From Execution to Settlement: Demystifying the Trade Lifecycle in T+1 Era

26 min read

Explaining the trade lifecycle in a different way: The Trade Affirmation and Settlement Lifecycle: A Thrilling Journey

Imagine the world of securities trading as a bustling city, where each building represents a different stage in the trade lifecycle. Let’s embark on an exploratory tour of this city, highlighting key landmarks and their historical significance, especially focusing on the Depository Trust Company (DTC) and the role of regulation.

Stage 1: The Advisor’s Decision and the Executing Broker’s Action

Stage 1: The Advisor’s Decision and the Executing Broker’s Action

Picture a block order as a train loaded with goods (securities) leaving the advisor’s station, heading towards the bustling marketplace of the executing broker (EB). The EB’s role is to navigate this train through the complex tracks of the market, executing the order efficiently. Historically, this process evolved from manual to electronic systems, enhancing speed and reducing errors – a true technological revolution.

Stage 2: Navigating the Maze of Trade Exceptions

After the train (order) reaches its destination, the advisor’s ops and the broker’s ops teams are like diligent traffic controllers, ensuring everything is in order. They deal with any derailments (trade exceptions), a crucial step to maintain the integrity of the market and prevent fraud or errors.

Stage 3: The Puzzle of Allocations

The advisor sends out allocations, akin to distributing the goods from our train to various destinations. The EB then matches these allocations, ensuring that each piece of the puzzle fits perfectly. This step is vital for fair and accurate distribution, a response to historical challenges of misallocations and favoritism.

Stage 4: Confirming the Journey

The EB sends out trade confirmations, like postcards confirming the successful delivery of goods. This transparency is a regulatory triumph, introduced to keep all parties informed and to avoid disputes.

Stage 5: The Custodian’s Receipt

These confirmations are received by both the advisor and the custodian, ensuring that everyone has the same information. This step adds another layer of verification, a practice developed to ensure accuracy in record-keeping.

Stage 6: The Settlement Instructions – A Crucial Message

The advisor sends settlement instructions to the custodian, directing how the transaction should be finalized. This is like giving the final address for the goods on our train.

Stage 7: The Affirmation – A Seal of Approval

By 9pm EST, the custodian affirms the trade. Think of this as stamping the transaction with a seal of approval, a practice that became essential to avoid settlement failures.

Stage 8: Smooth Sailing Through Settlement Exceptions

The custodian, with the advisor’s ops team, ensures any settlement exceptions are managed. It’s like making sure every last piece of cargo reaches its rightful owner.

Stage 9: DTC – The Grand Central Station

Finally, the custodian and EB send settlement instructions to the DTC. Imagine DTC as the grand central station where all the trains (securities) are directed to their final destinations. The DTC’s role is monumental – it’s the heart of the settlement process, ensuring the secure and efficient transfer of securities. Historically, the DTC was formed to reduce the massive amounts of physical securities that needed to be transferred, a response to the paperwork crisis in the 1960s and 70s. It digitized securities, making the process more efficient and reducing the risk of theft and loss – a true game-changer.

The Role of SEC and Regulation: Guardians of the Market City

Throughout this journey, the SEC and other regulatory bodies act as the guardians of this market city. They set the rules, patrol the streets, and ensure everyone plays fair. This governance evolved over time, especially in response to financial crimes and market crashes. Regulations like the T+1 settlement cycle are designed to reduce risks like credit risk and market risk, making the entire city safer and more reliable.

Conclusion: A Well-Oiled Machine of the Financial World

This journey through the trade affirmation and settlement lifecycle is a testament to how the financial world operates like a well-oiled machine, constantly evolving and adapting. Each player – from advisors to custodians, from EBs to the DTC – plays a crucial role in keeping this machine running smoothly. The evolution of these processes is a story of innovation, response to crises, and a relentless pursuit of efficiency and security.

Historical details:

Stage 1: The Advisor’s Decision and the Executing Broker’s Action

Stage 1 of the trade lifecycle, involving the selection and execution of block orders by advisors and their subsequent execution by executing brokers, is deeply rooted in the history and evolution of the financial markets. This process has evolved significantly over time, reflecting broader changes in market structures, regulatory environments, and technological advancements.

Early Financial Markets

Early Financial Markets

In the earliest stages of organized financial markets, going back several centuries, the role of an “advisor” was less formalized. Investment decisions were often made by individual investors or by merchants and financiers who acted both as advisors and investors. The concept of a dedicated investment advisor, as we understand it today, began to take shape with the development of more sophisticated financial markets and instruments in the 18th and 19th centuries.

The Rise of Professional Advisory Services

The 20th century, particularly the period following World War II, saw significant growth in the financial services industry, including the emergence of professional investment advisors, mutual funds, and pension funds. This period was marked by increased participation in the stock market by a broader segment of the population, facilitated by the establishment of regulatory bodies like the U.S. Securities and Exchange Commission (SEC) in 1934, which was created in response to the stock market crash of 1929 and the ensuing Great Depression.

