Letter of Free Funds Automation: A Case Study in Savings

2 min read

For many financial firms, the reams & reams of paper that are required to keep the company humming along are not always at the top of the list of executive concerns. However, as companies begin the yearend budgetary process, it might be time to cast a more critical eye on the mountains of paper that are most likely drowning the back office employees. There’s no denying the correlation between the increasing complexity of modern financial markets and the seemingly endless appetite for more paper.

Furthermore, as markets become increasingly complicated, regulatory due diligence and recordkeeping has become markedly more important. Take for example the process for executing a trade through a third party broker dealer (referred to as a trade away) in delivery versus payment (DVP) accounts. According to Regulation T, Section 220.8 C (a), the executing broker dealer and custodian are required to verify that funds are available by T+5 for every non-exempt security trade with a principal amount in excess of $1,000.

The resulting verification is referred to as the Letter of Free Fund, which is sent by the executing broker/dealer to the custodial broker of the account. The traditional method for sending and validating fund availability for trades executed in DVP accounts involves sending and receiving manual paper faxes, which must be retrieved, organized, processed, faxed back to the counter-party, stored in file cabinets, and eventually sent to an offsite storage facility.

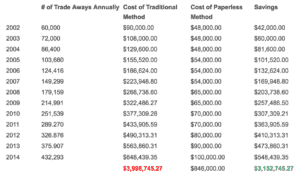

Needless to say the complexity of the traditional method is also more likely to contribute to user errors. For many firms this process is not only logistically arduous, but financially onerous as well. Consider chart A below, which compares the financial burden of the traditional method versus the cost savings provided by going paperless using Loffa Interactive’s Freefunds Verified Direct TM (FVD).

*For Illustration purposes only. Loffa Interactive’s solution was available starting 2005.

**Chart assumes an annual trade away transaction growth of 20%, with the traditional method costing an average of $1.50 per transaction.**Monthly fees are subject to change.

Savings are conservative as they only take into the account the cost of performing the initial process. Internal or home grown solutions would actually be more, once the cost of storing these documents and ultimately destroying them properly, are taken into account.

Loffa Interactive Group’s patented Freefunds Verified Direct TM (FVD) application provides your firm with a paperless, centralized, automated and scalable solution that can help you achieve the goal of realizing significant cost savings while improving supervisory/regulatory controls and storage requirements. Our approach is focused on leveraging the efficiency of straight-through processing for Executing Broker/Dealers and Custodians.