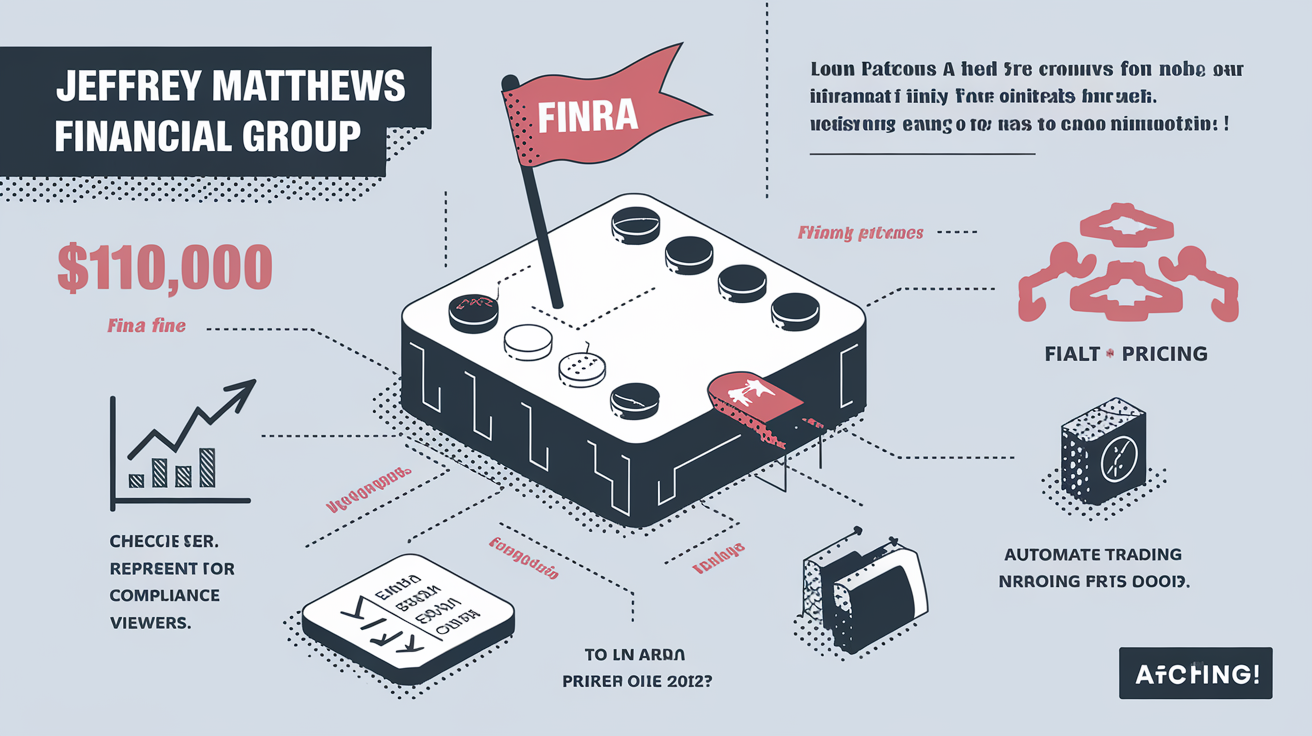

$110K FINRA Fine Spurs Compliance Wake-Up Call for Financial Industry

3 min read

Cracking Down on Compliance: The $110K Fine That’s Waking the Industry Up

In what’s clearly not just another day at the office, the Financial Industry Regulatory Authority (FINRA) hit Jeffrey Matthews Financial Group with a hefty $110,000 fine. You’re probably thinking, “Ouch.” And you’d be right — especially since this move is all about reinforcing those fair pricing practices we like to think we’re already on top of. But, as this case highlights, there’s always room to double-check those compliance measures.

The Scoop on the Fine

The bottom line? Jeffrey Matthews Financial Group kinda dropped the ball on adhering to fair pricing in their bond transactions. FINRA wasn’t just throwing darts; their investigation pointed out that the firm’s practices resulted in their customers getting hit with excessive markups and markdowns on bond trades. Not cool, right? This kind of move doesn’t just dent the firm’s wallet but also dings the bond market’s integrity and investors’ confidence.

The bottom line? Jeffrey Matthews Financial Group kinda dropped the ball on adhering to fair pricing in their bond transactions. FINRA wasn’t just throwing darts; their investigation pointed out that the firm’s practices resulted in their customers getting hit with excessive markups and markdowns on bond trades. Not cool, right? This kind of move doesn’t just dent the firm’s wallet but also dings the bond market’s integrity and investors’ confidence.

Why This Matters For You

Now, you’re probably sitting back and thinking, “What’s this got to do with me?” Here’s where it gets real: Compliance isn’t just about ticking boxes; it’s about ensuring your trading practices are on the straight and narrow. And let’s be honest, in the financial industry, your reputation and client trust are as good as gold.

Impactful Insights for Prime and Executing/Clearing Brokers

Navigating the Regulatory Maze

For prime brokers, executing and clearing brokers, the heat is always on to stay compliant. With regulatory eyes constantly watching, slipping up isn’t an option. This is where Loffa Interactive Group strides in with its cape, providing tech solutions like Freefunds Verified Direct (FVD) and the Prime Broker Interactive Network (PBIN) to keep things running smoothly.

- Freefunds Verified Direct (FVD): Think of FVD as the compass for navigating Regulation T requirements. It’s crucial for managing those Letters of Free Funds, making sure your trades in cash accounts are on the up and up. Considering the complexity of free funds trading, having FVD in your toolkit isn’t just nice; it’s a must-have.

- Prime Broker Interactive Network (PBIN): For the uninitiated, managing F1SA, SIA-150, and SIA-151 forms can feel like decoding an ancient language. PBIN doesn’t just make sense of these prime brokerage agreements and clearance agreements; it turns them into a walk in the park. If you’re looking to streamline these cumbersome processes while ensuring you’re not stepping out of line, PBIN’s your wingman.

The Bigger Picture

The fine slapped on Jeffrey Matthews Financial Group isn’t just a warning shot; it’s a clear message that the regulators mean business. And in this game, being caught on the back foot with compliance can cost you more than just money; it can tarnish your image and shake your clients’ faith.

Partnering Up for Compliance Perfection

With regulatory scrutiny in no mood to take a backseat, it’s high time to level up with a partner who knows the terrain. Loffa Interactive Group, with its track record of bolstering Wall Street firms and unwavering commitment to security and operational excellence, is that comrade-in-arms you need to fortify your compliance framework.

With regulatory scrutiny in no mood to take a backseat, it’s high time to level up with a partner who knows the terrain. Loffa Interactive Group, with its track record of bolstering Wall Street firms and unwavering commitment to security and operational excellence, is that comrade-in-arms you need to fortify your compliance framework.

Regulators have their eyes peeled for any slip-ups on fair pricing practices, and this hefty fine is their way of saying, “We’re not messing around.” As the landscape keeps evolving, those who prioritize compliance and are game to embrace innovative solutions will not just survive; they’ll thrive amidst the sea of regulatory oversight.