Regulatory Framework and the Investment Advisers Act of 1940

A key moment in the formalization of the investment advisory profession in the United States was the enactment of the Investment Advisers Act of 1940. This legislation defined the role and responsibilities of investment advisors and established a regulatory framework for the advisory industry. The Act aimed to protect investors by ensuring that advisors acted in the best interests of their clients and provided transparent and honest investment advice.

Technological Advancements and Market Evolution

The latter half of the 20th century and the early 21st century have been characterized by rapid technological advancements that have transformed the investment advisory landscape:

-

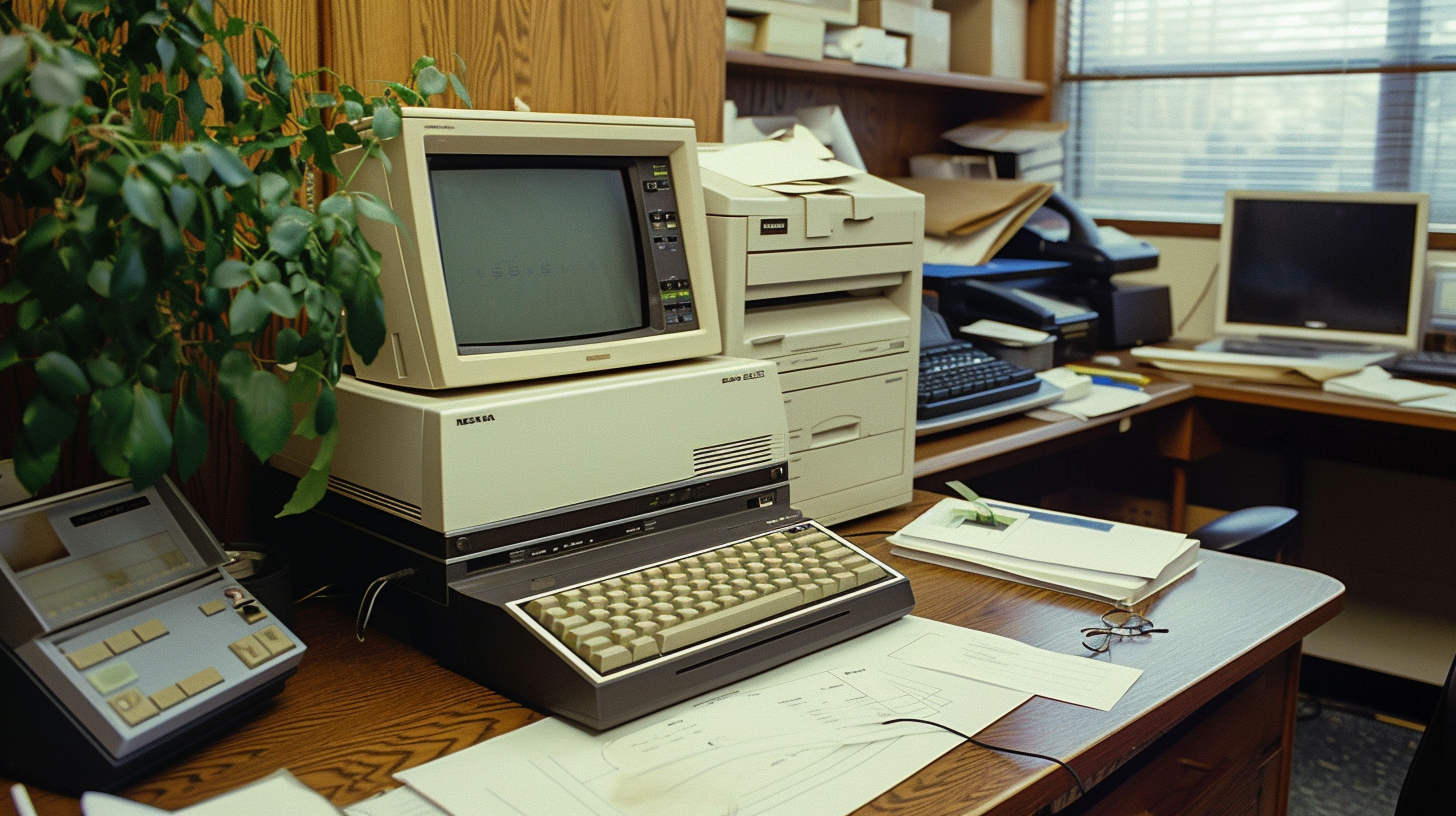

- Electronic Trading: The introduction of electronic trading platforms in the 1970s and 1980s revolutionized the execution of trades, making it possible to execute large block orders more efficiently and with greater precision.

