FINRA’s Crackdown on Compliance Violations: Lessons from the Rudy Mejia Jr. Case

2 min read

Broker Fined and Suspended: A Wake-Up Call for Compliance

The Financial Industry Regulatory Authority (FINRA) has once again made headlines with a decisive move against undisclosed private investment activities. The case in question involves Rudy Mejia Jr., a broker formerly associated with PFS Investments Inc. Mejia has been hit with a $10,000 fine and a one-year suspension. This action comes after findings that Mejia engaged in the solicitation of investments for a private fund, raising around $277,000 from 16 investors, without prior written notification to his employing firm. Such activities contradict FINRA Rules 3280 and 2010.

The importance of transparency and the strict adherence to regulatory obligations within the financial industry cannot be overstated. Agents are expected to exercise utmost honesty regarding their investment activities. The repercussions for failing to comply, as clearly evidenced by Mejia’s case, include hefty fines and potentially career-altering suspensions.

The Critical Impacts on Prime and Clearing Brokers

The Importance of Regulatory Compliance Tools

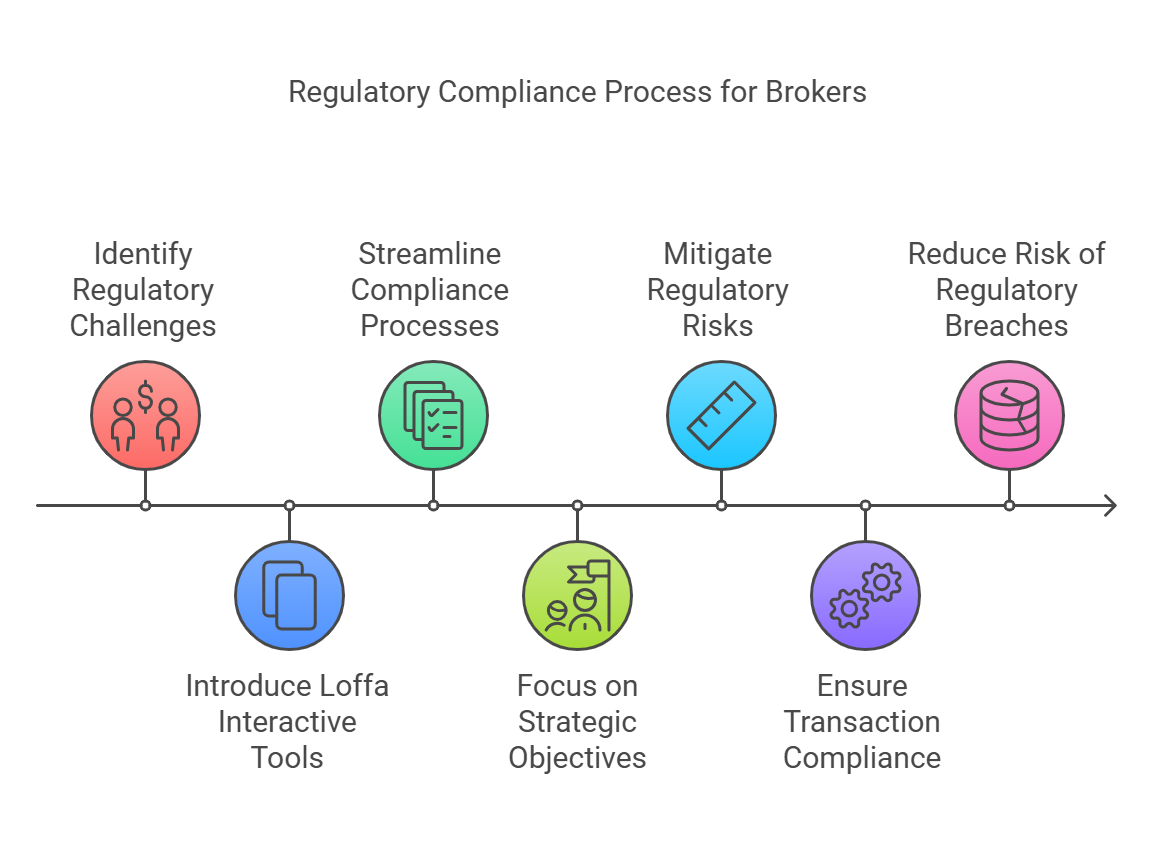

For prime brokers, executing brokers, and clearing agencies, navigating the complex terrain of financial regulations stands as a formidable challenge. Mejia’s case sheds light on crucial aspects where advanced solutions, like those offered by Loffa Interactive Group, can make a significant difference.

