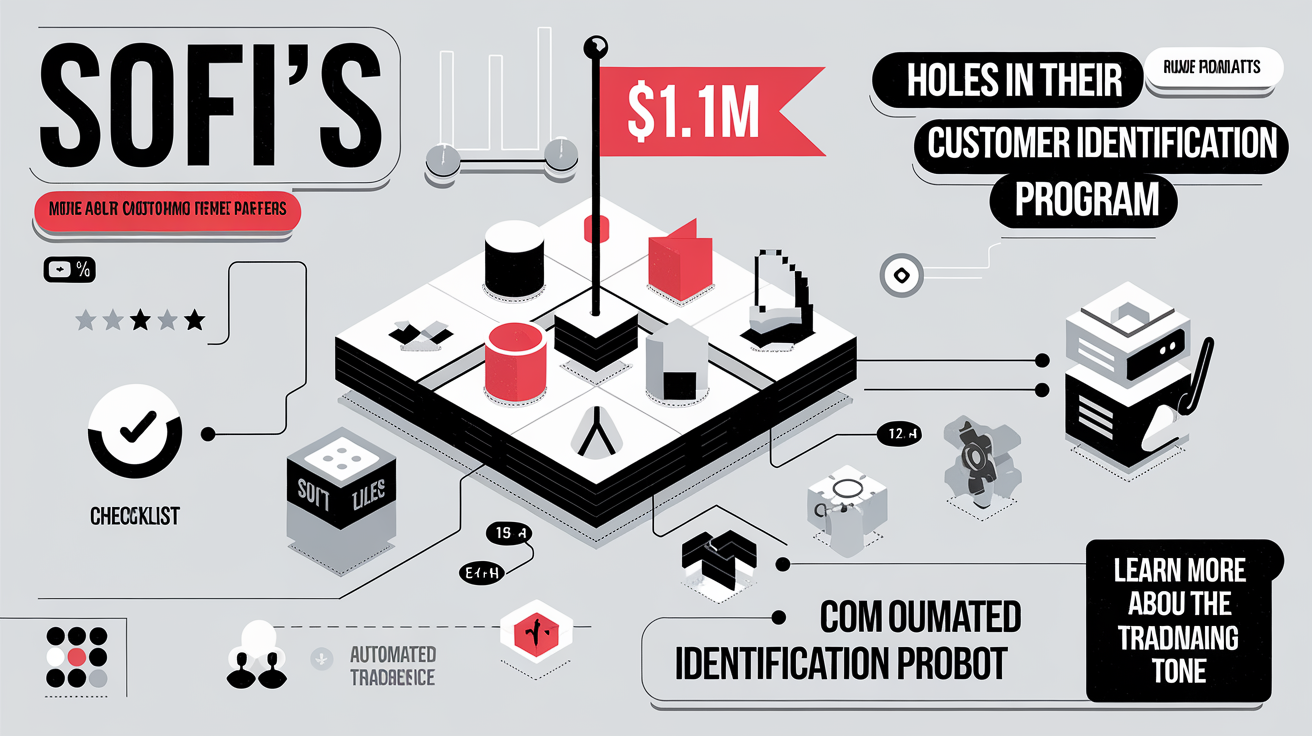

Elevating Financial Security: Key Lessons from SoFi’s $1.1M FINRA Fine

3 min read

Lessons from SoFi’s $1.1M Fine: Elevating Customer Security Measures

In an eye-opening development for the finance sector, SoFi Securities got hit with a hefty $1.1 million fine by FINRA. This penalty puts a spotlight on the gaping holes in SoFi’s Customer Identification Program (CIP) which paved the way for unauthorized fund siphoning from customer cash accounts. This situation isn’t just a wake-up call; it’s a loud siren for financial institutions everywhere to beef up their security game and stay on the right side of regulatory compliance.

In an eye-opening development for the finance sector, SoFi Securities got hit with a hefty $1.1 million fine by FINRA. This penalty puts a spotlight on the gaping holes in SoFi’s Customer Identification Program (CIP) which paved the way for unauthorized fund siphoning from customer cash accounts. This situation isn’t just a wake-up call; it’s a loud siren for financial institutions everywhere to beef up their security game and stay on the right side of regulatory compliance.

The Crucial Role of a Solid Customer Identification Program

A tight Customer Identification Program isn’t just a nice-to-have; it’s your fortress against fraudsters. SoFi’s recent stumble into regulatory hot water is a textbook case of what happens when that fortress has a breach. The consequences? Customer losses and a tarnished brand reputation.

Key Ingredients for a Rock-Solid CIP

- Thorough Customer Vetting: Kickstart your relationship with new customers by double-checking their creds. Use government IDs, cross-reference with trusty databases, and bring out the big guns with advanced verification tech.

- Ongoing Vigilance: Keep the radar on. Refresh customer info regularly and circle back for risk check-ups to sniff out any fishy business.

- Employee Know-How: School your frontline in the art of your CIP. They should be eagle-eyed and quick on their feet to spot and flag anything off-script.

- Teaming Up with the Tech Aces: Enter stage, partners like Loffa Interactive Group. Their tech-fortified solutions beef up your defenses and ensure you’re ticking all those compliance boxes.

Digging Deeper: The High Stakes for Prime and Clearing Brokers

Continuous Monitoring: Your Secret Weapon

For prime and executing brokers, the stakes are sky-high. Continuous monitoring isn’t just about keeping the bad guys out; it’s about safeguarding the very essence of your operation. Regular sweeps through customer transactions and activities can be the difference between smooth sailing and a regulatory storm.

Cutting-Edge Tech: More Than Just a Back-Up Plan

In this arena, leaning on technology isn’t a luxury; it’s a necessity. Solutions like those offered by Loffa Interactive aren’t just support acts; they’re frontliners in the battle against financial crime. For prime brokers, striking a balance between seamless operations and impenetrable security measures is non-negotiable.

The Ripple Effect: A Wake-Up Call for the Financial Sector

SoFi’s hefty fine is more than a mishap; it’s a lesson for the whole financial ecosystem. The risks of lax security measures can no longer be ignored. Financial institutions must pivot to a proactive defense strategy, anchoring on robust security protocols and embracing regulatory compliance as their guiding star.

The Watchful Eye of Regulatory Bodies

FINRA’s crackdown is a clear signal. Regulatory bodies are on high alert, ready to enforce the law to the letter. This vigilant oversight ensures that the financial playground remains safe and fair for everyone.

Wrapping Up

SoFi Securities’ run-in with a $1.1 million fine is a stark reminder of the non-negotiable need for stringent customer security measures. By zeroing in on precise identity verification, relentless monitoring, comprehensive employee training, and fortifying partnerships with tech veterans, firms can shield themselves against the tidal waves of fraudulent activities. In the grand chess game of financial services, prioritizing security and compliance isn’t just strategic; it’s essential for survival.