- Information Technology: The rise of information technology and the internet in the 1990s and 2000s provided advisors with unprecedented access to market data, analytical tools, and real-time information, enabling more informed decision-making and strategic trade execution.

- Algorithmic Trading: The development of algorithmic and high-frequency trading strategies further refined the execution process, allowing advisors and executing brokers to optimize trade execution in terms of timing, price, and volume.

The Modern Advisor

Today, the advisor decision-making process in Stage 1 of the trade lifecycle is supported by a sophisticated ecosystem of financial analysis tools, electronic trading platforms, and regulatory compliance systems. Advisors rely on a combination of market research, quantitative analysis, and risk assessment tools to make informed decisions on behalf of their clients.

The evolution of the advisor’s role from informal financial guidance to professional investment advisory services reflects the maturation of the financial markets and the ongoing innovations in financial technology and regulation. This historical progression has led to a more structured, efficient, and transparent trade lifecycle, benefiting both advisors and their clients.

Stage 2: Navigating the Maze of Trade Exceptions

Is an aspect of securities trading that has evolved significantly over time, especially in response to the growing complexity and volume of financial market transactions. The historical development of trade exception management can be traced back through several key periods and innovations:

Pre-Electronic Era

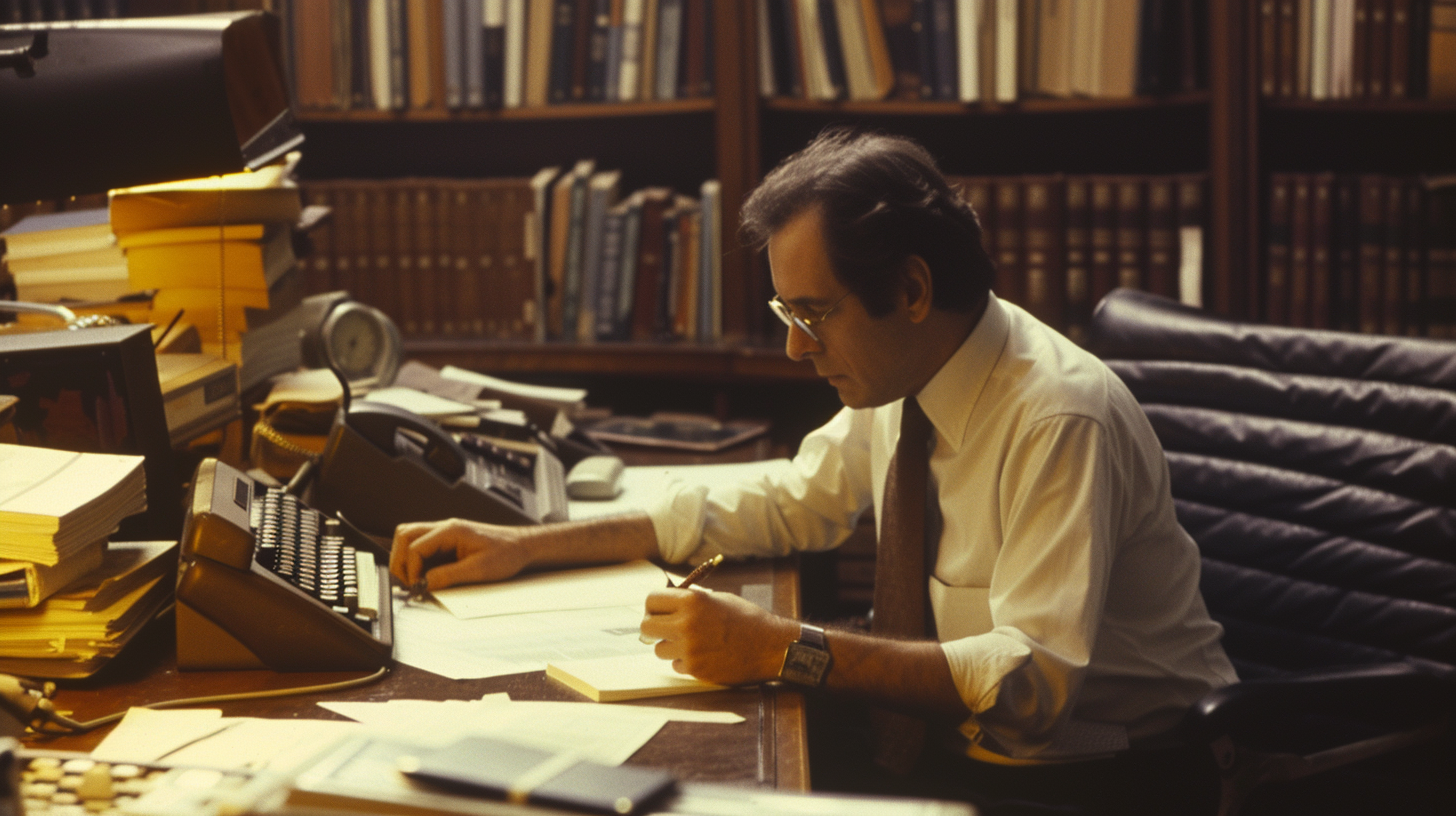

Before the advent of electronic trading and processing systems, the financial markets relied heavily on manual processes for trade execution, confirmation, and settlement. In this era, trade exceptions—discrepancies or issues arising from trade orders, confirmations, or settlements—were managed manually. This involved a significant amount of paper-based communication, telephone calls, and face-to-face meetings to resolve issues. Due to the manual nature of these processes, resolving trade exceptions was often time-consuming and prone to errors, leading to delays in settlement and increased operational risk.

The Paperwork Crisis of the 1960s and 1970s

The Paperwork Crisis of the 1960s and 1970s

The post-World War II era saw a significant increase in trading volumes, which, coupled with the manual and paper-intensive processes of the time, led to the “Paperwork Crisis” in the late 1960s and early 1970s. The industry struggled with the backlog of physical securities and documentation, leading to failed trades and settlement delays. This period underscored the urgent need for more efficient systems to manage trade exceptions and other aspects of trade processing.

Regulatory Reforms and the Move Towards Automation

In response to the Paperwork Crisis and the inefficiencies of manual processes, regulatory bodies, including the U.S. Securities and Exchange Commission (SEC), initiated reforms aimed at improving the efficiency and reliability of the securities markets. One of the key outcomes was the push towards the automation of trade processing.

-

- Introduction of Automated Systems: The 1970s and 1980s saw the introduction of automated trade processing systems, which greatly improved the handling of trade exceptions. These systems allowed for faster identification and resolution of discrepancies between trade orders and confirmations.

