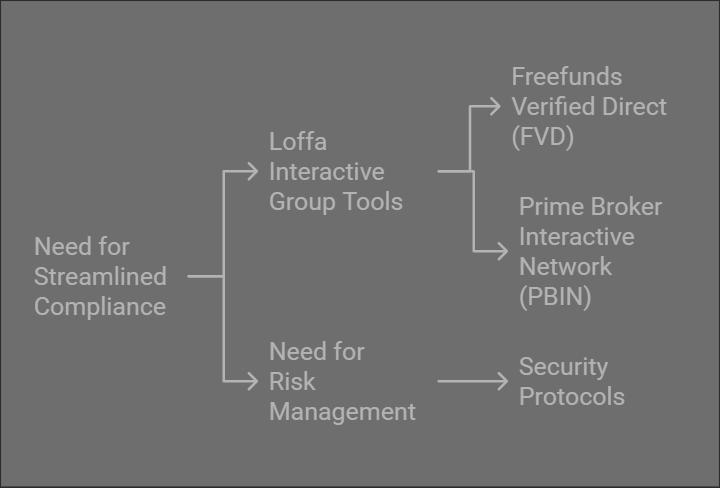

- Streamlined Compliance Processes: With regulatory landscapes prone to shifts, brokers require agile operational frameworks to remain in compliance. Loffa Interactive Group’s tools, including Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN), stand out as beacons of efficiency, enabling streamlined compliance with evolving regulatory standards.

- Risk Management and Security Protocols: In a sector where security and compliance are sacrosanct, Loffa Interactive’s commitment to offering fortified and reliable technological solutions helps brokers mitigate operational risks, safeguarding against potential regulatory pitfalls.

Navigating the Future with Loffa Interactive Group

As the cryptocurrency landscape braves potential shifts in the regulatory climate, the need for resilience and adaptability has never been more pronounced. For financial institutions, particularly prime and executing/clearing brokers, thriving amidst uncertainty demands a partnership with a seasoned and versatile ally. Enter Loffa Interactive Group – with a storied history of championing technological innovations tailored for the financial services industry, they stand ready to guide firms through the tempest of regulatory changes with their cutting-edge solutions and unwavering commitment to operational excellence and security.

In summary, the trajectory of crypto regulations and market dynamics hinge on the pivotal decisions of the SEC’s new chair. For prime brokers, executing, and clearing brokers, leveraging Loffa Interactive’s suite of products not only fortifies compliance and operational efficiency but also positions them at the vanguard of navigating through an evolving regulatory framework.