- Streamlining Compliance Processes: One of the standout offerings from Loffa Interactive is their suite of regulatory compliance tools. For a prime broker or a clearing agency, managing compliance while focusing on core operations can be a daunting task. Implementing SaaS solutions from Loffa Interactive simplifies compliance, allowing these firms to focus on their strategic objectives without the overhead of regulatory complexities.

- Mitigating Risk: The risk of regulatory breaches poses a constant threat. Loffa Interactive’s sophisticated solutions offer prime and clearing brokers a comprehensive toolkit. These tools are designed to manage letters of Free Funds under Regulation T, ensuring that all transactions are compliant with the latest financial regulations. This proactive approach to compliance greatly reduces the risk of encountering issues similar to those faced by Mejia.

Advantages of SaaS Solutions for Workflow Efficiencies

Advantages of SaaS Solutions for Workflow Efficiencies

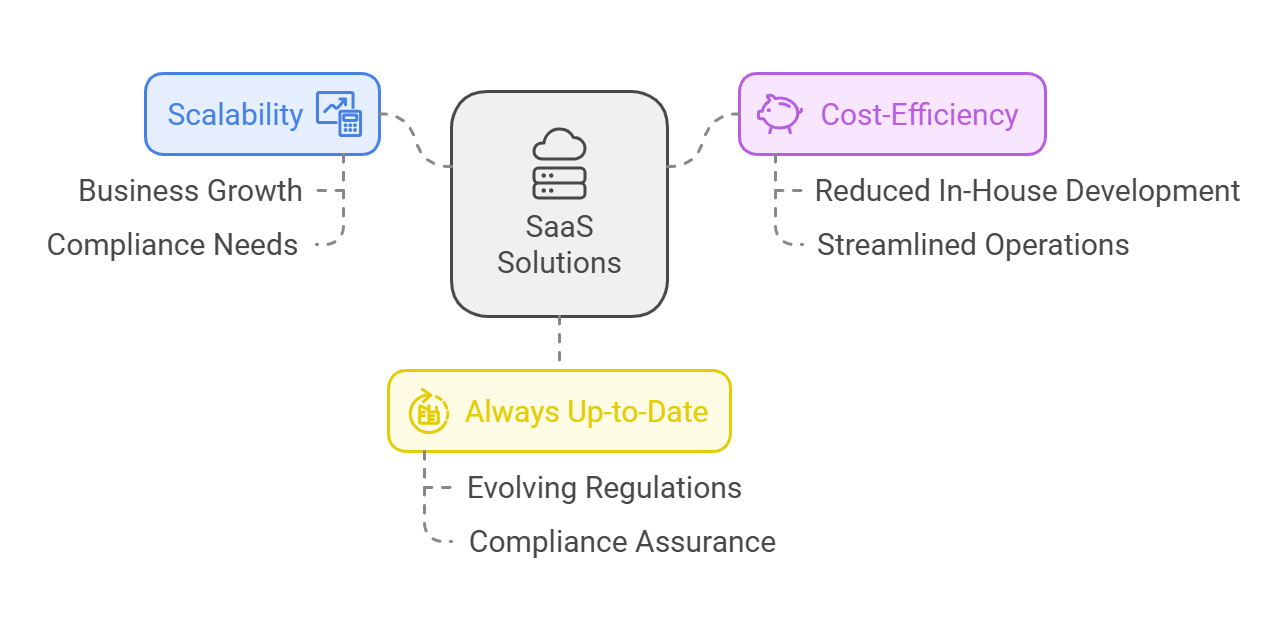

Implementing SaaS solutions for operational workflow efficiencies has distinct advantages:

- Scalability: As your firm grows, so do your compliance needs. SaaS solutions effortlessly scale with your business, ensuring that you’re always covered.

- Cost-Efficiency: Reducing the need for in-house development and maintenance of compliance systems, SaaS solutions offer financial advantages by streamlining operations and cutting unnecessary costs.

- Always Up-to-Date: With regulations constantly evolving, SaaS solutions ensure you’re always in compliance with the latest rules, thanks to automatic updates.

The case of Rudy Mejia Jr. serves as a stark reminder of the critical importance of transparency and strict regulatory compliance in the financial industry. It also highlights the effectiveness of SaaS solutions in maintaining compliance and operational efficiency. As the industry continues to evolve, the adoption of robust, scalable, and cost-efficient technological solutions will play a pivotal role in the survival and growth of prime brokers, executing brokers, and clearing agencies.