- Central Clearing and Settlement: The establishment of centralized clearinghouses, such as the Depository Trust Company (DTC) in 1973, helped standardize and streamline post-trade processes, including the management of trade exceptions. Centralized clearing facilitated the electronic matching of trades, reducing the likelihood of exceptions and enabling more efficient resolution when they did occur.

Technological Innovations and Further Developments

The continued advancement of technology has played a pivotal role in the evolution of trade exception management:

-

- Electronic Communication Networks (ECNs) and Trading Platforms: The 1990s and 2000s saw the rise of ECNs and advanced trading platforms, which further reduced the incidence of trade exceptions by enabling more accurate and real-time execution of trades.

- Straight-Through Processing (STP): The concept of STP emerged, aiming to automate the entire trade lifecycle from order to settlement, minimizing the need for manual intervention and thereby reducing the likelihood and impact of trade exceptions.

- Regulatory Changes: Ongoing regulatory changes have emphasized the importance of robust systems and processes for managing trade exceptions. Regulations such as the Dodd-Frank Act and the Markets in Financial Instruments Directive (MiFID) have introduced more stringent requirements for trade reporting, transparency, and the timely resolution of exceptions.

Today, trade exception management is a critical component of the trade lifecycle, supported by sophisticated systems that can detect, analyze, and resolve exceptions quickly and efficiently. The evolution from manual to automated processes reflects the financial industry’s ongoing efforts to enhance operational efficiency, reduce risk, and improve the overall reliability of securities trading and settlement.

Stage 3: The Puzzle of Allocations

Involves the distribution and matching of allocations by advisors and executing brokers, has its historical roots in the practices and regulatory reforms that shaped the securities industry, particularly during the latter half of the 20th century.

Early Practices

Initially, the process of allocating trades and confirming these allocations was manual and heavily paper-based. Advisors would communicate their allocation instructions to brokers using phone calls, faxes, or mail. The brokers would then manually match these allocations against the executed block orders. This process was cumbersome, error-prone, and lacked transparency, leading to inefficiencies and disputes.

The Need for Change: The Paperwork Crisis

The 1960s and 1970s witnessed a dramatic increase in trading volumes, which overwhelmed the existing manual and paper-based systems, leading to the notorious “Paperwork Crisis.” This period was marked by significant delays in the processing of trades, errors in allocations, and a general lack of timely confirmation of trade details. The crisis highlighted the need for more efficient, accurate, and automated processes in the securities industry.

Regulatory Reforms and Technological Innovations

In response to these challenges, regulatory bodies, including the U.S. Securities and Exchange Commission (SEC), implemented a series of reforms aimed at improving the efficiency and reliability of the securities markets. One of the key objectives was to enhance the process of trade allocation and confirmation.

In response to these challenges, regulatory bodies, including the U.S. Securities and Exchange Commission (SEC), implemented a series of reforms aimed at improving the efficiency and reliability of the securities markets. One of the key objectives was to enhance the process of trade allocation and confirmation.

-

- Centralized Clearing and Settlement: The establishment of centralized clearinghouses, such as the Depository Trust & Clearing Corporation (DTCC) in 1973, and its subsidiary, the National Securities Clearing Corporation (NSCC), played a pivotal role in automating and standardizing the post-trade process, including allocations and confirmations.

- Technological Advancements: The adoption of electronic systems in the 1970s and 1980s facilitated the electronic communication of allocation instructions and the automated matching of trades. Systems like the Automated Confirmation Transaction Service (ACT) introduced by NASDAQ in the 1980s helped streamline the process by providing an electronic platform for reporting and confirming trades.

The Role of FIX Protocol

The development of the Financial Information eXchange (FIX) Protocol in the early 1990s marked a significant milestone in the evolution of trade allocations and confirmations. FIX provided a standardized messaging format for the electronic exchange of trade information, including allocations, thereby greatly improving the speed, accuracy, and efficiency of post-trade processing.

Modern Developments

Today, the process of trade allocation and confirmation is highly automated, with sophisticated systems in place to ensure that allocations are accurately matched and confirmed in real-time or near-real-time. Regulatory mandates continue to emphasize the importance of transparency, accuracy, and timeliness in the allocation and confirmation process, with strict requirements for record-keeping and reporting.

The evolution from manual processes to today’s automated and regulated environment reflects the industry’s response to the challenges of increased trading volumes, the need for operational efficiency, and the imperative of risk management. As technology continues to advance, it’s likely that we’ll see further innovations in the allocation and confirmation process, including the potential use of blockchain and smart contracts to further enhance transparency and efficiency.

Stage 4: Confirming the Journey

This has its roots in the regulatory reforms that took place primarily in the 1960s and 1970s, a period marked by significant changes in the securities industry. This era was characterized by a massive increase in trading volumes, which, coupled with the manual processes of the time, led to what was known as the “Paperwork Crisis.”

In response to this crisis and the need for greater transparency and efficiency in the market, the U.S. Securities and Exchange Commission (SEC) and other regulatory bodies implemented a series of reforms. One of the key developments was the establishment of the National Market System (NMS) under the Securities Acts Amendments of 1975. These amendments aimed to improve the transparency, fairness, and efficiency of the securities markets and led to the creation of centralized processes for clearing and settling trades.

In response to this crisis and the need for greater transparency and efficiency in the market, the U.S. Securities and Exchange Commission (SEC) and other regulatory bodies implemented a series of reforms. One of the key developments was the establishment of the National Market System (NMS) under the Securities Acts Amendments of 1975. These amendments aimed to improve the transparency, fairness, and efficiency of the securities markets and led to the creation of centralized processes for clearing and settling trades.

A pivotal component of these reforms was the emphasis on the prompt and accurate confirmation of trade details to all parties involved. This was facilitated by the adoption of electronic systems for trade processing, confirmation, and record-keeping. The move towards electronic confirmations significantly enhanced transparency, allowing for real-time or near-real-time acknowledgment of trade details, including the securities involved, the price, the number of shares, and the parties to the transaction.

Before these reforms, trade confirmations were often delayed and prone to errors due to the manual handling of trades and confirmations. The lack of timely and accurate trade confirmations could lead to discrepancies and disputes between parties, contributing to the inefficiency and risk in the market.

The introduction of regulations mandating the prompt issuance of trade confirmations was a crucial step in enhancing market transparency. It not only helped in reducing the risk of errors and misunderstandings but also played a significant role in building investor confidence by ensuring that all parties had a clear and timely understanding of their trade obligations and entitlements.

Over the years, technological advancements have continued to refine the process, with electronic communication networks (ECNs), straight-through processing (STP), and blockchain technology further improving the speed, accuracy, and transparency of trade confirmations. Today, the process that began with regulatory reforms decades ago has evolved into a highly efficient system that is fundamental to the integrity and smooth functioning of the securities markets.

Stage 5: The Custodian’s Receipt

Involves the receipt of trade confirmations by the advisor and custodian, a critical step that ensures all parties are aligned on the trade details. The evolution of this stage is closely tied to the broader history of financial market developments, regulatory changes, and technological advancements.

Early Days: Manual Processes and Physical Delivery

Historically, trade confirmations and communications in the financial markets were manual and paper-based. This included physical delivery of trade confirmations, which were often mailed to the involved parties. This process was not only slow but also prone to errors and losses, leading to discrepancies and reconciliation issues. The physical handling of securities and documents made the settlement process cumbersome and risk-prone, particularly as trading volumes began to increase in the mid-20th century.

Regulatory Response and Reforms

In response to these challenges, regulatory bodies, including the SEC, initiated reforms to modernize and improve the efficiency of the securities markets. The Securities Acts Amendments of 1975 were pivotal, laying the groundwork for the development of the National Market System (NMS) and the establishment of centralized clearing and settlement facilities like the Depository Trust Company (DTC). These reforms aimed to enhance transparency, reduce risks, and improve the operational efficiency of the markets.

Technological Advancements

The introduction of electronic systems for trade processing and confirmation in the late 20th century marked a significant evolution in Stage 5 of the trade lifecycle. Technologies such as Electronic Data Interchange (EDI) and later, the Internet, transformed the way trade confirmations were communicated. This shift to electronic confirmations enabled faster, more accurate, and secure dissemination of trade details to advisors, custodians, and other relevant parties.

The Advent of Straight-Through Processing (STP)

The Advent of Straight-Through Processing (STP)

The concept of Straight-Through Processing (STP) emerged as a goal in the late 1990s and early 2000s, aiming to automate and streamline the entire trade process from execution to settlement, including the automatic generation and receipt of trade confirmations. STP sought to minimize manual intervention, reduce the settlement cycle, and lower the risk of errors and discrepancies.

The Role of Regulations

Regulatory mandates have continually shaped the evolution of trade confirmations. Requirements for timely, accurate, and transparent trade reporting have been reinforced through regulations such as the Dodd-Frank Act in the United States, MiFID (Markets in Financial Instruments Directive) in Europe, and other global regulatory standards. These regulations have emphasized the importance of real-time or near-real-time trade confirmations to enhance market integrity and protect investors.

Current State and Future Trends

Today, the process of issuing and receiving trade confirmations is highly automated and integrated into the broader trade and post-trade processing systems. The use of advanced technologies like blockchain and distributed ledger technology (DLT) is being explored to further enhance the efficiency, transparency, and security of trade confirmations.

The evolution of Stage 5 from manual, paper-based processes to today’s highly automated and regulated environment reflects the financial industry’s response to growing trading volumes, the need for operational efficiency, and the increasing importance of risk management and regulatory compliance. As the market continues to evolve, we can expect further innovations in how trade confirmations are generated, communicated, and used in the trade lifecycle.

Stage 6: The Settlement Instructions – A Crucial Message

The concept of settlement instructions, as encapsulated in Stage 6 of the trade lifecycle, has origins that stretch back to the early days of organized financial markets but became more formalized and crucial with the advent of modern financial systems and technologies.

Early Financial Markets

In the earliest financial markets, the settlement of trades was a straightforward but manual process, often involving the physical exchange of securities and payment between parties. Settlement instructions in this era would have been basic and conducted through direct communication or written agreements.

The Birth of Centralized Exchanges

As financial markets evolved and centralized exchanges were established, the process of settling trades became more structured. Exchanges facilitated the clearing and settlement of trades, acting as central points where settlement instructions were executed. This period saw the development of standardized procedures for trade settlement, although many processes remained manual and paper-based.

The 20th Century: Automation and Regulation

The mid-20th century brought significant changes to the settlement process, particularly with the rise of electronic trading and the introduction of computers in financial markets:

The mid-20th century brought significant changes to the settlement process, particularly with the rise of electronic trading and the introduction of computers in financial markets:

-

- Post-World War II Boom: The post-WWII era saw a boom in financial markets, leading to increased trading volumes. The need for efficient settlement processes became evident as manual systems struggled to keep up.

- The Paperwork Crisis: By the late 1960s and early 1970s, the securities industry was facing what was known as the “Paperwork Crisis.” The explosion in trading volumes overwhelmed the existing manual and paper-based systems, leading to settlement delays and increased risk.

Regulatory Responses and Technological Innovations

In response to these challenges, regulators and industry participants pushed for reforms to modernize the settlement process:

-

- The Bank Securities Association: In the 1970s, organizations like the Bank Securities Association (now SIFMA) began to advocate for improvements in securities processing, including standardized settlement instructions.

- The Depository Trust Company (DTC): Established in 1973, the DTC was a landmark development for settlement instructions, providing a centralized depository that facilitated the electronic settlement of securities. This significantly reduced the need for physical transfer of documents.

- Global Standards: The establishment of global standards for settlement instructions, particularly through the efforts of organizations like the International Securities Market Association (ISMA), helped harmonize and streamline settlement processes across borders.

The Move to T+ Settlement Cycles

The transition from T+5 (trade date plus five days) to T+3, and eventually to T+2 and the proposed T+1 settlement cycle, marked significant milestones in the evolution of settlement instructions:

-

- T+3 Settlement: Adopted in the U.S. in 1995, the move to T+3 was aimed at reducing settlement risk by shortening the time between trade execution and settlement.

- T+2 and T+1 Settlement: The move to T+2 in 2017, and the ongoing efforts to transition to T+1, reflect the industry’s continuous pursuit of efficiency and risk reduction. These changes necessitate more precise and timely settlement instructions.

Modern Era: Digitalization and Globalization

Today, settlement instructions are a critical component of the trade lifecycle, facilitated by sophisticated electronic trading and settlement systems. The instructions include detailed information about the trade, the counterparties, and how the securities and cash should be exchanged. The evolution of financial markets towards digitalization and globalization has made accurate and efficient settlement instructions more important than ever, reducing settlement risk and enhancing market stability.

In summary, the historical evolution of settlement instructions from simple, manual agreements to complex, automated processes reflects the broader transformation of the financial markets, driven by technological advances, regulatory changes, and the need for greater efficiency and reduced risk in trade settlements.

Stage 7: The Affirmation – A Seal of Approval

The practice of trade affirmation, a critical component of Stage 7 in the trade lifecycle, has evolved significantly alongside the broader development of financial markets, especially with the advent of modern trading and settlement systems.

Early Practices

In the initial stages of organized financial markets, the affirmation process was informal and predominantly manual. Parties involved in a trade would verbally confirm the details post-execution, often followed by a written confirmation. This process was prone to errors and delays due to its reliance on manual communication methods.

In the initial stages of organized financial markets, the affirmation process was informal and predominantly manual. Parties involved in a trade would verbally confirm the details post-execution, often followed by a written confirmation. This process was prone to errors and delays due to its reliance on manual communication methods.

The Mid-20th Century: Increasing Volumes and the Paperwork Crisis

As financial markets expanded rapidly in the mid-20th century, the volume of trades surged, leading to what was known as the “Paperwork Crisis” in the 1960s and early 1970s. The existing manual processes for trade affirmation and settlement became overwhelmed, resulting in significant backlogs, errors, and inefficiencies. This period underscored the need for more standardized and automated processes for trade affirmation.

Regulatory Reforms and Technological Innovations

The challenges of the Paperwork Crisis prompted regulatory interventions and technological innovations aimed at improving the efficiency and reliability of trade processing:

-

- The Securities Acts Amendments of 1975: In the United States, these amendments led to significant reforms in the securities industry, including the establishment of a national system for the clearance and settlement of securities transactions. This legislative framework laid the groundwork for more formalized and efficient affirmation processes.

- The Advent of Automated Systems: The 1970s and 1980s saw the introduction of computerized systems for trade processing. These systems enabled electronic trade capture, confirmation, and affirmation, significantly reducing the time and errors associated with manual processes.

- The Role of Central Securities Depositories (CSDs): Institutions like the Depository Trust Company (DTC) in the United States, established in 1973, played a crucial role in automating the affirmation process. By centralizing the custody of securities, CSDs facilitated more efficient and secure affirmation and settlement of trades.

The Evolution Towards Real-Time Affirmation (RTA)

The concept of Real-Time Affirmation (RTA) emerged as a goal in the late 1990s and early 2000s, driven by advances in technology and the push for greater efficiency and risk reduction in trade settlement. RTA involves the immediate confirmation and affirmation of trade details following execution, minimizing the lag time between trade execution and settlement:

-

- Technological Platforms: The development of electronic communication networks (ECNs) and trading platforms facilitated the move towards RTA by enabling the instant electronic exchange of trade details between counterparties.

- Standardization of Processes: Efforts to standardize trade affirmation processes globally, led by organizations like the International Securities Market Association (ISMA), contributed to the adoption of RTA practices.

The Impact of Global Regulations

Regulatory initiatives such as the Markets in Financial Instruments Directive (MiFID) in Europe and the Dodd-Frank Act in the United States further emphasized the importance of timely and accurate trade affirmation. These regulations introduced more stringent requirements for trade reporting and processing, driving the adoption of automated systems for real-time trade affirmation.

Today’s Landscape

In the current financial markets, trade affirmation is a highly automated and integral part of the post-trade process, often achieved in real-time or near-real-time. The evolution from manual and error-prone processes to today’s automated and standardized systems reflects the financial industry’s ongoing efforts to enhance operational efficiency, reduce settlement risk, and improve the overall stability and transparency of the markets.

Stage 8: Smooth Sailing Through Settlement Exceptions

The management of settlement exceptions, as outlined in Stage 8 of the trade lifecycle, is a process that has evolved significantly over the history of financial markets, especially with the growth of trading volumes and the complexity of financial instruments.

The management of settlement exceptions, as outlined in Stage 8 of the trade lifecycle, is a process that has evolved significantly over the history of financial markets, especially with the growth of trading volumes and the complexity of financial instruments.

Specialization of Settlement Exception Management

As financial markets evolved, the handling of settlement exceptions became a specialized function within the post-trade process. This specialization was driven by the need to address discrepancies and issues that arise specifically during the settlement phase, such as unmatched trades, failed deliveries, and discrepancies in settlement instructions.

Development of Dedicated Systems and Services

In response to the unique challenges of managing settlement exceptions, financial institutions and service providers developed dedicated systems and services focused on identifying, tracking, and resolving these exceptions. These systems are designed to flag issues in real time, allowing for swift corrective action to prevent failed settlements.

Adoption of Exception Management Platforms

By the late 1990s and early 2000s, the industry saw the adoption of exception management platforms that provided a centralized view of post-trade processing, including the tracking and resolution of settlement exceptions. These platforms integrated with existing trading and settlement systems, enabling more efficient communication and collaboration between counterparties, custodians, and clearing agencies.

Role of Third-Party Service Providers

The complexity of managing settlement exceptions led to the emergence of third-party service providers specializing in post-trade processing and exception management. These providers offer expertise and technology solutions to help financial institutions minimize settlement risks and improve operational efficiency.

Impact of T+2 and T+1 Settlement Cycles

The move towards shorter settlement cycles, first to T+2 and the proposed transition to T+1, has heightened the focus on efficient settlement exception management. With less time to resolve exceptions, firms have had to enhance their operational capabilities to address discrepancies quickly and ensure timely settlement.

Continuous Process Improvement and Best Practices

The management of settlement exceptions is characterized by continuous process improvement, with best practices evolving in line with technological advancements and changing market dynamics. Financial institutions regularly review and update their exception management procedures to adapt to new challenges and opportunities.

In summary, Stage 8’s focus on the management of settlement exceptions reflects the financial industry’s targeted efforts to address the specific challenges that occur during the settlement phase. The development of specialized systems, services, and best practices for managing exceptions underscores the industry’s commitment to ensuring the efficiency and integrity of the settlement process.

Stage 9: DTC – The Grand Central Station

The practice of custodians and executing brokers (EBs) sending settlement instructions to the Depository Trust Company (DTC) as part of Stage 9 in the trade lifecycle can be traced back to the establishment of the DTC in 1973. This development was a significant milestone in the evolution of the securities settlement system in the United States, fundamentally transforming how settlement instructions are processed and executed.

The practice of custodians and executing brokers (EBs) sending settlement instructions to the Depository Trust Company (DTC) as part of Stage 9 in the trade lifecycle can be traced back to the establishment of the DTC in 1973. This development was a significant milestone in the evolution of the securities settlement system in the United States, fundamentally transforming how settlement instructions are processed and executed.

Establishment of the DTC

The DTC was founded in response to the paperwork crisis of the late 1960s and early 1970s, a period during which the financial markets experienced rapid growth in trading volumes that overwhelmed the existing manual and paper-based systems for trade processing and settlement. The crisis highlighted the need for a more efficient, automated system to handle the increasing volume of securities transactions.

Early Operations and Automation

Initially, the DTC’s role was to immobilize physical securities and facilitate their transfer through book-entry, thereby reducing the need for physical movement of paper securities. This was a significant shift from the traditional settlement process, which involved the physical delivery of securities certificates and checks. The introduction of book-entry transfers by the DTC allowed custodians and EBs to send electronic settlement instructions, streamlining the process and reducing the risk of errors and delays.

Expansion of Services and Electronic Communication

Over the years, the DTC expanded its services and capabilities, becoming a central hub for the clearing and settlement of securities transactions. The development and adoption of electronic communication networks and standards in the financial industry further enhanced the efficiency of sending settlement instructions to the DTC. The implementation of standardized messaging formats, such as those developed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), facilitated the secure and efficient exchange of settlement information between custodians, EBs, and the DTC.

Regulatory Changes and Market Reforms

Regulatory changes and market reforms have also played a crucial role in shaping the process of sending settlement instructions to the DTC. The push for shorter settlement cycles, such as the move from T+5 to T+3 in 1995, and later to T+2 in 2017, necessitated more timely and accurate processing of settlement instructions. These changes were aimed at reducing settlement risk and enhancing market efficiency.

Adoption of Straight-Through Processing (STP)

The adoption of straight-through processing (STP) principles in the late 1990s and early 2000s further streamlined the process of sending settlement instructions to the DTC. STP enables the automatic processing of trades from execution through to settlement without manual intervention, reducing the likelihood of errors and delays.

Current Practices and Future Developments

Today, the process of sending settlement instructions to the DTC is highly automated and integrated into the broader post-trade infrastructure. The continued advancement of technology, including the exploration of blockchain and distributed ledger technology (DLT), holds the potential to further transform the settlement landscape.

In summary, the practice of custodians and EBs sending settlement instructions to the DTC has evolved significantly since the DTC’s establishment in 1973, driven by technological advancements, regulatory changes, and industry-wide efforts to enhance the efficiency and reliability of the securities settlement process.